Here’s why a 51% attack on Bitcoin is impossible

On-chain crypto analytics company CoinMetrics has released a new research report dispelling fears of blockchain regulation. They say the need for more powerful mining and the cost of 51% attacks make it unmanageable. Even as the Bitcoin network prepares for the halving of the hashrate.

According to CoinMetrics researcher Lucas Nuzzi, a 51% attack on Bitcoin would require 7 million miners. Ethereum's transfer rate limits the transfer of verifiers to six months of regulatory trials.

Bitcoin holdings are cost prohibitive.

The company also confirmed that 51% and 34% of ideological attacks on Ethereum and Bitcoin fail at different levels. If they were rich, governments would have to spend over $20 billion to produce their own reverse-engineered Antminer S9 Bitcoin mining machine in volume. Alternatively, they would have to pay nearly $20 billion to buy those machines on the open market.

Read More: 51% of Blockchain Attacks Explained: What Are the Risks?

“This is the first empirical evidence … that countermeasures become unattractive when compared to other strategies, such as honest participation in the network or avoidance of violence,” Nuzzi said.

The researchers estimate that a 34% attack on Ethereum liquidity protocols such as Lido Finance and Rocket Pool could cost over $34 billion in ETH. To do this, the attacker must manage more than 200 nodes and spend 1 million dollars on cloud services for six months. Additionally, common crypto attack methods, including double-spend attacks, selfish mining, and transaction fee market manipulation, cost too much to scale financially.

Bitcoin Miner is the perfect foil.

According to crypto financial services firm Galaxy Digital, the upcoming Bitcoin halving will drive many miners out of the market. Halving reduces crypto mining profits and costs less energy efficient mining machines.

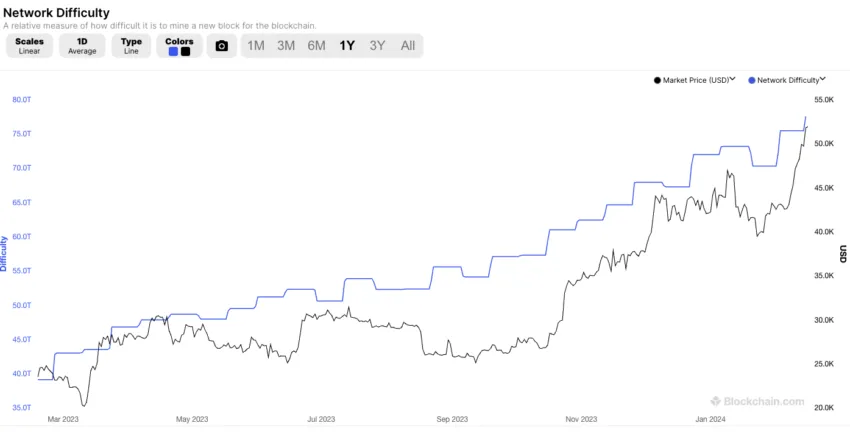

The drop in miners is measured by the decrease in hashrate, which is the amount of time miners try to estimate the hash of a Bitcoin transaction block per second. Hashrate decline refers to the decline in online mining and is used as a proxy for miners exiting the market.

We estimate that 15-20% of network hashrate may come offline during the halving in late 2023 (86-115 EH). Based on our analysis, we expected the 2024 network hashrate to end up in the range between 675 EH and 725 EH,” Galaxy said.

To prevent the collapse of the Bitcoin network, companies with more powerful machines are able to put power in the hands of a few entities, so it begins to correct the problem. As these computers become more powerful, governments will find it harder to attack 51%.

New machines like the Antminer S21 are difficult to reverse engineer, making them difficult to replicate. Therefore, takeover attempts will always be playable.

Read more: How to Withdraw Cryptocurrencies: A Step-by-Step Guide

BeinCrypto spoke to mining company Core Scientific about the possibility of a 51% attack after the reduction. The company was unable to respond at the time of publication.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.