I became an Ordinals RBF shooter to get rich… but I lost most of my Bitcoin

3 days ago Benito Santiago

Bitcoin Ordinals proved the critics wrong. NFT-style aggregators are still going strong two years after their launch – and as you might expect, gins have found an unusual way to make money from them.

It's called the “Forward-For-Feed (RBF) Fraud,” and skilled people can make tens of thousands of dollars overnight when the market conditions and timing are right.

It's basically a subtle way to cut an ordinal before anyone else. Legal collectors hate it, and some forums are doing their best to kill it.

On the Bitcoin network, transactions wait in a buffer before being processed, like passengers waiting to be picked up at a bus stop. A bus that arrives every 10 minutes is a newly mined block.

Most people wait patiently for their turn to board the bus, but the RBF sniper will slip the driver a little extra cash to get on the bus first. In the world of Bitcoin Ordinals, this means you can grab a valuable asset before someone who has been waiting in line.

Cutting the queue doesn't mean stealing the assets, as the sniper still pays for them. However, the technique seems a bit unfair to most people except for those who are coded. Quarry, who runs the Bitcoin marketplace Magisat, argues that RBF is a built-in function of Bitcoin and that the cut-fee auction it creates is an inherent part of the network.

“Bitcoin has to assume that every participant is profit-driven and has to adapt the rules to facilitate the rules, and the market still has to deal with that. That's how Bitcoin works,” he says.

In the first half of the year, there were only about five shooters, Quary can earn up to two BTC on a good night. Currently, the proceeds are split between multiple shooters.

Table of Contents

ToggleA rude proposal

Quarry offered to send me 0.05 BTC to learn RBF hacker ways. I agree in the name of science but if I make money I will give the profits to charity; If I lose, I'll just take back what's left.

SPOILER ALERT: It's harder than it sounds, and I'm not getting any charity much out of this story.

What I've learned is that cutting a line to get stuff first doesn't pay off easily. The fees piled up, the market moved quickly, and I was often stuck with properties that no one wanted unless I sold at a loss.

By the end of the experiment I was only about 0.017 BTC and no one wanted to buy two assets. But when I least expected it, an unknown trader took my Based Angels for 0.03 BTC.

What at first seemed like a simple and easy way to make a quick profit turned out to be another risky bet where I saved myself from total failure with a last minute purchase.

Quary still agreed to donate 0.01 BTC but the big profit I was hoping for never really happened.

Meanwhile, some NFT marketplaces have started to experience the updates while Magic Eden is pulling the trigger recently.

