Ethereum Price Analysis: Can ETH Climb to $6,000 in the Coming Weeks?

The post Ethereum Price Analysis: Can ETH Climb to $6,000 in the Coming Weeks? It first appeared on Coinpedia Fintech News

This month, the Ethereum market opened with a big red candle. On the third of October, it dropped to a low of $2,351.01. At the moment the market seems a little wobbly. On the fourth of October, buying pressure set in. Newfound momentum is pushing prices higher at this point. Could this newfound strength take the price to new heights? Some technical analysis experts have given some positive comments about the future prospects of the market. Are you eager to learn what you have observed? Read it!

Ethereum follows the recovery of Bitcoin

The unexpected escalation of the Israeli-Iranian crisis has pushed Bitcoin's price down to $60,628 in the first days of this month – similar to what was seen on the Ethereum market. Like ETH, on the fourth of October, BTC buyers dominated the market, raising the price from $60,776.02 to $62,102.19 in one day. Since then, the price has been hovering between $62,000 and $62,900. Currently, the price of BTC stands at 62 375 dollars.

Bitcoin Daily Chart and Ethereum Daily Chart Comparison Analysis Ethereum has been going along with Bitcoin. Like Bitcoin, Ethereum has been in the arduous task of recovering from its recent slump earlier in the month.

Key technical patterns suggest a potential breakout in Ethereum

Cryptocurrency technical analyst trader Tredigrade says that Ethereum has been following an upward trend since June 2022.

A combination of these two factors suggests that a bullish breakdown is imminent. A chart shared by a crypto analyst suggests that a major crash in Ethereum can be expected soon.

Ethereum usage ratio and market activity

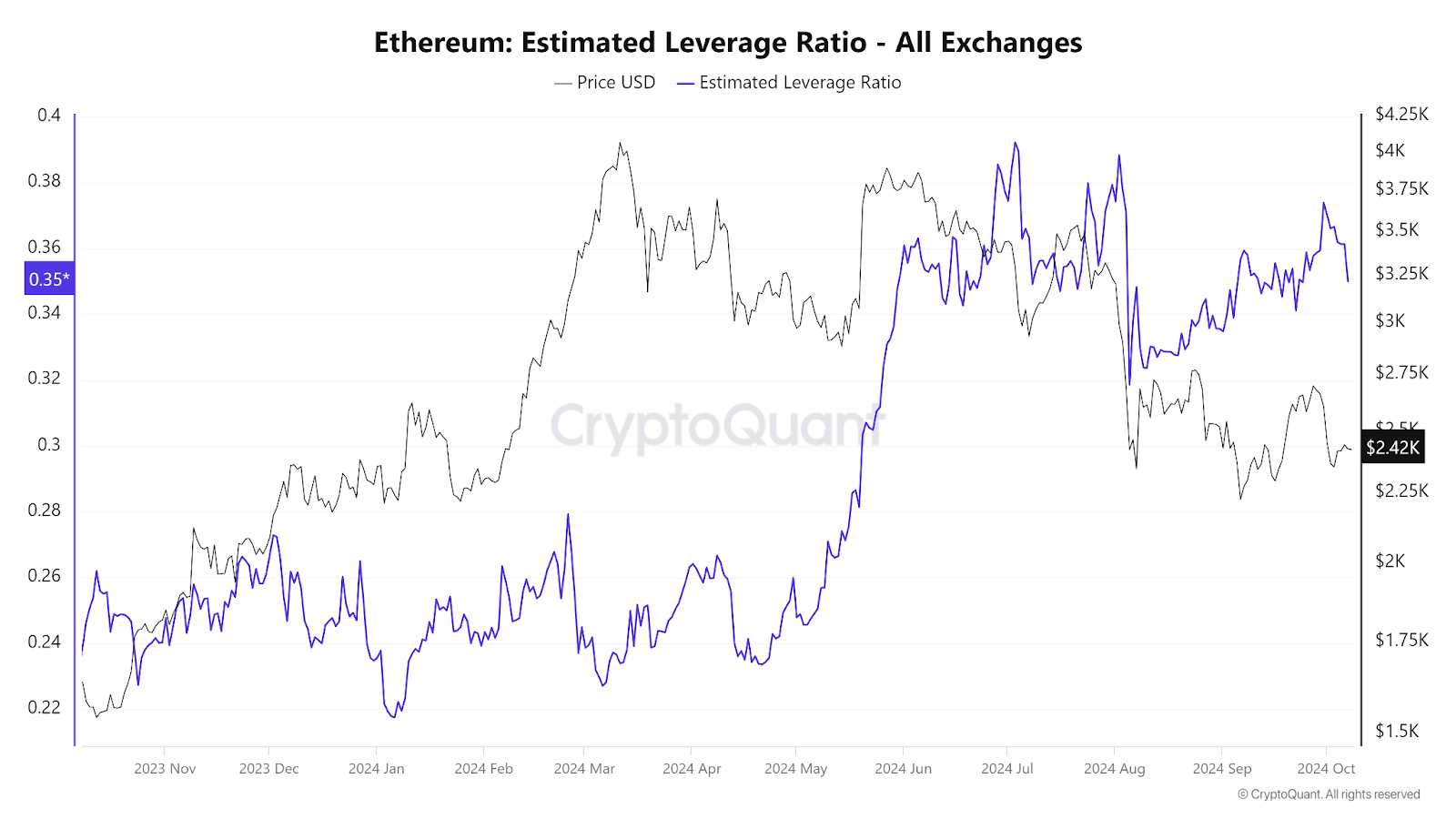

The chart of Ethereum estimated exchange ratio (all exchanges) shows that the ratio has increased significantly. It was only 0.21 on January 4th. A higher elevation was observed between April 22 and June 5; In that short period alone, the ratio rose from 0.233 to 0.36. Since then, the ratio has hovered between 0.31 and 0.39. Currently, the ratio is 0.35.

A high estimated leverage ratio is a clear indication of earnings price volatility. Open demand for ETH decreased slightly, Ethereum trading volume increased by 120%.

A comprehensive analysis of the above details shows that traders are positioning themselves for the next big price movement in the Ethereum market.

Analyst Ethereum Forecast: Key support at $2,300

The post shared by Ali X highlighted the importance of the $2,300 key support level in the Ethereum market. In his view, the market should hold this level of support. If the Ethereum market holds a key support level, it is predicted that it may touch $6,000 in the near future. His post warns that if the ETH market fails to stay above this key level, it may drop to $1,600.

In conclusion, right now, there is nothing to indicate that the price of Ethereum will fall below the key level of $2,300. However, it is important to closely monitor how the market reacts when the technical analysis expert violates the pattern.

.paragraph-in-link { margin-left: 0 !required; border: 1px solid #0052CC4D; border-left : 0 ; border-right: 0; padding : 10px 0 ; text-align: left; } .intro ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; List-style Type: None; margin-bottom: 0; display: inline-block; } .intro ul.article-inside-link li:last-child { display: none; }

Also read: Bitcoin Golden Cross Set To Spark Massive Rally Due To $10 Billion Short Squeeze! ,

Stay tuned to Coinpedia for the latest updates on Ethereum price momentum!