FEED’s recent decision may affect the 2025 CREPTO markets

Bitcoin may rise to $1002,000 after a rebound in 2025, but the US Fed reserves in 2025 December 2024 Federal Open Market Committee meeting BTC / USD The exchange rate dropped to a low of $91,220.84.

Bitcoin has since then stabilized at around $95,000, but the ongoing losses will further negatively impact the performance of Bitcoin and other cryptocurrencies.

Cryptopratiffices have been affected by policy changes from the federal record as they entered the financial market. With this in mind, let's see what it means for both Bricon and the training performance in the coming months.

Why the mystery fell on the last annual news

As mentioned in the minutes of the Fuding meeting, the central bank once set interest rates at 0.25% or 25%. This was in line with expectations. However, other investors were caught off-guard by the recent cut-off times other than the meeting minutes.

It is proposed to mark the plans of the plans In 2025, reduce the number of pieces of the 25-level measurement rate. Minutes before the meeting, before hitting the road, the market was still waiting for four such pieces during the year. The latest comments from the authorities who are thinking about the fence of the number are protected by the inspection of “the pivit that eats” this year.

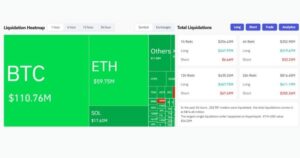

With this in mind, it is not entirely surprising that Bitcoin has once again experienced negative volatility. A lot of volatility, like Terem, Solana and Dogecon all have a double digit chance in the last week, even though Blacksmith is in the spotlight. “Accidents” risk, cryptors, especially in hedges, are better done during residential financial policy.

However, the Fed will continue to participate in financial hedging, even if it is not as abstract as previously expected, so that the impact of these policy decisions does not have an impact on the first surprise in 2025.

What does this mean for BBC and training prices in 2025?

Although the current markets of Crypocurrent have given a negative view to FAED's current policy plagiarism, the plans may lead to more Bitcoin and other secret offerings. For one, the planned performance of less than 25 violence-points is still realizing that this “dangerous” property is an additional source of getting the property class.

Second, other positive factors in relation to Bitcoin are driven by other positive factors that can drive the biggest increase in market capitalization. These include more institutionalization and retail investor efficiency, as well as a more favorable environment for Tockcy management.

Wasting Chief Executive Officer has commented on what we expect in the crypto industry in 2025. Crypto regulation has shown great growth around the world and we expect to see more in 2025, the recent US presidential election, we see that other countries will get leadership from the US leadership. around the world. “

In terms of institutional interest, “CLUPPock and Loyalty, like Blackrock and Loyalty, have entered the CRUPTO business in terms of 2024, and we expect to see new discussions next year. Many companies are learning about Crespto and integrating Crypto features such as adoption into their business operations. This is a trend that has been growing for years and we expect to see more growth.

Admittedly, recently implemented changes will still have a negative impact in the short term. Changes in financial policy. However, if the bull market continues in Bitcoin, chances are that it will also fill the Alkatan space. Investors from the price of Bitcoin, investors can carry on Bitcouns, XRP, Solana and other majors and to other majors and to other majors.

The main point

In the long run, FARDED's decision can hardly threaten long-term real issues with excessively reckless low interest rates and STANCE's fiscal policy. Due to the various trends established in exchange trading, investment products, processing products, institutional and retail capital flows to continue.

Of course, nothing is certain. For example, following the latest job reports, there is doubt that FUSED will add FUSEDED More growth plans return to 2025 rate plans. Even if it feeds the current plan, this asset class seems to remain very volatile. Caution and patience remain the key.

Nevertheless, not only the Frew one, but taking into account the positive trends of the game, long-term price appreciation with Bitcoin and other Cryptiprurectrices are still on the table.