How Bitcoin RBF traders go about their business

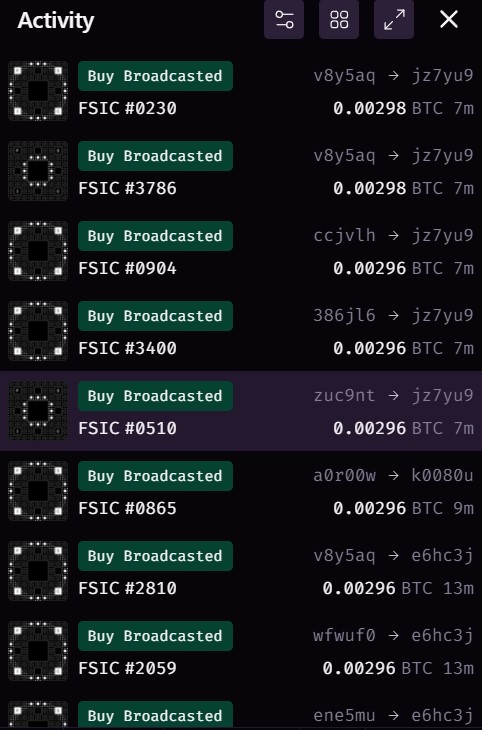

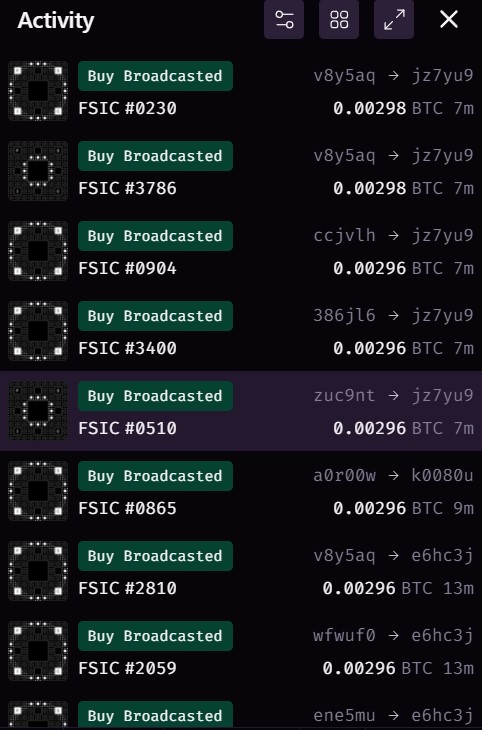

So, how do RBF shooters identify assets for fraud in regular marketplaces?

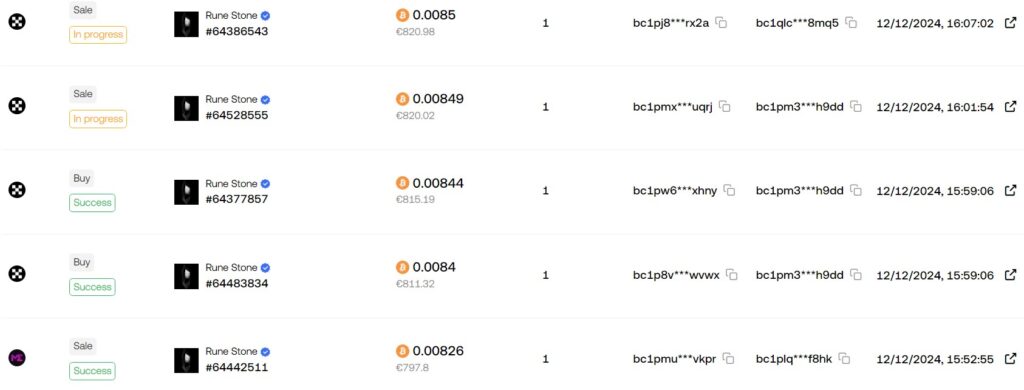

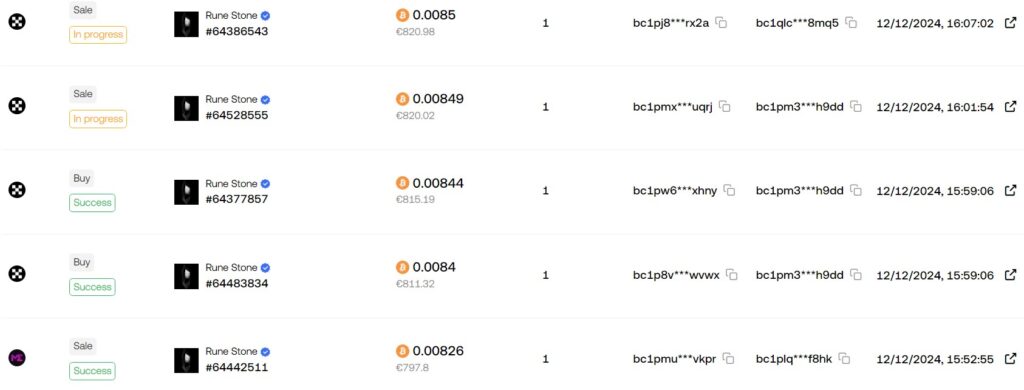

The first step is to identify a pending transaction in the market, which means that they can be snatched. How these transactions are presented varies by platform, but is usually well marked.

