Grayscale lists SUI, TAO, OP, CELO among top “high potentials” for Q4 2024.

Key receivers

Grayscale adds new cryptocurrencies like Sui and Bittensor to its top 20 list for Q4 2024. The list highlights themes such as decentralized AI and traditional asset tokenization.

Share this article

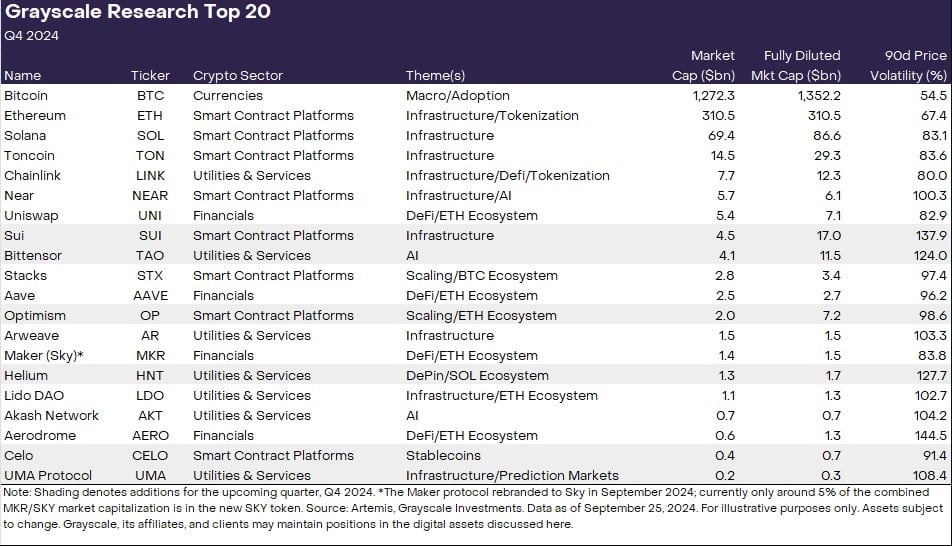

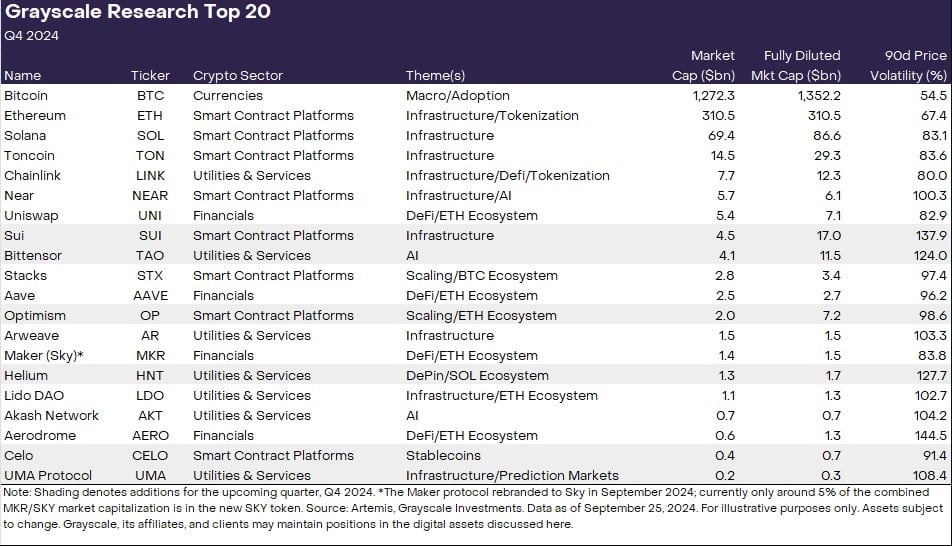

With the final quarter of the year just four days away, Grayscale Research has updated its list of the top 20 crypto assets expected to outperform in the next quarter. The updated list comes with six new altcoins including Sui (SUI), Bittensor (TAO), Optimism (OP), Celo (CELO), Helium (HNT) and UMA Protocol (UMA).

Grayscale Research stated that these new additions reflect the crypto market themes that the group is “focused on”.

“The Top 20 represents a variety of assets in crypto sectors that, in our view, have the most potential in the coming quarters. Our approach includes network growth/adoption, upcoming catalysts, sustainability of fundamentals, token price valuation, token supply inflation, and potential tailwinds.” It covers various situations including threats.

“Grayscale believes these new additions, along with existing assets in the top 20, offer compelling investment opportunities with growth and risk-adjusted returns,” he added.

Based on the list, areas of focus are decentralized AI, high-performance infrastructure, as well as projects with “unique adoption trends.” Grayscale research highlights decentralized AI platforms, traditional asset tokenization and the continued appeal of memecoins as key emerging trends.

According to the team, Sui is known for its 80% increase in transaction speed following its network upgrade, while Bittensor is advancing the integration of crypto and AI. Specifically, Grayscale currently offers trust products for Sui and Bittensor, namely the Grayscale Sui Trust and the Grayscale Bittensor Trust, which debuted last month.

Optimism, an Ethereum Layer 2 solution, and Helium, known for its decentralized physical infrastructure, made the list, with Silo's move to the Ethereum Layer 2 network and its growing adoption in payment solutions being key factors.

The development of the use of selo stable coins was not only seen by Grayscale Research, but also by Vitalik Buterin. Ethereum's founder recently hailed Silo's milestone in stablecoin addresses that are active daily, spurred by the app's adoption and demand in Africa.

It is the latest addition to the UMA protocol that supports the Polymarket forecasting platform. UMA's presence on the list underscores Oracle's importance in blockchain prediction markets.

Bitcoin, Ethereum and Solana are still in focus.

Established crypto assets such as Bitcoin, Ethereum and Solana still hold leading positions in Greyscale's portfolio. The research team noted that Bitcoin and the crypto sector have outperformed other sectors this year.

As noted in the analysis, Ethereum underperformed Bitcoin but outperformed most crypto assets. Despite facing competition from popular blockchains like Solana, Ethereum dominates in terms of applications, developers, payment revenues and locked-in value.

Grayscale Research expects the entire smart contract platform sector to grow, leveraging Ethereum due to its network effects. In addition to Ethereum's high network reliability, security and decentralization, the team believes that its regulatory environment gives it a competitive advantage over competing networks.

In addition to making room for new crypto assets, the research team removed six people from the list. These symbols are Render, Mantle, THORChain, Pendle, Illuvium and Raydium. According to the team, while these assets still have value in the broader crypto ecosystem, the revised listing offers more compelling risk-adjusted returns for the next quarter.

Grayscale Research also warns of risks around crypto investments, citing high volatility and unique challenges such as smart contract vulnerabilities and regulatory uncertainty.

Share this article