High Performance Altcoin DYDX Spikes 30%: How It Happened

DYDX, the native token of decentralized trading platform dYdX, has become the top performing altcoin in the past 24 hours. According to CoinGecko, DYDX rose to this high after its price increased by 30%.

As a result, it outperformed altcoins including Bitget Token (BGB) and Virtuals Protocol (VIRTUAL). How it happened and what might be next for the brand.

The demand for dYdX has reached a very high level

DYDX price 24 hours ago was $1.82. But in today's first trading session, the price of the cryptocurrency rose to $2.48, becoming the top performing altcoin out of the top 100, while the price returned slightly to $2.34, Santiment data shows that there is a strong interest in the market.

One measure that confirms this is social dominance. Social dominance measures the percentage of conversations in crypto-related media for a specific asset or keyword. This metric provides insights into the relative popularity or attention a property receives compared to others.

As the scale increases, it means there are more conversations about cryptocurrency among 100's of others. As of this report, DYDX's social dominance has grown to 0.59%.

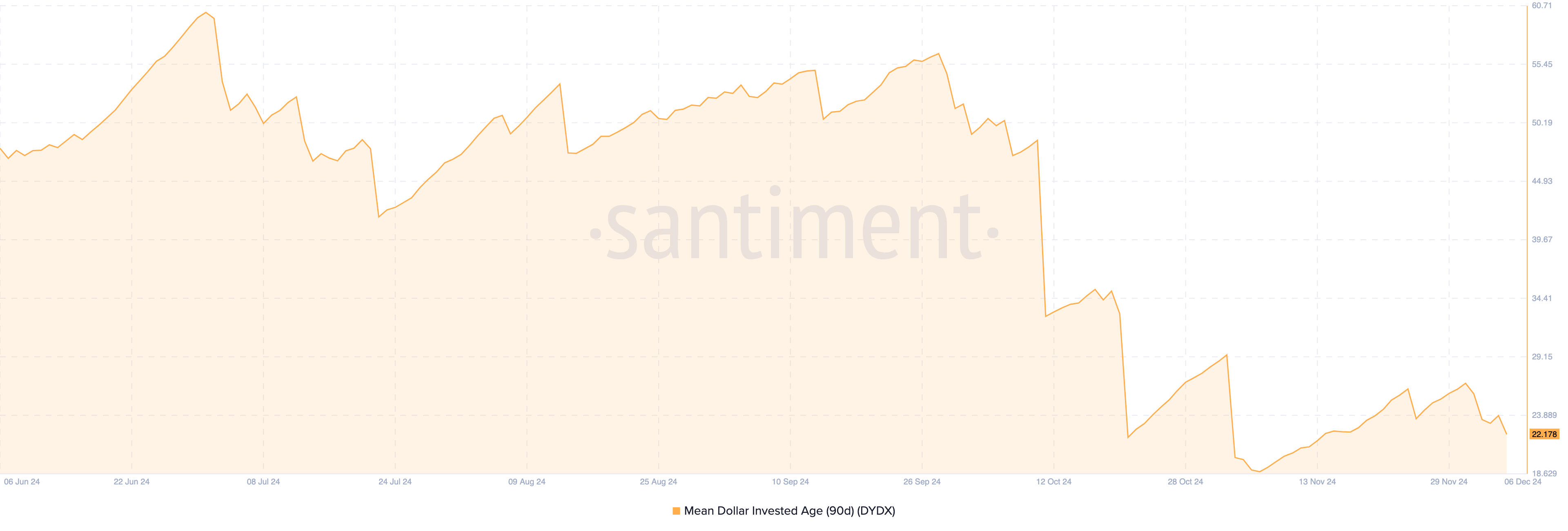

If social dominance continues to increase, it may indicate an increase in demand for the altcoin, which may cause the price to return to $2.48. In support of this view, the average dollar invested period (MDIA) shows that market activity is growing.

MDIA measures the average age of all dollar transactions in cryptocurrency and may reflect market levels. Typically, a rising MDIA indicates a token slowdown, often inhibiting price growth.

However, sentiment data shows that the MDIA has recently declined, indicating increased trading activity as previously dormant signals are now moving. This trend could further strengthen the altcoin recovery potential.

DYDX Price Prediction: Coming to $4?

According to the 3-day chart, DYDX is positioned as the top performing altcoin due to its exit from the descending triangle.

A descending triangle is a bearish pattern that is frequently defined by a series of low highs and a falling uptrend that acts as support for a horizontal downtrend. This pattern indicates a weakening of buying pressure and the possibility of a breakdown below the horizontal support level, indicating that the downtrend is likely to continue.

However, the altcoin has broken out of the upper trend line, defying the bearish forecast. If this is the case, the price of DYDX could increase to $4.53. On the flip side, if selling pressure increases and trading volume decreases, the trend may reverse, and DYDX may lose its position as a top-performing altcoin.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.