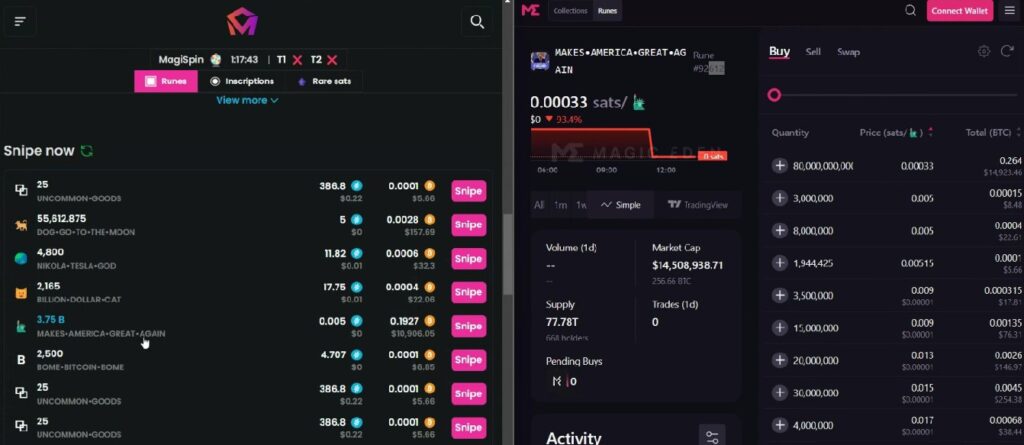

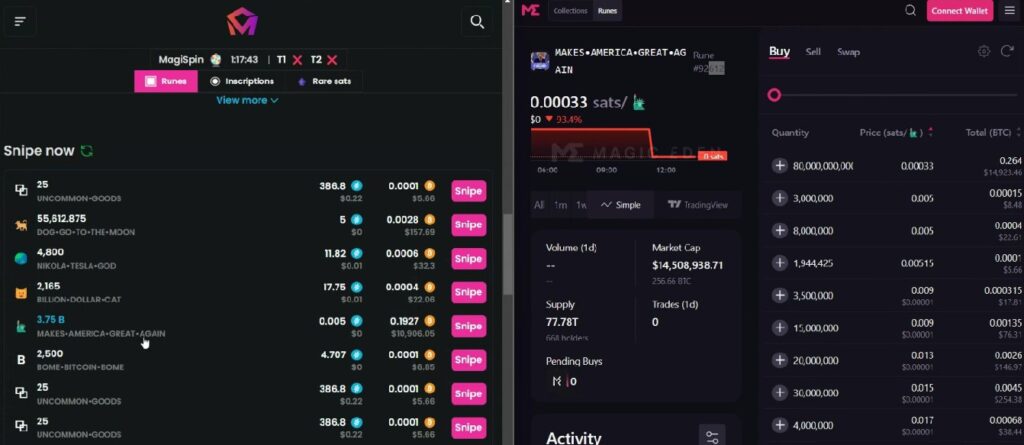

Some shooters build their own scripts or bots, while those without the technical know-how head to platforms like Magisat.

On these platforms, shooters choose how much extra transaction fees they'll pay to cut the line, and if successful, claim the property. From the first buyer's point of view, they were making purchases on Bitcoin marketplaces, but their transactions did not end.

One of the first things I hit was Bitcoin Frog in a transaction of around 0.033 BTC. I relisted the item, but it didn't sell in the next 24 hours, and Quarry bought it himself and kicked me out.

“We have to play together [liquid] Collections because those can be instantly copied, and we're not speculating on the price. Make a false profit, then list a little higher and sell for some cash,” Quary said.

