How Bitcoin Millionaires Are Multiplying Ahead of the New Bull Run

The cryptocurrency market is going through a massive upheaval, as evidenced by the rise of Bitcoin millionaires. In the year By 2023, the number of addresses holding more than $1 million in Bitcoin has more than tripled, reaching an impressive number of over 81,000.

Representing a 237% increase since January, this impressive increase coincides with Bitcoin's price rally, which has surpassed the $37,000 threshold.

Multiply Bitcoin millionaires

Bitcoin has been on a dramatic climb, reaching close to $38,000 last week and hovering around $37,000 in the early hours of Monday. This price increase reflects Bitcoin's strong market performance and shows a trend taking shape in the crypto market. Indeed, the increase in Bitcoin millionaires has been dramatic, nearly tripling year-over-year.

Short-term bitcoin holders also benefited from this growth, selling and accumulating over $1.8 billion in profits. This contrasts with long-term holders who were in the process of accumulating before the upcoming Bitcoin halving.

“Most of them enter the exchanges for short-term holders, which shows the huge profits from the recent rally. Short-term Bitcoin holders can profit, and this movement can affect the market volatility,” said an author verified by CryptoQuant.

This bullish trend in the price of Bitcoin and the increasing number of millionaires in the market is supported by strong liquidity trends. Data from Glassnode, an on-chain market intelligence firm, indicates that the supply of bitcoin has reached historic lows, indicating a tightening supply and reluctance to sell among existing holders.

Institutional pressure of interest

Moreover, the open demand for Bitcoin and Ethereum passed the $20 billion mark for the first time since the collapse of FTX. This indicates higher market activity and demand levels.

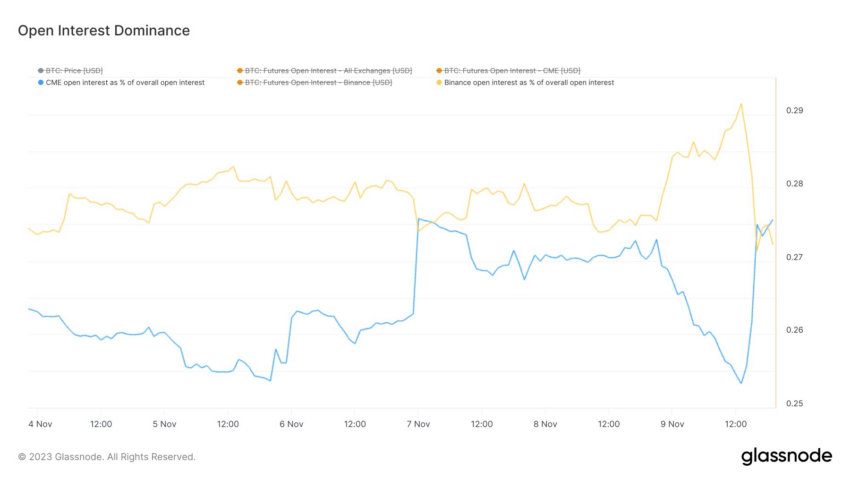

Of course, these trends are further supported by institutional capital. The increasing market share of the Chicago Mercantile Exchange (CME) suggests that it is the preferred place for large traditional financial companies to gain exposure to crypto.

“Bitcoin futures open interest surpassed Binance on the CME, a sign that institutions are serious about getting their feet wet and betting on ETF (exchange-traded fund) approval. Perpetual funding continues to rise, while forward and risk reversals continue to rally throughout the week,” QCP said. Capital analysts said.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

Additionally, order book depth has strengthened for Bitcoin and Ethereum despite strong price increases. This indicates a relative lack of sellers compared to buyers, which supports high market sentiment.

Year-to-date volatility for Bitcoin and Ethereum is also relatively low, further reinforcing the stability of the current market rally.

“Currently, the funding rate is at its highest level since October 2021, when Bitcoin hit its last historic price high. This value indicates that optimism is spreading in the market, which is driving a large number of futures contracts to bet on the price increase,” said Cau Oliveira, head of research at Blocktrends.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

The ongoing crypto rally, characterized by Bitcoin's sharp price hikes and altcoins like Chainlink and Solana, reflects a shift in the market. A market with institutional investors and relatively few sellers could start the next bull market.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.