Greyscale’s Ethereum Trust Offer Is Narrowing Amid ETH Trading Volume

The number of Ethereum Exchange Traded Fund (ETF) applications has positively impacted Greyscale's Ethereum Trust (ETHE).

The increasing interest has significantly increased the trading volume of various crypto exchanges, narrowing the discount of ETHE below 15%, which is the lowest level this year.

Greyscale's Ethereum Trust Discount Waterfall

The discount on Greyscale's Ethereum Trust in 2018 It's down 13.94% since November 10, according to Coinglass data. This represents a significant turnaround for the property, which was 60 percent off earlier this year.

Etfstore President Nate Gerasi said that this contract at a reduced price shows that the market is maintaining the position of the Ethereum ETF ETAM ETOP. He believes that discounting is a real-time indicator similar to a “live betting line”. Therefore predicting the probability of ETF approval.

In recent months, the US Securities and Exchange Commission (SEC) has been reviewing applications for spot ETFs covering major cryptocurrencies, including Bitcoin and Ethereum. The regulator has received several applications from prominent traditional financial institutions such as BlackRock and Greyscale.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

These applications have contributed to the bullishness in the crypto market, driving Bitcoin to a year-to-date high of nearly $38,000 and Ethereum to over $2,000. In particular, they have significantly reduced offers for Greyscale's Bitcoin and Ethereum Trusts, which currently do not support redemptions.

Observers believe that deals in Greyscale's trust will close if the SEC approves the applications to switch to ETFs.

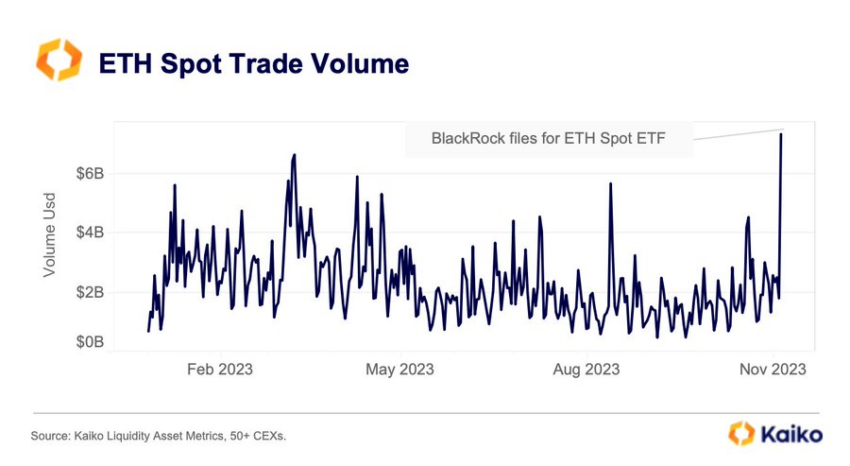

Spot Ethereum trading volume has increased.

The ETF-led rally pushed Ethereum's trading volume to over $6 billion, a milestone not seen since FTX's collapse last year. This increase follows a comparable increase of more than $6 billion in March, according to data from Caico.

The increasing trading volume also suggests that crypto investors are actively trading Ethereum after a multi-year hiatus.

Read more: How to buy Ethereum (ETH) with a credit card: a step-by-step guide

Recently, the crypto market has seen a turnaround, with the recent ETF-inspired rally reversing the fortunes of many crypto assets and sending them to new highs. Data from BeInCrypto shows that ETH is trading at $2,052 as of press time, up 12% over the past week.

Top crypto platforms in America | November 2023

Paybis” width=”32″ height=”32″>

Paybis” width=”32″ height=”32″>Paybis

For 1st exchange → no fees

iTrustCapital” width=”32″ height=”32″>

iTrustCapital” width=”32″ height=”32″>iTrustCapital

Crypto IRA →

Coinbase;” width=”32″ height=”32″>

Coinbase;” width=”32″ height=”32″>Coinbase

200 dollars to register

Support” width=”32″ height=”32″>

Support” width=”32″ height=”32″>keep it up

→ No withdrawal fee

eToro;” width=”32″ height=”32″>

eToro;” width=”32″ height=”32″>Etoro

$10 for first deposit →

BYDFi” width=”32″ height=”32″>

BYDFi” width=”32″ height=”32″>WorldFi

No KYC transaction →

The post Greyscale's Ethereum Trust discount as ETH trading volume shrinks appeared first on BeInCrypto.