Read more

Features

Blockchain is as revolutionary as electricity: big ideas with Jason Potts

Features

Beyond in-game assets: Blockchain Gaming, DAOs, Guilds and Ragequitting

If you don't have a benefactor to bail you out, like me, you just spent $3,325 on a worthless frog, which highlights the dangers for inexperienced players.

Once we learned to just copy more liquid stocks, it wasn't that difficult to immediately flip the assets for a slightly higher price, and the assets often sold immediately. But my bitcoin balance kept dropping as transaction fees piled up. If I listed the items at a higher price for the billing account, I had trouble getting them down.

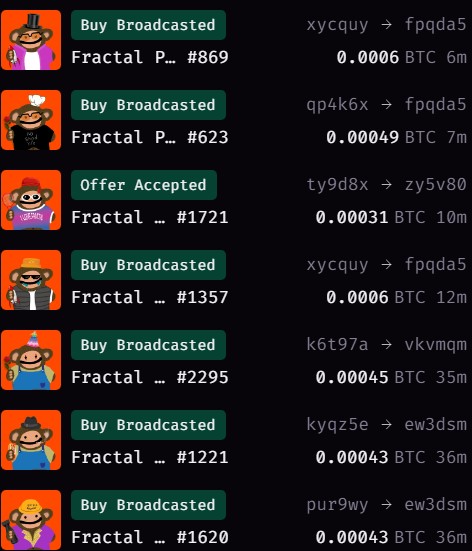

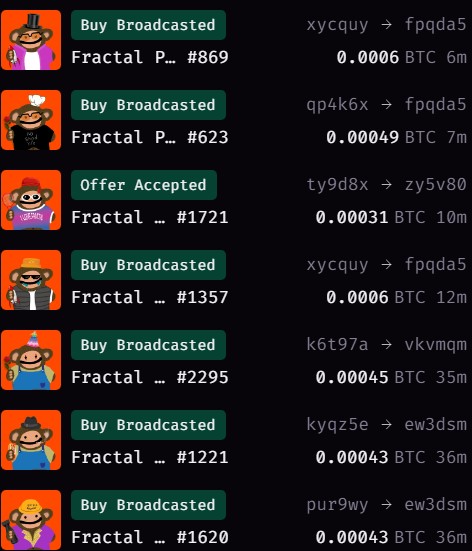

Once, I traded Fractal Puppet for 0.00175 BTC. But after I listed it for resale, the floor price suddenly took a dive. I even lowered my list price a few times in desperation, but still no one bought it.

At one point my wallet balance dropped to 0.015 BTC, I couldn't download holding more assets as their value dropped.

When I asked the coach for advice, his response was simple: “I usually see them as zero.

It looks like I will lose all my money. On the flip side, it might be a useful warning to readers who can't risk that kind of money.

How veteran RBF shooters profit

Who is the shooter? I don't know, but impersonating yourself is a very frustrating experience. During peak online activity hours, it felt almost impossible to mock anything without getting snapped myself.

