Ethereum (ETH) price may suffer from negative funding level.

Thereum (ETH) price remains stuck below a key resistance level that could open the door to a push towards $3,000.

However, hesitant investor sentiment is stalling the recovery, preventing ETH from gaining the momentum it needs to climb.

Ethereum investors are not sure

Ethereum price may continue to move sideways or recover due to uncertainty among investors. The Net Unrealized Profit/Loss (NUPL) indicator has recently slipped into the fear zone, indicating a sharp decline in investor optimism.

A near dip into the fear zone suggests increasing caution among market participants. The NUPL (Net Unrealized Profit/Loss) indicator, which gauges investor sentiment, is showing a shift into the fear zone, indicating that confidence in Ethereum's short-term outlook is waning.

As this indicator approaches negative territory, it raises the possibility of further declines, reflecting growing uncertainty among investors, which could hamper a significant price recovery.

Read more: How to invest in Ethereum ETFs?

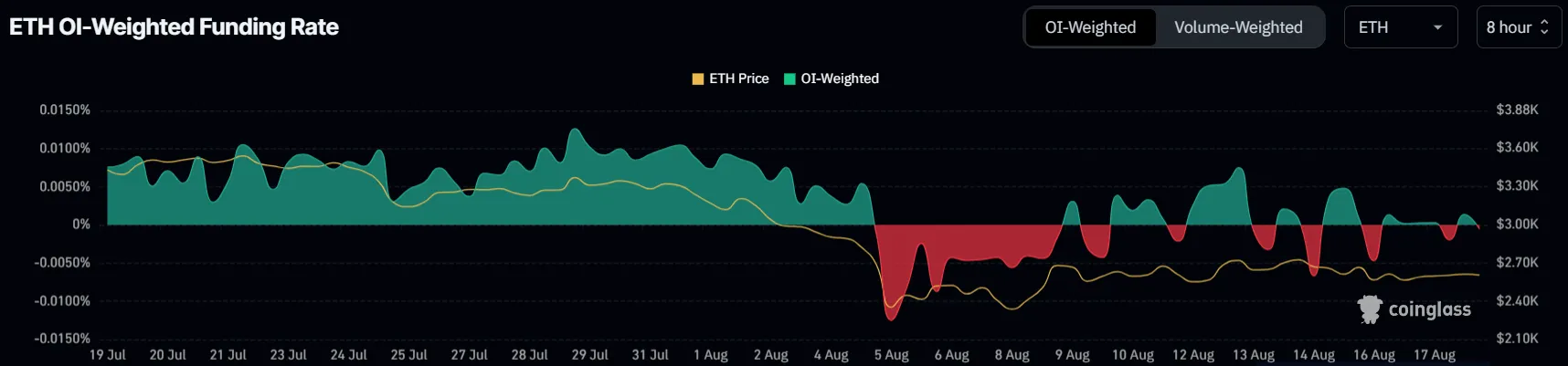

In addition to NUPL, Ethereum funding has been showing signs of instability over the past couple of weeks.

The price is swinging between positive and negative, highlighting the uncertainty among traders. This volatility in the funding rate shows a constant lack of confidence in Ethereum's future performance.

The declining funding rate and the NUPL indicator close to slipping into the fear zone indicate a growing sense of anxiety in the market.

ETH price prediction: correcting the correction

Ethereum's price dropped 30% at the end of July, and to date, ETH has only recovered a third of that drop. Stuck under the $2,681 resistance, the altcoin leader is trading at $2,651.

The above signs indicate that Ethereum may struggle to break and maintain a close above the current resistance level. Altcoins have faced similar challenges in the past, with past failed attempts leading to periods of price consolidation.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if the Ethereum price can close above $2,681, it could trigger an upward move. This could move ETH to $2,930, and a breach of that level would undermine the outlook, which could push the price to $3,000.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.