How Bitcoin ETFs Continue Their Trend With $439M in Revenue

Bitcoin ETFs are showing no sign of weakness as they enter their ninth consecutive streak of positive returns, even as the broader market continues to bear down.

BlackRock's Spot Bitcoin ETF IBIT led the day's biggest gains.

Bitcoin ETFs extend the momentum

According to data from SoSoValue, Bitcoin ETFs extended their winning streak after posting positive gains for the ninth straight day on Dec. 10. All 12 funds posted the second-biggest weekly gains last week at $2.73 billion. Despite ample liquidity in the market this week, ETF investors appear to be very bullish on the currency.

BlackRock's IBIT brought in $295.63 million, followed by Fidelity's FBTC with $210.48 million, while ETFs attracted the largest share of $439.56 million.

At the same time, Greyscale's GBTC recorded over $60 million in inflows. However, the $400 million net inflows confirm strong investor interest in US spot BTC ETFs.

The total net assets under these ETFs exceeded $107.76 billion, which is 5.65% of Bitcoin's total market value. More interestingly, these funds currently hold more Bitcoin than Satoshi Nakamoto.

In November, Bitcoin ETFs recorded $6.1 billion in inflows, the highest monthly inflow since they launched in January. Total inflows are approaching $4 billion in December, and if the momentum continues, the currency could hit a new record this month.

Ethereum ETFs didn't disappoint either, with daily revenue crossing $305 million on Tuesday. But the same cannot be said about the rest of the market.

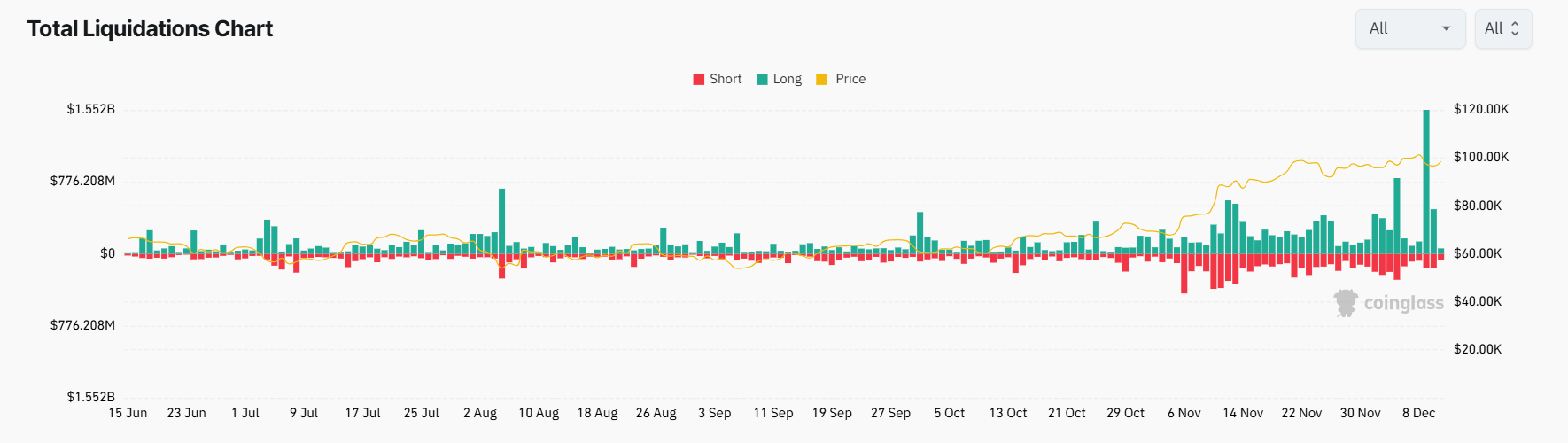

Crypto liquidations are growing into the billions.

Despite the upswing in the ETF market, the past two days have seen increasing liquidity as Bitcoin has failed to hold above $100,000. As the overall crypto market outperformed, Bitcoin dragged down the rest of the market. Major altcoins like XRP and Solana have mirrored Bitcoin's losses.

According to Coinglass data, the market recorded $1.7 billion in liquid payments on December 9 alone.

The sell-off continued through the week, with total liquidity rising to $2.5 billion over the past three days.

However, Bitcoin recovered and was trading around $100,555 at press time, up 5.06% in the last 24 hours. If Bitcoin manages to stay above the $100,000 mark, the largest cryptocurrency could continue to consolidate its position in institutional portfolios.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.