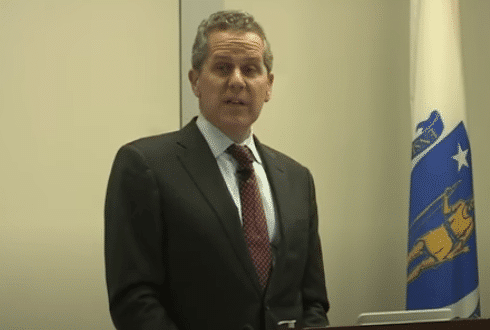

Federal Reserve official Michael Barr has called for stablecoin regulation

US regulators are finally discussing digital assets backed by fiat, the popular stablecoin.

Michael Barr, the Federal Reserve's vice chairman for supervision, said it was important for a stable coin to fall under government control.

Presenting his ideas at a conference in Washington, DC, Barr unequivocally stated that the ability of a stablecoin to be pegged to any government currency would make it a private currency.

Additionally, these digital fiat currencies act as a means of payment and store of value, meaning they are borrowing the trust of a central bank.

Barr, who was appointed by President Biden as the Federal Reserve's top banking cop, argued that a stable coin should be adjusted against these strong indicators.

Expanding on his stance, he pointed out the importance of subjecting stable science to a sound financial framework to avoid risks that could threaten financial stability or the integrity of payment systems.

“Also, we have given the banks the correct instructions on how to communicate with their supervisors when they are considering using these products,” Barr added.

Barr's comments dovetail with a growing belief among U.S. regulators in the need for strong oversight in the crypto space.

In recent years, calls for proper regulation of the rapidly growing decentralized economy have echoed on the walls of Washington, DC. However, the stable coin is considered less.

Until this year, the Fed, which serves as the central bank equivalent of the United States, has taken a hard look at the potential impact of a privately controlled digital sovereign currency on the economy.

To that end, the Federal Reserve launched a new line of protection in August of this year, specifically targeting crypto assets and stablecoins.

In the set of rules, the federation announced the launch of a new program called SR 23-7, which is the Novel Activities Control Program.

In this new setting, the Fed wants to increase the control of new technologies used by banking institutions in its interest.

These new technologies target crypto assets, blockchain technology and complex, technology-enabled partnerships with non-bank entities to deliver financial services to customers.

Regarding the objectives of the SR 23-7 program, the central bank stated that it is risk-oriented and meets supervisory guidelines designed to regulate banking operations.

In a related press release, the Federal Reserve Bank announced that banks will not be deterred from participating in Stablecoin activities.

But before they start, they are required to confirm to the country's lender of last resort that they have the appropriate security guards in place.

The decision of the CBDC has not yet been made.

Barr, who serves as Vice Chairman of Supervision, touched on the long-term pursuit of a central bank digital currency (CBDC) in his address.

The central bank is currently consulting with a number of experts on the most robust and appropriate emerging technology to support a sovereign-backed digital currency.

This study focuses on the end-to-end system architecture, security, authentication and token models of CBDCs. However, he said no decision has been made on whether CBCC should be issued.

But the Fed official said the decision ultimately rests with the US Congress and the White House.

While the US is reluctant to launch a CBDC program, its European counterpart is going full steam ahead with plans for a digital euro.

The euro is key to our European unity. The digital euro with cash future-proofs our currency. It will be secure, easy to use and free of charge.

Although the decision to issue a digital euro will be taken later, we are now starting the preparation phase. pic.twitter.com/fs81p7otVW

— Christine Lagarde (@Lagarde) October 19, 2023

On October 19, the European Central Bank chief Christine Lagarde gave the green light to start the preparatory phase of the ECB's Governing Council on X (formerly Twitter).