Goldman Sachs has revealed a new filing that it holds $461 million in BlackRock IBIT

Key receivers

Goldman Sachs saw an 83% increase in shares of the BlackRock Bitcoin ETF. The bank also expanded investments in other Bitcoin ETFs, including Fidelity's Wise Origin and Grayscale's Bitcoin Trust.

Share this article

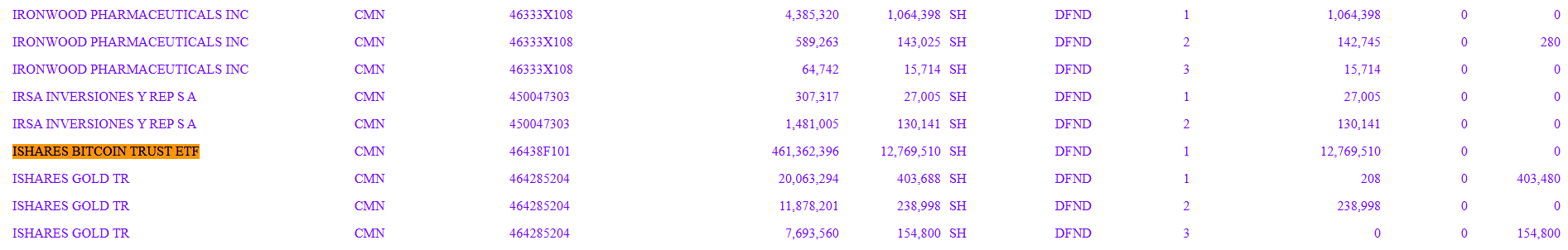

Goldman Sachs increased its holdings in BlackRock's iShares Bitcoin Trust (IBIT) by $461 million to a stake worth $12.7 million, an 83 percent increase from its previous position of roughly 6.9 million shares.

A recent increase in Goldman Sachs' IBIT holdings significantly outpaces Capula Management's roughly $253 million in holdings. The firm is currently IBIT's second-largest shareholder, trailing Millennium Management, which owns nearly $844 million.

The investment bank, which was added to the Bitcoin ETF as an authorized participant by BlackRock, has also invested in several other Bitcoin ETFs.

The firm's holdings included more than 1.7 million shares of Fidelity's Wise Origin Bitcoin ETF (FBTC) worth $95.5 million, a 13 percent increase from its previous filing.

Goldman Sachs holds more than 1.4 million shares of Greyscale's Bitcoin Trust (GBTC) at $71.8 million, up 116% from its previous filing. The bank owns 650,961 shares of Bitwise's Bitcoin ETF (BITB) worth $22.5 million, a 156% increase from the previous position.

Goldman Sachs' portfolio also includes other funds managed by Invesco/Galaxy, WisdomTree and Ark/21Shares.

Share this article