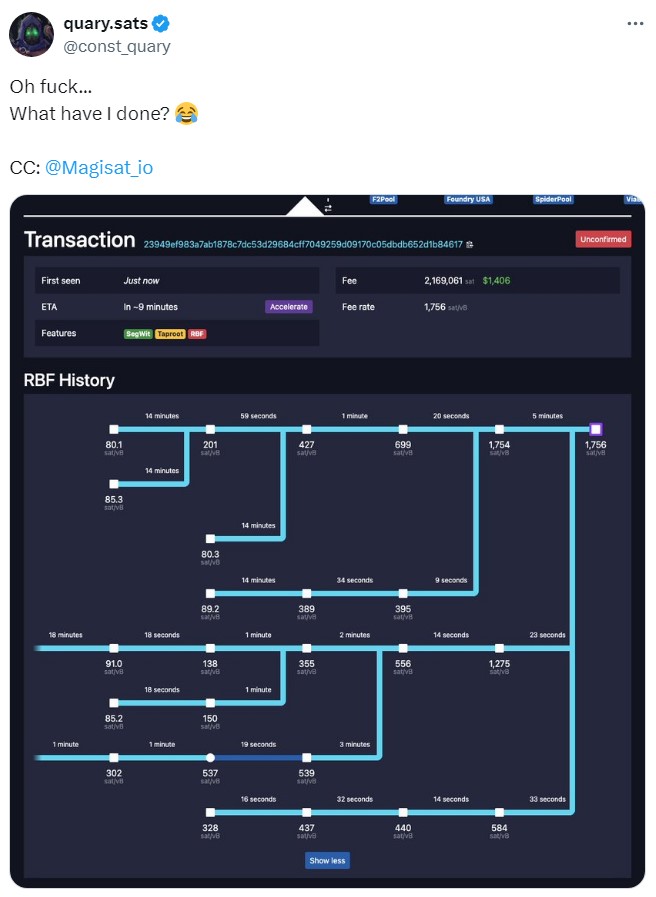

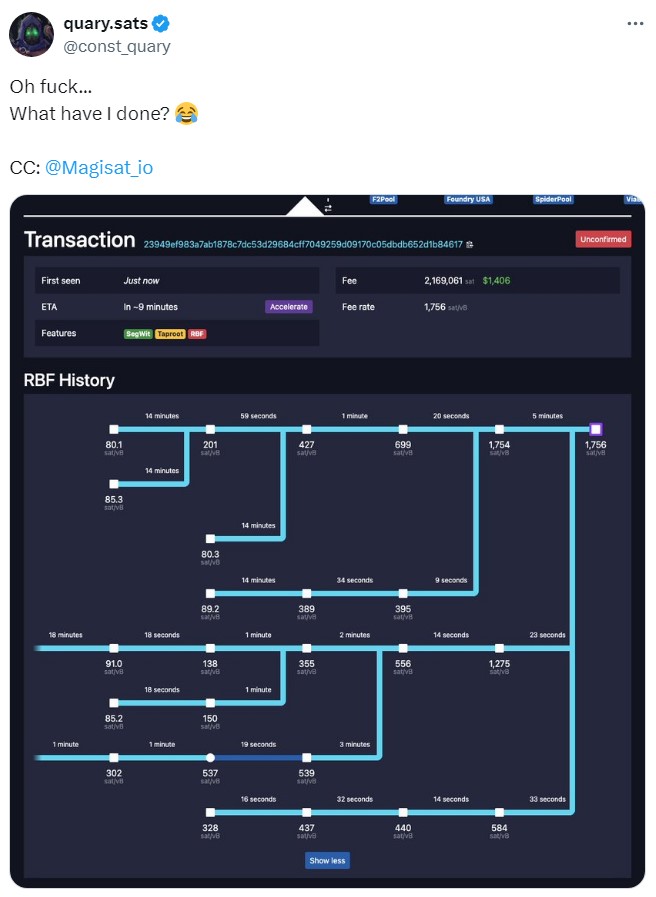

I requested an RBF transaction and was redirected to another web browser tab. When I got back to it, I realized that my transaction had been replaced by another shooter. How unfair!

One night, I saw a pending property in Mempul, and the price of the floor was higher than the buyer's offer.

This has happened quite frequently, even in the cases where I've picked up the fee it's much higher than the transaction in Mempool.

Experienced shooters are very strategic, says Quary, as he shares several pay battles he's been involved in.

In one example, Quary noticed that the seller accidentally listed Bitcoin Frog at 0.04 BTC instead of 0.4 BTC. A sniper bot immediately tried to buy it but ended up in a bidding war with Quarry, who asked around $3,700 while paying $1,300 more. He was able to flip it for $17,000, blockchain records show.

“Once you hit ‘Sell,' there's nothing you can do about it. Bots and snipers will all be on it,” he says.

Shooters crash the Bitcoin Ordinals and Runes sweepstakes.

