How the bitcoin halving will affect price and investor sentiment

The Bitcoin halving is a significant event in the cryptocurrency market, where the supply of new BTC is halved. This discount is expected to increase scarcity and raise prices, especially if demand remains constant or increases.

Bitcoin's upcoming halving has sparked intense interest and speculation, with many experts predicting a significant price increase.

How will the next Bitcoin decline affect prices?

Historically, although not immediately, Bitcoin has experienced significant price increases following halvings. Hannah Fung, lead data analyst at SpotOnChain, told BeCrypto that price hikes are likely to occur around 6 to 12 months after the halving.

For example, in After falling in the first half of November 2012, the price rose from around $12 to $1,000 in late 2013. Similarly, in the second half of July 2016, the price of Bitcoin increased from $650 in December 2017 to nearly $20,000. A third halving in May 2020 took the price from around $8,000 to a peak of $69,000 in November 2021.

“Theoretically, a reduction in supply would increase scarcity, resulting in higher inflation, especially if demand is stable or rising. Additionally, the reduction in supply means miners have to sell less BTC to cover their costs, reducing selling pressure,” Pung emphasized.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

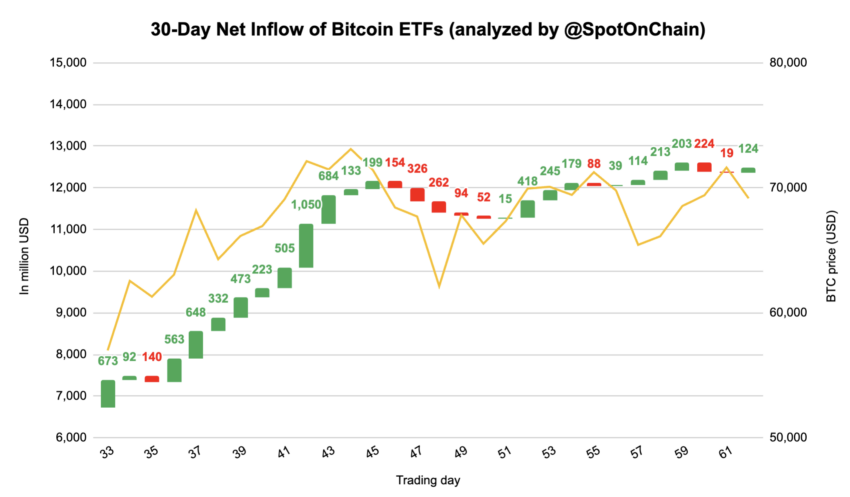

After these early halving events, the cryptocurrency market has rebounded significantly. Wide adoption and growing institutional interest. Indeed, the demand for Bitcoin exchange traded funds (ETFs) may introduce additional complexity to price volatility as well as monetary policy easing.

For these reasons, some analysts predict that the price of Bitcoin may rise to $200,000 or $500,000. However, the exact time and scale are still unclear.

“Although past trends provide some insight, the cryptocurrency market is unpredictable. There is no guarantee that the upcoming halving will follow the exact pattern of the previous one. The Bitcoin market is much larger and more established compared to previous halvings. Still, I am very optimistic about the price increase after the halving. But the exact timing and amount is uncertain,” Pung added.

Market sentiment as a barometer for BTC price

Market sentiment typically goes through various stages leading up to and following the Bitcoin halving. In the pre-half, the anticipation builds, leading to a general sense of ferocity. After the halving, sentiment may experience a short-term boost as the reduced supply of new BTC begins to take effect.

During these stages, investors should pay attention to several indicators, including technical analysis, news and social media, and chain analysis to gauge market sentiment and potential price movements.

“Technical indicators such as price charts and trading volume can provide insights into market sentiment. Meanwhile, news and social media conversations around Bitcoin and Bitcoin can reveal investor sentiment. On-chain data such as active addresses or exchange flow/exit Analysis can also indicate investor behavior.Finally, net inflows into Bitcoin ETFs indicate buying behavior, Peng explained.

Read more: Bitcoin Half Cycles and Investment Strategies: What You Need to Know

According to Pung, investor behavior will show significant changes in response to the Bitcoin halving. Increasing risk tolerance, a focus on long-term holdings and the entry of institutional investors are common trends.

While the surge in purchases due to FOMO (fear of missing out) may be short-lived, increasing institutional participation suggests a focus on long-term holdings that could lead to a more mature market with lasting impact. This narrative around halving may encourage institutions to view reduced supply as good long-term inflation.

However, institutions can approach Bitcoin investment with strong risk management strategies. You can weigh the potential benefits against the inherent volatility of the property.

“While Bitcoin offers the potential for high returns, it carries significant risk compared to most traditional assets, so investors should carefully evaluate these trends and correlations when integrating Bitcoin into their investment portfolios,” Peng concluded.

Read more: Bitcoin Half Countdown

As a long-term store of value, similar to gold, Bitcoin's limited supply and decentralized inflation appeal appeal to investors seeking a hedge. The integration with traditional financial systems has made Bitcoin more legitimate. Given these market conditions, the upcoming Bitcoin halving could result in long-term price stability due to reduced supply.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.