Ethereum sales ahead? Institutions will drop the price of 35M dollars

The overall cryptocurrency market is turning red and experienced a decline rate of 1.75%. In this market downturn, institutions are looking to sell their crypto holdings.

Institutions lost $35M worth of Ether

In the year On August 26, 2024, on-chain analytics firm lookonchain reported on X (formerly Twitter) that two institutions dumped more than $35.3 million worth of 12,882 Ethereum (ETH) to centralized exchanges, including Binance and Kraken.

According to lookonchain, Amber Group and Cumberland are the institutions that dropped Ethereum. The data shows that Amber Group moved 6,443 ETH worth $17.62 million to Binance and Kraken, while Cumberland moved 6,439 ETH worth $17.99 million to Binance.

These are known selling pressures of ETH being dumped into CEXs.

Ethereum price prediction

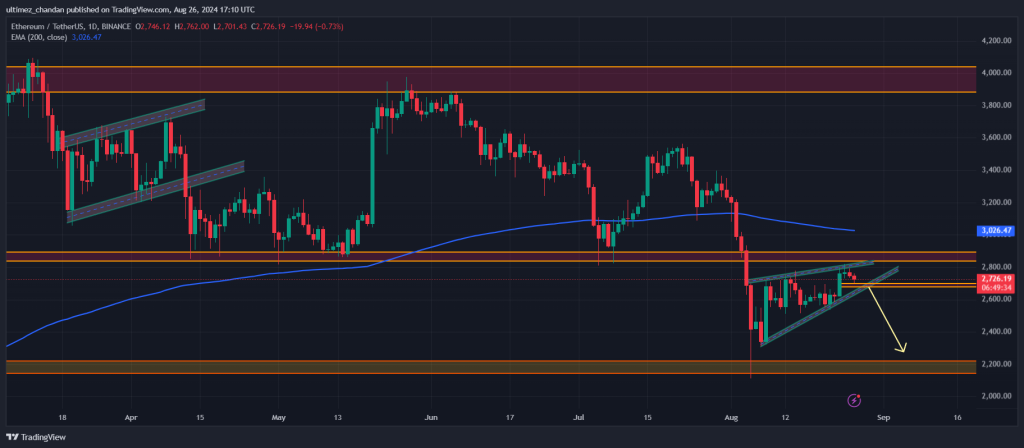

According to expert technical analysis, ETH looks bearish when it trades below the 200 Exponential Moving Average (EMA) on a daily time frame. Additionally, a bearish rising wedge price is forming an action pattern and there is a high probability that this pattern will be defined soon.

If the sentiment remains weak and ETH breaks down and closes a daily candle below $2,645, there is a high possibility of a 12% drop to the $2,310 level.

Decrease in open demand

According to data from on-chain CoinGlass, interest from institutions and investors is slowly waning. ETH open interest is down 1% in the last hour and 2.3% in the last four hours. However, the open demand has not changed in the last 24 hours.

In addition to institutional sentiment, traders seem to be bullish on ETH. Currently, short positions are significantly higher than bullish long positions

Key fluid levels

Based on the liquidity map of the ETH exchange, the main liquidity levels are at the $2,680 level on the lower side and the $2,775 level on the upper side. According to CoinGlass data, traders are overextended at these levels.

If sentiment weakens and the price drops to the $2,680 level, nearly $119 million worth of long positions will be lost. Conversely, if the sentiment changes and the price rises to $2,775, about $289 million of short positions will be liquidated.

These data clearly show that bears are more active, and these significant positions could create additional selling pressure.