If the pricing of the beachew’s pricing are covered as carriers

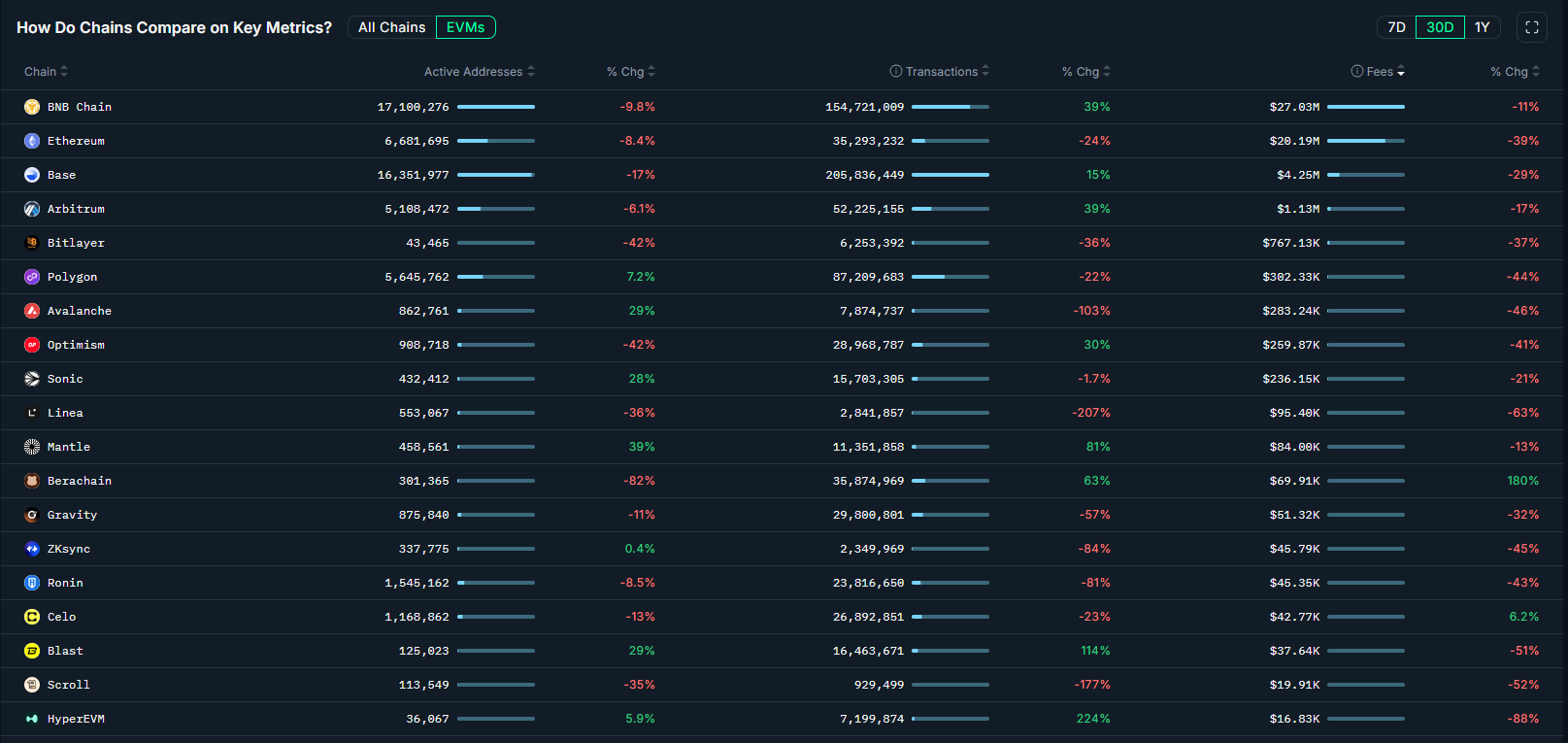

The beerchari received the bercharian from 12% to $ 4.71 but $ 3.85 fell. A relative strength index (RSI), ADX, and Macd signals. At the same time, the Berrachasenet of Network Network is 180% of the last month.

The value of the Beerchae's price today has been over 12% high levels of $ 4.71 and has been taken to 3.85 to $ 3.85 in the PC.

After reducing the two weeks after the shortest of the past 52.9% of the past 52.9% of the past 52.9% of the past two weeks, investors gave them an exciting hope.

The delete has been deleted on the 4-hour table on the 4 hour table where you cannot maintain a broader signal market.

Especially bears technical indicators are arrested by the advertising of technical indicators regarding the amazing 450% of the wonderful newspapers for more newspapers.

Technical Applicants Flash Warning Signs

The Hebrew strength of the beerchance's relatively index (RSI) recently been thrown into the shocking state at 16.97.

Although it comes to beyond the Ordealer of the Ordealer's region, he was shorted at the speed of noise, while there are still bears control.

Directivation Index displays 46.7 rehabilitation by reflecting oddly strong-strong land trends.

Sellers contain DMMs' readings to leave a small room of 50 (+ DIS) and 16.9 (DDA) and 16.9 (DDN) and 16.9 (DDN) and for profit.

Even if you see McDoo, it will be left below 0 by eating constant negative speed.

In addition, torture boling houses, now in 86% width, technical slices, or sharking flexibility.

Berrachanie Network Network Development of Prime woes

According to Nasin data, the growth of the Berrachanical enclosure of Berrachani had a richest week.

Network Payment from 180% to $ 6,910 to 69,910, transaction size has reduced 63% in the same time.

This growth is particularly 82% discount, especially if there are 82% off the network participation in a user in the network.

Revenue by 63% transactions from 63% of transactions from 180% of transactions from 180% of transactions from 180% of transactions from the Network Payment.

Specifically, micro-related employment accounts for 34.97% fees, primary protocol and Native Dex Bax Bax.

Interestingly, the jammet in the activity is 37.9% weekly bankruptcy and less than 62.44% of 62.44%.

Key-Braice levels to watch in the main pressure

If it sells $ 2.06 $ 3.06 $ 3.06 for $ 3.06.

The Pivot Point of $ 3.74 is a crucial standard of any rehabilitation.

Also, in the $ 4.44 and $ 4.78 of $ 4.78, the $ 4.78 of $ 4.78 is an obstacle to recover.

Currently, low fluid in 58.43% of Sharp can be expected of RSI spare and volumes before attempting of Mark's prices and merchants.