Forbes lists XRP, ADA, LTC, ETC among the top “zombie” tokens.

Share this article

![]()

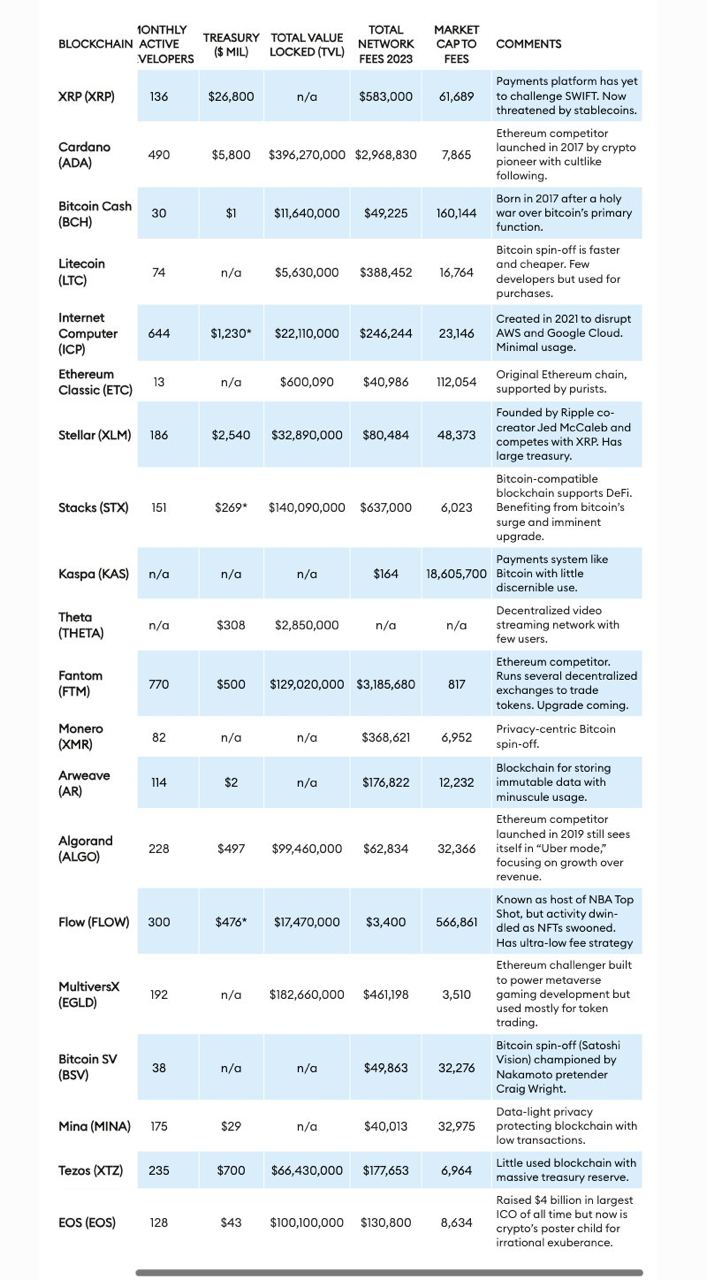

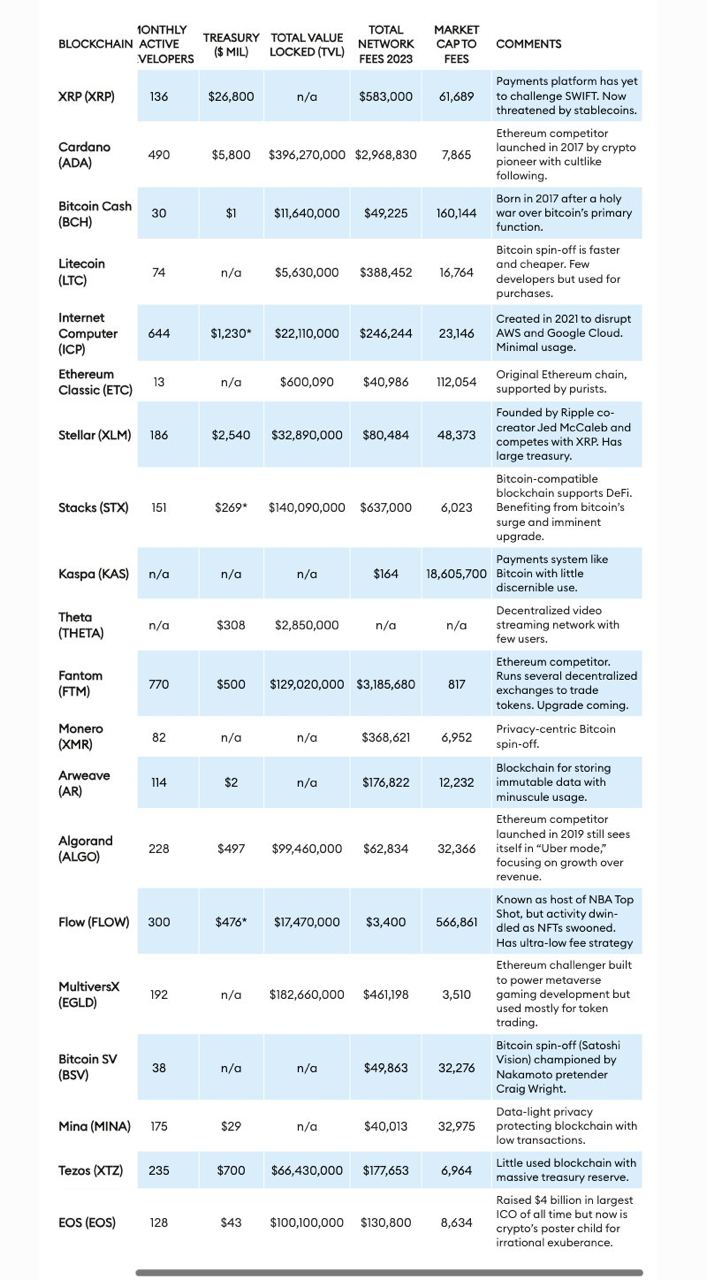

The number of tokens has exceeded 14,000, and the crypto market cap has reached $2.4 trillion, but more may not always be better. Forbes has identified a group of 20 cryptos, dubbed “zombie blockchains,” that maintain high market value despite little real-world utility or user adoption.

The list includes well-known names such as Ripple (XRP), Cardano (ADA), Litecoin (LTC), Bitcoin Cash (BCH) and Ethereum Classic (ETC), which are characterized by their continuous operation and trading without being complete. Practical purposes.

The term “zombie blockchains” refers to blockchain projects that are almost undead but show no signs of life in terms of utility or tangible user bases.

These tokens continue to exist, and sometimes grow financially, not because they have achieved their technological or practical goals, but because of speculative marketing and substantial initial funding.

Forbes analysts point out that Ripple's XRP was initially designed to compete with the SWIFT banking network by facilitating faster international bank transfers with lower fees. However, it failed to disrupt SWIFT and now relies on speculative trading at high market rates, with little revenue from actual network usage.

“This is largely useless, but the XRP token still has a market value of $36 billion, making it the sixth-most valuable cryptocurrency,” analysts said.

“Ripple Labs is a crypto zombie. Its XRP tokens, worth about $2 billion a day, continue to be actively traded, but serve no purpose other than speculation. Not only is SWIFT still going strong, there are now better ways to send payments globally on the blockchain, especially with stablecoins like Tether, which is pegged to the US dollar and has $100 billion in circulation,” he added.

Similarly, hard forks such as Litecoin, Bitcoin Cash, Bitcoin SV and Ethereum Classic are worth more than $1 billion but remain underutilized, serving as speculative investments rather than practical applications, according to Forbes.

These signs often arise from disagreements within the developer community and are perpetuated due to their historical significance or speculative trade.

“Liquidity is what keeps these zombies alive,” analysts quoted the VC statement as saying.

Analysts have pointed to “Ethereum killers” such as Tezos (XTZ), Algorand (ALGO) and Cardano (ADA) as a major part of this phenomenon.

Despite technological advances and empirical evaluations, these signs have not seen large adoption or movement. Although they offer advanced marketing process capabilities, they struggle to translate these capabilities into widespread adoption or developer engagement.

“Some blockchain zombies seem to trade based on the popularity of their creator. Cardano, another Ethereum competitor, was launched in 2017 after founder Charles Hoskinson's divorce from Buterin,” analysts said, noting that speculative interest in Cardano is driven primarily by its creator's popularity.

The Forbes report also explores the lack of governance and financial accountability mechanisms in these blockchain entities. This complicates efforts to assess their viability or financial health, as seen in cases like Ethereum Classic.

Share this article

![]()

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may also include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.