How can MAV be rerouted?

A growing tide of research and market data is undermining long-held assumptions about the future of business.

Analysts have avoided taking into account one possibility between traditional finance and Crypto markets: the daily rate of artificial general intelligence (AGI) is related to reality.

AGI doesn't exist yet, but in the field of multi-generational agents, markets are moving towards an environment where machines can make purchases and leave little room for human feedback.

It shows how the current commercial automatic machines design the edges when the machines take them.

Algorithms Buy 70% of Crypto Trading, Analysts Say Retail Alphas May Avoid

High frequency trading many years ago, when companies such as Leap, Winter and GSR were overburdened, the focus was extended to the crystal markets.

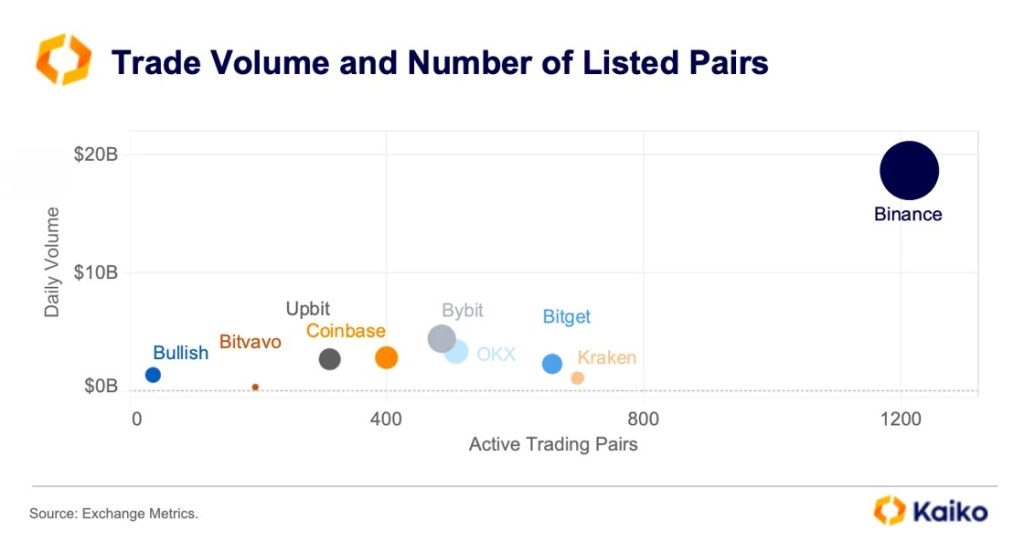

In the year By 2024, Kakaki reports that 70% of the trading flow of Bitcoin and Coins will be generated by algorithms rather than humans.

This shift will reduce the bottom of the market structure and accelerate the speed of execution, making it difficult to profit during periods of high volatility.

Researchers point to these trends as evidence of the loss of efficiency in the past.

In Solana Memecon 2024, trading bots, especially the “blacksmith” and “Annie” bots, are generally foreign traders at an alarming speed, due to automatic bias.

Small AI systems designed to recognize the behavior of fishers and identify the flow of bait can be faster than human traders and often understand what is happening before human participants.

It has automatically reduced the opportunities available to the next participants, and analysts have pushed this design to its logical position.

The difference between today's narrow guy and future sharer is placed at the center of this debate.

Current models are better in certain tasks such as scanning order books, reading market sentiment or the duty section. They cannot recognize domains or apply logic that is appropriate for human beings.

Primarily, it is expected to learn new tasks with minimal education, adapt to unfamiliar environments and combine information from many unfamiliar sources.

In financial markets, this means understanding political risk, analyzing investor activity and assessing supply chain disruptions.

The “perfect efficiency paradox” of marketing chore is the result of allowing “perfect efficiency”. If an agri system has the ability to predict with near perfect accuracy, the market will adjust immediately.

Traditional trading behavior fails when every market participant is guided by the same intelligence.

Prices react faster than humans, the bill of lading contracts, games are lost, and liquidity becomes a machine-driven process rather than a competitive strategy.

Analysts warn that this dynamic could create a black hole as the trade continues.

The I market makers move to practice the districts as automatic flows

So the warnings of shifts have been spread over the years. DWF Labs said in July that I-Drive market makers, especially historically thin order books and widely distributed small crypto assets, will increase liquidity.

Economist Alex Kruger described the future of the markets for small amounts of blood demand for errors.

The founder of Bitmax expressed that the thing that spins better than humans is that the most important monitoring of advanced systems can control the issues of participation in the main market activities and reduce human participation.

These observations were considered as hypotheses at the time, but they have more weight as Mr. Auto's level increases.

As automation accelerates, the human element in business operations is already changing.

Professionals do not disappear completely, but they are responsible for risk management, regulatory control, and interpretation of unusual arrangements from legal and speculative expectations.

Killing itself moves to independent systems. The growth of iTrading agents reflects this transition.

These tools are markets, choose strategies, choose risk parameters, execute trades in the application and learn from real input. Forecasts suggest that the AI trading bot market will reach approximately $75.5 billion by 2034.

Closing news news analysed, cryptographic predictions