Future Mining Trends: Gold vs Bitcoin

Bitcoin is challenging the age-old allure of gold. As these two value titans battle for supremacy, the future of mining for both assets is at a crossroads.

Gold, with a long history, symbolizes cultural wealth. On the other hand, Bitcoin represents the forefront of digital innovation.

Gold vs Bitcoin: Which is better now?

Gold mining passed the test. It has been a symbol of wealth and stability for centuries. The process of extracting gold from the earth is labor intensive and taxing the environment. Yet it remains a cornerstone of the world economy.

Gold's tangible nature and historical significance make it a safe store of value, especially during times of economic uncertainty.

On the contrary, Bitcoin mining represents the pinnacle of digital innovation. It involves solving accounting problems to verify transactions on a blockchain decentralized ledger. This process, known as proof-of-work (PoW), requires significant computing power and, consequently, large amounts of energy.

Rob Chang, CEO of Gryphon Digital Mining, told BeInCrypto about the strategic approach of Bitcoin miners. He emphasized that Bitcoin mining can stabilize local grids and support renewable energy projects, a unique advantage that traditional gold mining lacks.

“Miners need low-cost energy, often in areas with low demand or where there isn't even enough demand to support a stable grid. Having a Bitcoin miner that uses a fixed amount of energy is useful for regions where the local area may not be willing to support a stable grid,” Chang said.

Both gold and bitcoin mining have high environmental footprints. Gold mining often causes deforestation, water pollution and habitat destruction. Efforts to mitigate these impacts include developing stricter regulations and more sustainable practices.

However, the inherent physical nature of gold mining poses ongoing environmental challenges.

On the other hand, Bitcoin mining has been criticized for its high energy consumption. Despite controlling Bitcoin's carbon footprint, the industry is increasingly turning to renewable energy sources.

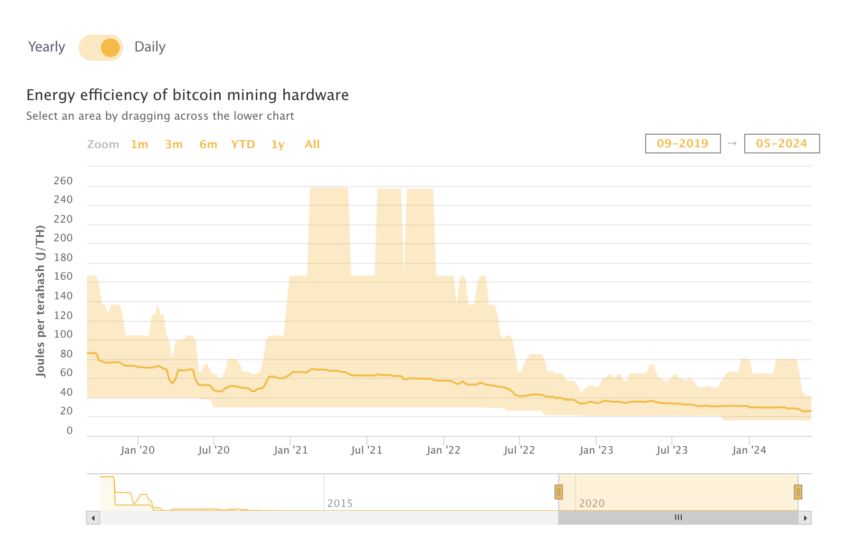

Chang notes that the competitive nature of Bitcoin mining drives efficiency and innovation, leading to more sustainable practices over time.

“Bitcoin mining problems are an inevitable consequence of Bitcoin's success and something miners should expect and actually accept because this will only happen if Bitcoin continues to succeed. It encourages miners to innovate to be as efficient as possible and keep costs as low as possible,” Chang added.

Read more: Free Cloud Mining Providers to Bitcoin in 2024 My Bitcoin

Competitive mining market for both assets

The economic value of mining operations is critical to both industries. The price of gold is influenced by geopolitical stability, currency fluctuations and market demand. Although stable, gold mining profitability can be affected by fluctuating mineral prices and rising production costs.

Bitcoin market volatility is more volatile. The price is subject to market sentiment, regulatory changes and technological developments.

Chang explained that power prices are the most critical cost variable for Bitcoin miners. Efficient energy management can make or break a mining operation.

“The best measure of this is Bitcoin's efficiency ratio, which measures the amount of Bitcoin generated per exahash deployed. A good way to think of this is that Bitcoin is oiled like hashrates are on oil rigs. The more bitcoin or oil a company needs to generate, Chang told BeCrypto.

Read more: Top Countries Where You Can Legally Withdraw Bitcoin

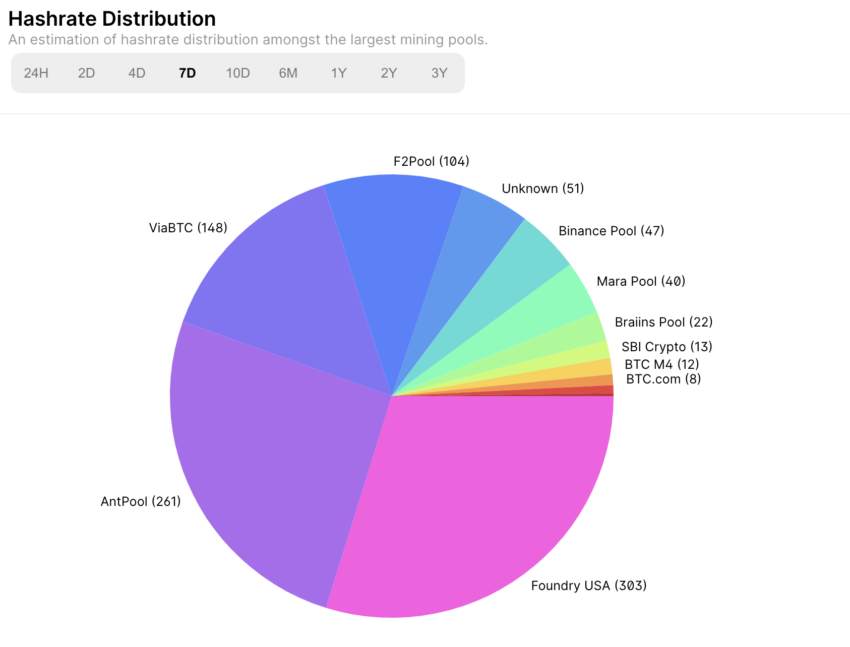

Moreover, hardware competition at the ASIC mining level is welcome and good for the industry. Historically, a few major players dominated the mining machine market, crushing profitability by changing equipment based on real-time Bitcoin prices. This has made miners uncompetitive, as most are forced to make large upfront payments for machine purchases.

The centralization of mining power can be a concern for the Bitcoin network. While not currently an issue, it is important to ensure that bad actors do not gain control over global hashrate. Decentralization is key to ensuring a secure blockchain.

Regulations will play an important role in the future of mining. A weak political environment can completely kill mining operations. Chang pointed out that most of the laws that affect Bitcoin mining relate to its power consumption.

If a mine is carbon neutral, it can avoid regulations targeting carbon-emitting operations.

Read more: 5 best platforms to buy Bitcoin mining stocks before 2024 halving

Looking ahead, gold remains a safe haven, but its environmental impact could lead to stricter regulations and push for greener mining technologies. Bitcoin has the potential to support renewable energy and stabilize the grid, potentially paving the way for a more sustainable future in digital asset mining.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.