Fractal predicts correction despite fear and greed

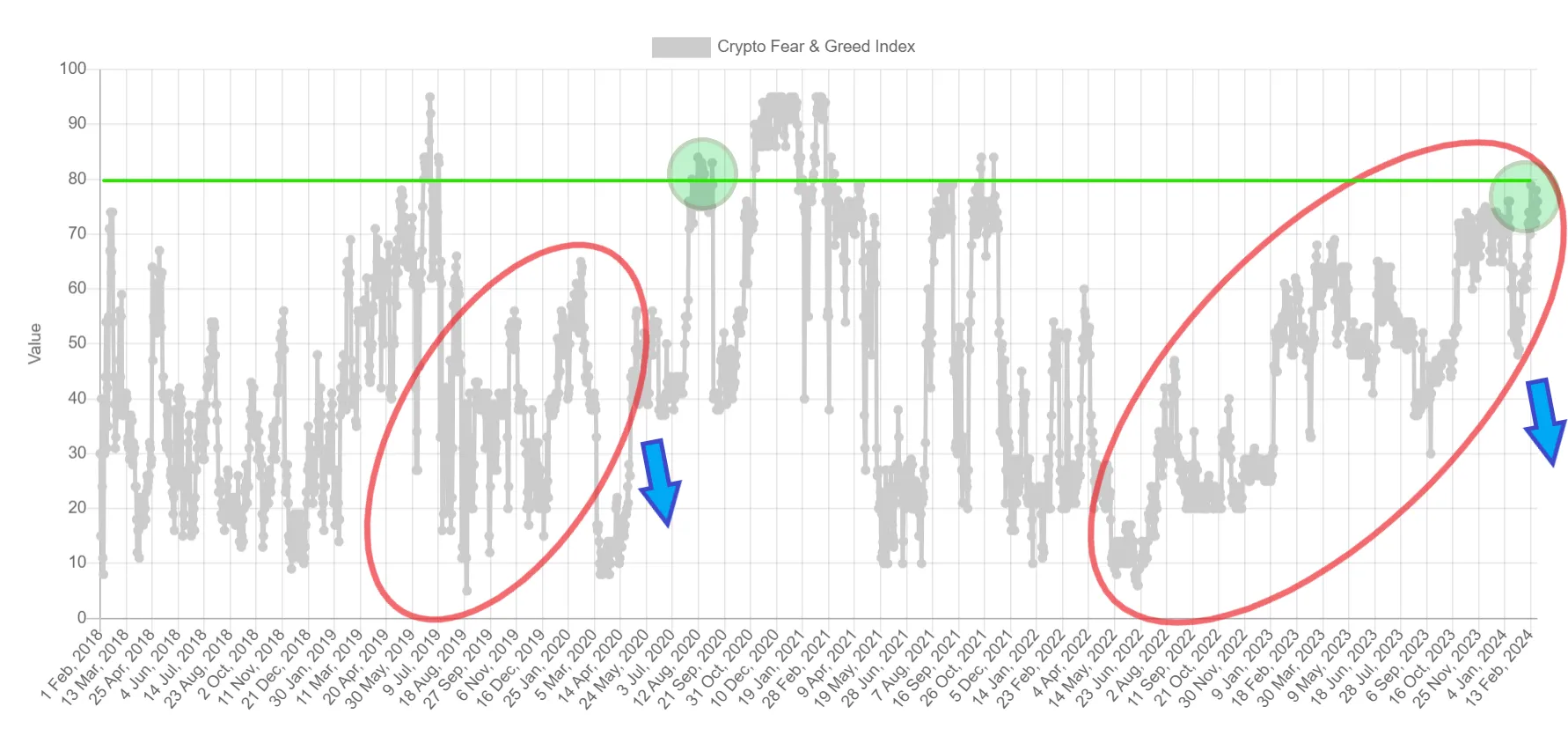

The popular Fear and Greed Index has once again entered the greedy range of over 75. Although such a situation in the cryptocurrency market can last for weeks and months, the similarity with the fractal of 2019-2020 suggests that a deep correction is possible.

If Bitcoin experiences a major decline before the halving, it could retest the $20,000 range. This will be consistent with price action and events prior to the previous half. After the halving, there may be a slight correction (about 21%), which has proved to be a good buying opportunity in the past.

The index of fear and greed returns to high greed

Today's readings from the fear and greed index are 76. This is a very greedy value from the dark green area. Usually, such a feeling indicates an impending correction, but it can remain relatively long in the cryptocurrency market.

Interestingly, last month's index of fear and greed averaged 48. This is a fairly neutral sentiment of market participants, which usually includes periods of consolidation and side trends.

Next, we look at movements in the Fear and Greed Index chart over the past 12 months and compare them to the corresponding period of the previous half-day. This happened in May 2020 and was preceded by extremely volatile BTC price action. The culmination of this volatility was a 62% drop in Bitcoin's price in March 2020. It was naturally triggered by the widespread crash of financial markets caused by Covid-19.

Read More: Bitcoin Price Prediction 2024/2025/2030

Although this is a black swan, we see similarities in the two fractals (red areas). First, the increase in fear and greed index readings is associated with the systematic increase in the price of BTC, counting from the macro low. 2020, this development has brought the indicator to greedy territory (above 55). On the other hand, we're going a little higher today, as they've already achieved over 75 readings by 2024.

In the year In the current situation, 2 months before the release and the market is very hot, a deeper correction (blue arrow) is more likely.

Extreme greed and the price of BTC

Also, it should be noted that in the previous cycle, the fear and greed index did not reach the peak of greed before it was halved. Unlike now, when the price of BTC reached around $12,000 (green area), after halving, the index indicated values above 75.

This resistance (green line) ended in the rejection of the first test, and Bitcoin briefly fell below $10,000 for the last time in September 2020. If such a situation were to happen now, in approximately 21% correction. The value of BTC remains in the game. At that point, Bitcoin price will test the $41,000 area, just above the 0.382 Fib retracement of the one-year uptrend.

On the other hand, if there was a stock market crash comparable to the events of Covid-19, before the halving, BTC could have fallen by 62%. Then the price of BTC will reach 20,000 dollars again, which seems very unlikely in the current market conditions.

However, despite these fractals being similar, each Bitcoin cycle works slightly differently. Perhaps the higher reading on the Fear and Greed index will not end in a deeper correction this time.

Read more: Who will have the most Bitcoins in 2024?

With the SEC's approval of Bitcoin ETFs, the ancient cryptocurrency is becoming an increasingly recognized and trusted global asset. This, in turn, eases the volatility of the broader cryptocurrency market, making deep corrections and incredibly high crashes fewer and less frequent events.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.