Bitcoin-based NFTs such as Ordinals have recorded the highest annual trading volume in the industry (as of mid-December).

According to NFT data provider CryptoSlam, Ethereum-based NFTs recorded a transaction volume of around $2.8 billion as of January 2024 (down from around $5 billion last year). During the same period, Bitcoin Ordinals and BRC-20s saw $3 billion in trading volume.

Magic Eden is seen as the go-to platform for trading Bitcoin assets, according to Quarry. Shooters often go there to look for pending normal and Runes transactions. But the rampant shooter activity created a bad user experience for Magic Eden customers, and a recent update to the platform attempted to remove the shooter activities.

Read more

Features

Dorsey's ‘algorithmic marketplace' could fix social media… so why hasn't it?

Features

Can blockchain solve the oral problem?

“It's been constant,” says Elizabeth Olsen, head of bitcoin marketing at Magic Eden, in response to questions about whether the platform has been receiving user complaints about shooters.

“All this back and forth is really an inefficient use of our users' fees. All those are just going to the miners, and just going out of the ecosystem. I think the only thing we're happy about is staying in the family. “

In addition to the obvious UX problems for customers, shooters also discourage legitimate users from using a strategy of refining inventory. That's when a trader buys a lot of NFTs from a particular batch.

Sweeps often remove the cheaper collection properties from the market, effectively leaving out high-priced listings and driving up the collection's floor price. This can be a strategic play as the scavenger can aim for high profits from bulk purchases.

“A lot of our users like to swipe,” says Matthew Swetz, Head of Bitcoin Product at Magic Eden. “If I go to Mempool to sweep 20 items, and a shooter bids high on one of those items, the whole sweep falls apart.”

“If things get to the bottom, and there's like an economic war on payments rather than asset prices, the economy gets the wrong impression,” Switz said.

