We do the research, you get the alpha!

Get exclusive reports and key insights on airports, NFTs and more! Sign up for Alpha Reports now and step up your game!

Go to Alpha Reports

Ethereum fell 4% yesterday after the historic adoption of US spot Ethereum exchange-traded funds (ETFs).

Many believed that the passing of spot ETFs in the US was a serious event for the second largest cryptocurrency in the world. And it still can be. But in the hours following the approval by the US Securities and Exchange Commission (SEC), the price of Ethereum barely budged – it rose just 1 percent.

At the time of the approval, Ethereum was sitting at $3,840 but is now down 3.6% to $3,701, according to CoinGecko. This fall is 6% from $3,926 in the last 24 hours as the approved news started to spread.

This is a classic display of “buy the rumour, sell the news” as the price of Ethereum surged 9% the minute ETF approval was rumored to be imminent. Now that the news has been confirmed, the market has started selling.

Bitcoin has seen similar action since spot Bitcoin ETFs were adopted in January. Bitcoin fell 6% the day after the approval and plunged 12% the following week. All told, after a full month of volatility, BTC has not returned to the value it was on the day the ETFs were approved.

But when it did, it began a steady march to a new all-time high as more than 10 Bitcoin ETFs poured into the market.

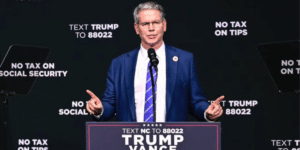

British Multinational Bank predicted that both ETH and BTC will touch higher after the approval of Standard Chartered Ethereum ETF.

“The approval of the ETH ETF will make the sector more legitimate and BTC positive,” said Geoff Kendrick, digital assets researcher at Standard Chartered.

If it's going to happen for Bitcoin, it might not happen anytime soon. BTC is currently down 3.5% in the last 24 hours.

Edited by Stacy Elliott.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.