How do Wales react before the event?

As the Bitcoin (BTC) community anticipates the impending collapse, the behavior of cryptocurrency whales — investors who hold large amounts of bitcoin — has come under intense scrutiny.

Analysts and market watchers will want to understand how these major players are positioning themselves ahead of a milestone that will impact historic Bitcoin prices and market volatility.

Despite the murky conditions, the whales are ruling.

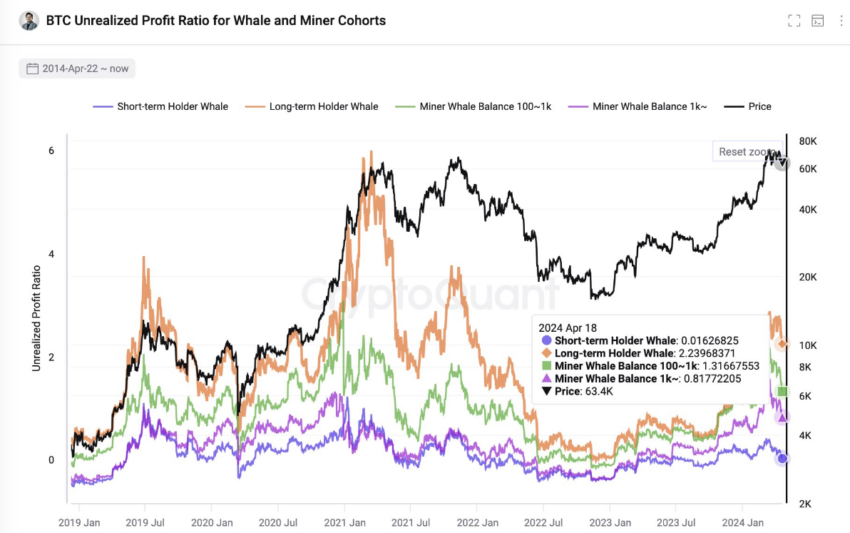

Recent data from blockchain analytics platforms such as CryptoQuant and Santiment have revealed significant changes in whale activity. According to a tweet from CryptoQuant, Bitcoin stocks rose by a whale, suggesting optimism from those anticipating a post-halving supply glut.

On April 18th, Bitcoin flow to storage addresses hit a new all-time high.

“Bitcoin inflows into storage addresses hit a record high of 27.7k BTC yesterday,” CryptoQuant reported.

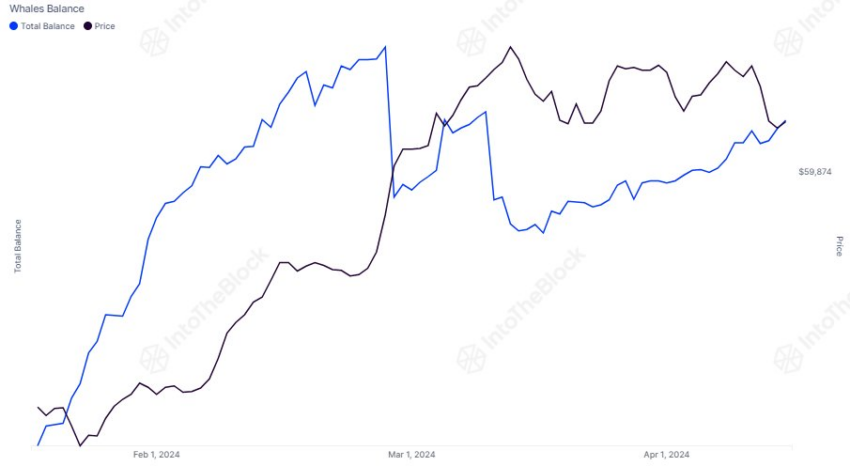

IntoTheBlock provides additional insight, which shows that large holders (1,000 BTC +) have increased their holdings by 16,300 BTC in the last seven days – equivalent to 1 billion dollars at the current price. However, the big whales are just starting to buy.

“The big whales, which account for at least 0.1% of the supply, have not started to harvest and have actually reduced their catch slightly yesterday,” Into Zeblock said.

CryptoQuant CEO Ki Young Joo tweeted that the historical trend of staying around the halving shows strong bearish sentiment. This behavior is consistent with the general assumption that a decrease in supply, a halving and a sustained or increased increase, will lead to an increase in price. Ju noted that they remain positive for chain gangs, particularly miners and whalers.

“Not enough profits to stop this cycle, imo.” Ju concluded.

Excessive bearish skepticism may soon lead to a market recovery.

Similarly, according to Santiment's analysis, Bitcoin Despite reaching $63,800 on April 18, overall sentiment remains weak.

“The public has a persistent arrogance towards senior leaders, which strengthens the argument for more rise.” Santiment explained.

Observers of the Bitcoin halving event, which halves the reward for mining new blocks, see it as a deflationary mechanism that reduces the new supply of Bitcoin.

As with previous halves, this event led to a massive run in the months following the correction. Investors and analysts speculate that this year's event could follow a similar pattern, although the extent of the damage remains to be seen.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

As the halving continues, both experienced traders and casual observers will continue to focus on Bitcoin's well movements. Their movements provide clues about market trends and sentiments. It sets the tone for small investors looking to keep up with changes in the cryptocurrency landscape.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.