If Bitcoin drops Annie’s bubble in abundance

Key controls

In the large technical industry, the concern about the policy of the year, with FADCOQ with NASADAQ to the highest level with NASDAQ driving experience influence the property.

Expect U.S. fiscal pressures to improve as U.S. fiscal pressures grow and Trump pushes his published stimulus agenda.

The techno-heavy NASADAQ index posted strong earnings and forecasts on Thursday despite forecasts from the He Chi Chi ency in New York. Investors followed the signs of spending in artificial intelligence and Bitcoin (BTCIN (BTCIN) from $86,000 below $86,000.

Investors are overvalued in the market, but billionaire investor Ray Daly Dion said there is no clear trigger for the upcoming market rally. “The picture is pretty clear,” Dalio told CNBC.

Dalio added that his biggest fear is higher wealth taxes rather than tighter monetary policy. However, contrary to Reddy Dalio's view, when the US Government's protected student reports report, traders are skeptical again.

Reversing the previous decline, the unrecognized payroll in 2010 Most of the FOMC participants said that “further policy rate cuts are likely to hold high inflation.” According to the minutes released from the October meeting, on Thursday, traders remained skeptical, reflecting renewed caution among equity and bitcoin investors.

At the price seen in the government bond markets, investors are currently given a 20% chance to set interest rates higher than 55% before January 28. The fomc minutes show that many of the FED's guidelines give policymakers little insight into how close monitoring has been to immediate rate cuts.

AI builds strong incomes and garden surprises

From Walmart, traders fear that even with strong corporate earnings, including positive labor, the economy will weaken AI developers like Opena. Gil Luria, head of technology research at Davidson, said, “The issue is about companies that raise a lot of debt to build data centers.”

Nevilia's earnings data centers are now “unusual speculative investments” that will be examined over two or three years, he said. The technical and heavy NASADAQ index on October 29 now gains 78% from 10 weeks since the previous 10 weeks.

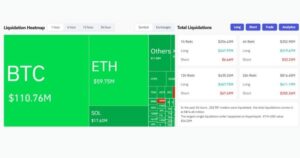

Related: Bitcoin Slides to $86K

In the midst of Pitcoin uncertainty, the price movement of Bitcoin continued to reflect trends in the tech sector. The correlation between the two asset classes rose to a six-month high.

Bitcoin traders are not necessarily below $90,000 and the broader macro situation is unstable. If Dalio is right, the U.S. Budget The financial crisis and the President of the United States, Donald Trump, to stimulate the economy, the proposal of “tariff distribution” can be tolerated by suppressing their exit.

This article is for general information purposes and should not be construed as legal or investment advice. The views, opinions and opinions expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of Akantim Photography.