Forget the dip, Bitcoin halved and remains bullish

As the cryptocurrency industry anticipates its next halving, market analysts and investors are carefully watching the potential impact on Bitcoin's price.

With the halving, miners' rewards are expected to be scheduled to be halved on April 20. It will reduce the reward from 6.25 BTC to 3.125 BTC. So this event effectively reduces Bitcoin inflation from 1.7% to 0.85% annually.

Before the decline, Bitcoin remains bullish

Historically, Bitcoin halvings have been associated with volatility in the short term but bullish trends in the long term. Vincent Malipard, director of marketing at IntoTheBlock, told BIncrypto that the halves of 2016 and 2020 were when Bitcoin entered the event, then fell shortly after, but eventually broke the previous all-time highs within months.

This pattern suggests that while traders may try to run the half front, it will lead to short-term volatility, while supply cuts will have a positive effect on price movements over time.

Another interesting trend is that the price increase is halving. For example, after the first half, the price of Bitcoin increased by 4,802%. However, such an increase was reduced in the next half of the year.

“Given Bitcoin's much larger market capitalization today, achieving the same percentage growth would require a significant amount of investment, suggesting that future percentage increases may decrease,” Malipard said.

Read more: Bitcoin Half Countdown

The future half is also different from the previous ones. Indeed, Bitcoin has surpassed all-time highs, likely due to substantial institutional investment following the approval of Bitcoin ETFs. This institutional source of income, consistent demand for ETFs, and a decrease in supply could increase the price of Bitcoin.

Moreover, crypto-wells have gone into enhanced reserves and strategic holdings in anticipation of price increases. These actions demonstrate short-term speculation and long-term strategic action to capture Bitcoin as a scarce resource.

Overall, these patterns show a deeper understanding and adaptation to the half-cycle's effects on Bitcoin's price over time.

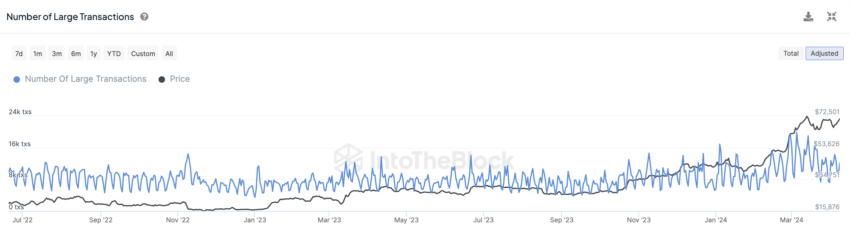

“There is an upward trend in the number of large trading volumes above $100,000, especially after the adoption of Bitcoin ETFs. As for the previous halves, this scale has mostly started to climb towards the end of the bull market,” Malipard told BeinCrypto.

Another interesting observation made by Malipard is the increase in the volume fraction of mineral fluxes. Last year, the percentage rose from around 4% to 12%, representing a 200% growth. This increase in mining flow rate share is important because it represents a significant change in mining behavior, which could affect Bitcoin's supply and liquidity dynamics.

Read more: Bitcoin price prediction for 2024/2025/2030

While the Bitcoin halving is expected to bring short-term volatility, the long-term outlook remains bullish, driven by reduced supply and continued institutional demand.

“The proposed emission reduction is one of the key economic measures that differentiates Bitcoin from fiat currencies. In the months leading up to the bitcoin halving and as investors anticipate the halving's impact on bitcoin scarcity and value, market sentiment will shift from anticipation to optimism, Malipard concluded.

Investors should monitor key indicators such as trading volume and mining behavior to gauge the impact of the halving on the market.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.