Hyperliquid (HYPE) jumps 37%, rally faces key resistance

The price of Hyper Liquidity (HYPE) is up 37% in the past seven days, following the biggest drop of the year. Momentum indicators such as RSI and BBTrend suggest that momentum remains subdued with room for further gains even though momentum has slowed from its highs.

If the bull momentum continues, HYPE may test a new all-time high of $28.95 and rise to $30 or $35. However, the weakening trend may expose the price to a correction, a strong support at $15 may indicate a downside of 42%.

HYPE RSI is currently far from overbought.

HYPE's RSI is at 55.8 from yesterday, indicating a strong recovery. This increase suggests that buying pressure is returning after the recent DEX freeze for good. Between December 13 and December 15, when HYPE hit a new all-time high, the RSI stayed above 70, reflecting overbought conditions.

The current reading, while below the overbought threshold, indicates a shift to bullish sentiment that could support further price stability or profit in the short term.

RSI (Relative Strength Index) measures the size and speed of price movements to assess whether an asset is overbought or oversold. Readings above 70 usually indicate overbought conditions and signs of a pullback, while readings below 30 indicate oversold conditions, often before a pullback.

With the HYPE RSI at 55.8, it shows neutral to bullish momentum, which remains comfortably below the overbought level, suggesting room for further upside. If the buying momentum continues, the HYPE may test new resistance levels, but if the RSI stalls, it may face a short-term consolidation.

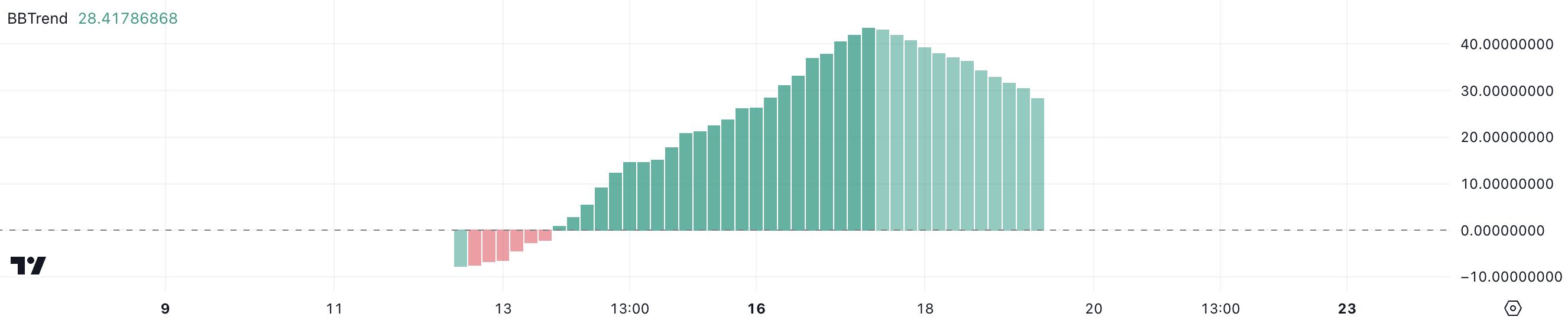

Hyperliquid BBTrend is still positive.

HYPE's BBTrend is currently at 28.4, remaining positive since the close of December 13th, days after the airdrop, indicating continued bearish momentum. However, it is down from its peak of 43 on December 17, indicating a period of strong strength as HYPE reaches new all-time highs like other altcoins.

This decrease shows that while the height change remains intact, the rate of upward movement is slower compared to the downtrend.

BBTrend measures the strength and direction of a price trend derived from Bollinger Bands. A positive BBTrend reflects bullish momentum, while a negative value indicates bearish pressure.

With HYPE's BBTrend still very positive at 28.4, the asset could continue its upward trend, albeit with more moderate momentum during the asset's highs. This static activity may support further gains, but the cooling trend suggests that HYPE may increase rapidly in the short term.

HYPE Price Prediction: New All-Time High Soon?

If the current trend continues, HYPE could soon challenge a new all-time high near $28.95, making it one of the best performing new altcoins.

A successful breakout above this level could push the price further, with targets at $30 and $35 possible, indicating a potential upside of 34%.

However, if the bullish trend weakens and a bearish trend develops, HYPE prices may face significant downside risk. The closest strong support is around $15, which would mean a 42% correction from current levels if tested.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.