How Bitcoin Half Cycles Can Turn a $5 Investment into $130,000

Prominent crypto analyst Plan B has suggested that those trading around Bitcoin's half-cycles stand to gain better returns on buy-and-holds.

The trading veteran said most of Bitcoin's price increase has occurred in the past three quarters. At the same time, the founder of BitMEX, Arthur Hayes, indicated that geopolitical instability could fuel the bull run.

Bitcoin Miner: How to turn $5 into $130,000

Around the Bitcoin halving events, only traders participating in the crypto market were able to record returns of up to 2,500%.

“Being in the market only in these three [Bitcoin halving] Plan B revealed.

Bitcoin's halving, which occurs roughly every four years, has historically reduced the volume of new BTC issuance by 50 percent, leading to significant price increases. This increase in scarcity provides a strategic window for savvy investors to capitalize on Bitcoin.

Read more: Bitcoin Half Cycles and Investment Strategies: What You Need to Know

Under Plan B's stock-to-flow model, traders must buy Bitcoin six months before the decline and sell it 18 months later. This approach aims to take advantage of Bitcoin's cyclical patterns, which capture large price spikes around Bitcoin's halving, sidestepping subsequent bear markets.

Bitcoin wins in times of geopolitical uncertainty

Moreover, BitMEX founder Arthur Hayes pointed out that buying Bitcoin in times of geopolitical unrest and war can be a strategic move for a crypto trader.

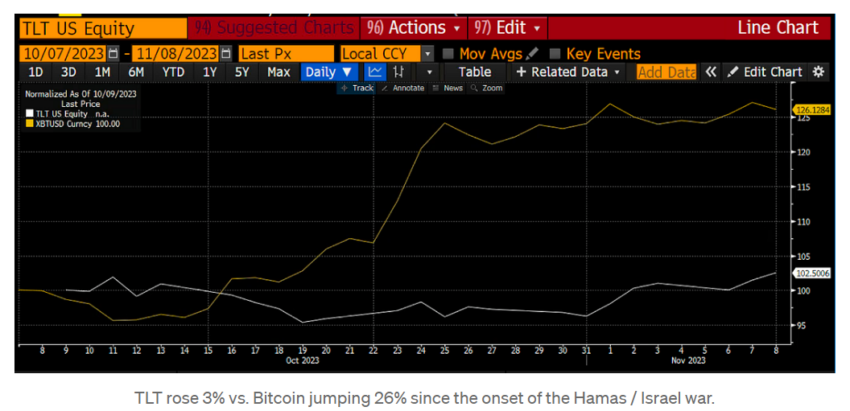

According to Hayes, Bitcoin has shown resilience against traditional assets such as long-term US Treasury bonds during conflicts such as the Ukraine-Russia war and the Hamas-Israel conflict. For context, the price of BTC has increased by 26% since the start of the war in Palestine.

“The smartest trade has long been crypto. Nothing has outperformed increasing central bank balance sheets like crypto,” Hayes said.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

Hayes also showed that Bitcoin's price performance is a potential hedge against uncertainties related to geopolitical tensions. Therefore, Bitcoin has become a reliable indicator of the health of the fiat financial system in these circumstances.

“Bitcoin has proven to outperform bonds in times of war. Despite the initial weakness, I buy the dips,” Hayes said.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.