Four major US events that could shake up the Bitcoin market this week

The Bitcoin market seems bullish right now. In the last seven days, the Bitcoin market has increased by 2.7%. Can the market continue this bullish momentum this week? The market opened the week on a positive note. Earlier today, the price was around $62,886. It now stands at $64,828. Whether the market can continue its performance depends on the factors affecting the market performance this week. So, this is an effort to understand the major US events that could shake up the BTC market next week. Let's dive in!

What to see in the US economy this week

According to expert opinion, the four main US events that could influence the cryptocurrency market in the coming week are unemployment claims, retail sales, industrial production and corporate earnings reports.

Jobless Claims: Will They Affect Bitcoin?

Some important indices that can show the state of the US labor market, US Initial Jobless Claims, US Jobless Claims and US Jobless Claims 4-Week Average will be released on October 17, 2024. A large number of claims may indicate this. Weakening the labor market. Economic weakness may push investors into digital assets.

On October 5, 2024, US initial jobless claims were 258 thousand. The consensus is that it will go down to 255 thousand at least. US continuing jobless claims on September 28 were 1.86 lakh.

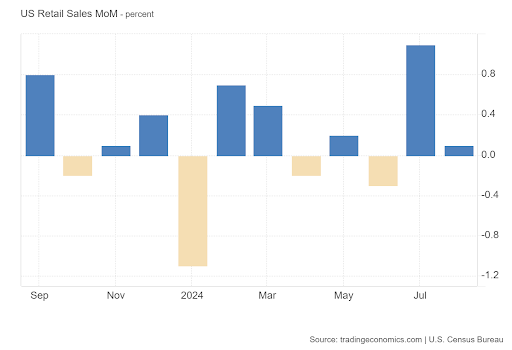

Retail sales: a sign of consumer confidence

The release of US retail sales data is another important event for this week. The US retail sales MOM index is scheduled for release on October 17. It was 0.1 percent in August. For October, consensus will rise slightly to 0.3%.

Strong sales numbers suggest consumers are feeling confident and spending more. This could lead to increased interest in risky assets such as cryptos.

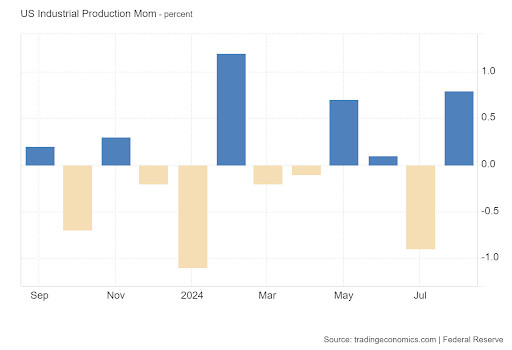

Industrial production: an understanding of economic growth

A third important event to watch is the release of US industrial production data. The US industrial production MOM index is also expected to be released on October 17. It was 0.8% in August. The consensus is that it will drop to -0.1%.

A strong report indicates a healthy economy and gives investors confidence in both traditional and digital assets.

Corporate earnings: A key market indicator

Major companies like Bank of America and Citigroup will release earnings reports this week. If the reports suggest strong earnings, they will push the stock price higher. The positive movement in the US stock market may spill over into the crypto market.

In conclusion, a positive outlook, supported by strong retail sales, declining unemployment claims and strong industrial production, could boost Bitcoin investment.

Stay tuned to Coinpedia for more information-driven news!