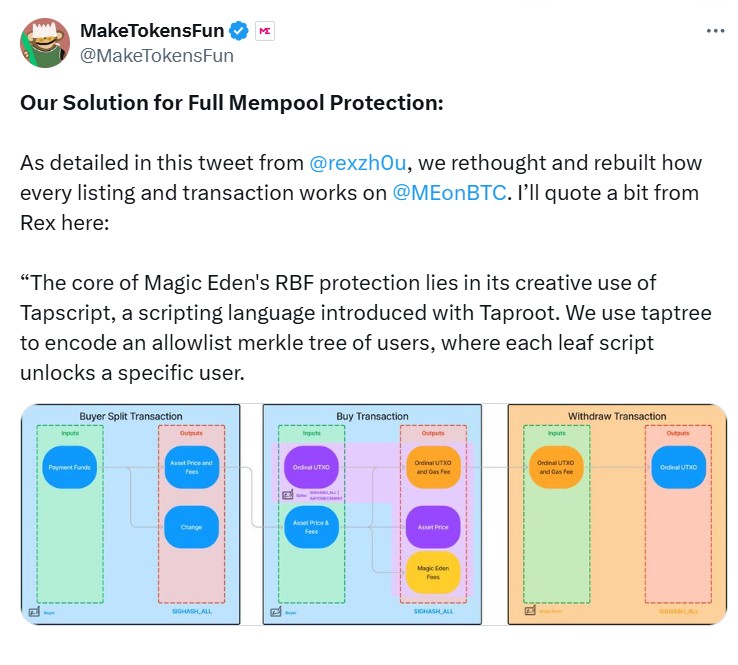

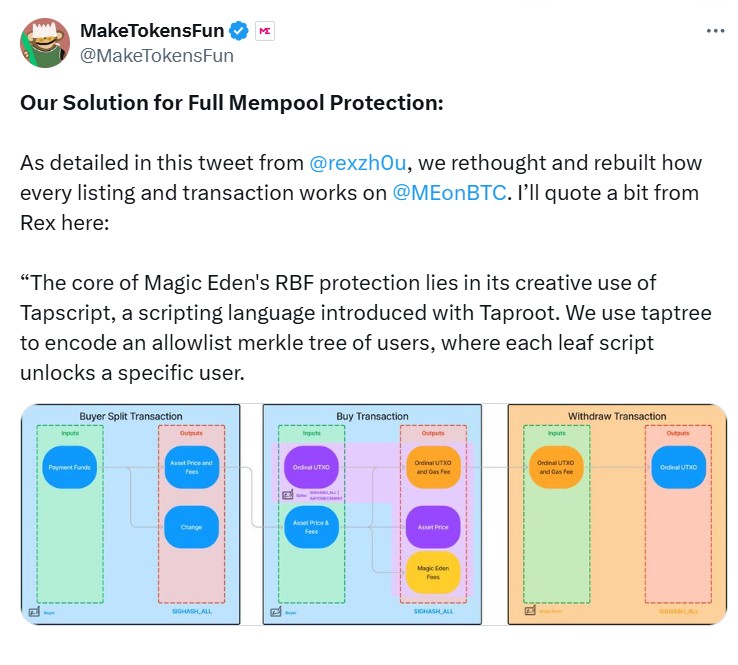

To fend off scammers, Magic Eden pushed an update so that only pre-approved buyers can pay for items. Switz calls this modification one of the most complex things his team has ever worked on.

To keep things simple, consider making a guest list for a private art auction instead of having everyone in the area show up.

This list is constructed using a Merkle tree. A Merkle tree is an elegant structure that uses hashing to securely group together multiple objects. It lets you make sure something is included without showing everything.

Next, instead of processing the entire sale at once, they split it into three smaller transactions. In the first two transactions, the asset goes to a multi-sig address in the Merkle tree, where the buyer pays the seller. The third transaction is when the buyer takes out the property. It also triggers the other two through the membrane at the same time, which prevents snipers from slipping it.

“Actually by getting the payment in the third transaction, what we can do is push all three of these through the union at the same time. And because the turn is moving in that Merck Tree signature scheme, no one can come in and take it away,” says Switz.

Read more

Features

The success of Off The Grid shows that ‘invisible' blockchain is the winning game

Features

The Real Risks of Etna's Stablecoin Model (Not What You Think)

My ordinal capture buys zero

My short and unsuccessful career as an RBF sniper ended when Magic Eden blocked sniper activity on the platform. But snipers can still find targets in rival markets.

For example, on Dec. 9, OKX had 3,275 casual transactions, compared to 3,333 at Magic Eden, according to Dune Analytics data.

“There will always be shooters or a shooter element because not all platforms want to be passengers for the transactions,” says Quary.

On December 10, the remaining 0.01 BTC was donated to the Open Ordinals Institute, a non-profit organization for the development of the Bitcoin Ordinals protocol, from Quarry Investments to train me.

I still own Fractal Puppet 75682950, which I can hold up to zero. The floor price of the set dropped to 0.000049 BTC at Magic Eden.

Subscribe

A very engaging read in Blockchain. It is given once a week.

John Yun

Yohan Yun is a multimedia journalist who has been reporting on blockchain since 2017. He has contributed as an editor to crypto media outlet Forkast and covered Asian technology stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.

Read more

Hodler's Digest

Bitcoin's Rollercoaster Ride, Ether Shines, XRP Secrets: Hodler's Digest, January 3–9

11 minutes

January 9, 2021

The best (and worst) quotes, adoption and regulatory highlights, coin leaders, predictions and much more – a week on Cointelegraph in one link!

Read more

Hodler's Digest

Binance, Coinbase take them to court, and SEC labels 67 crypto-securities: Hodler's Digest, June 4-10.

6 minutes

June 10, 2023

The SEC is suing Binance and Coinbase, and has designated dozens of coins as securities. Both crypto exchanges have temporarily suspended their services amid legal battles in the courts.

Read more