Illinois court confirms that Bitcoin and Ethereum are both products: CFTC chairman

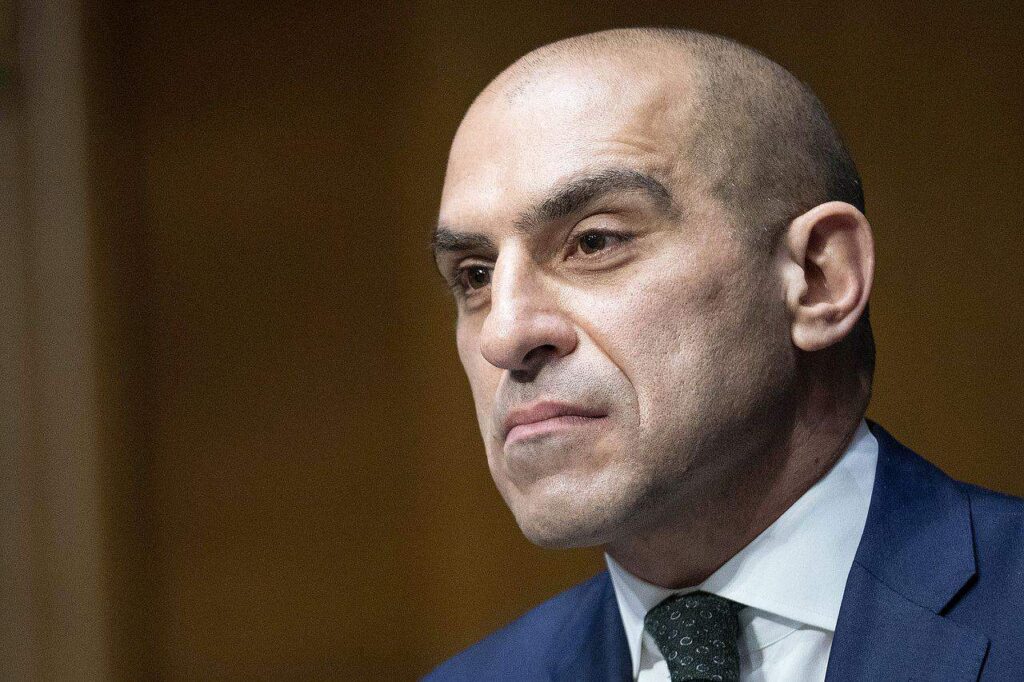

Rustin Benham – Chairman of the Commodities and Futures Trading Commission (CFTC) – An Illinois court has formally ruled that both Bitcoin (BTC) and Ethereum (ETH) are commodities, all but settling the CFTC's crypto turf war with its sister agency.

“In its ruling, the court reaffirmed that both bitcoin and ether are commodities under the Commodity Markets Act,” Benham said in remarks to a US Senate committee hearing on Wednesday.

Ethereum is a commodity, the court confirmed

The chairman cited a July 3 ruling by Judge Mary Rowland in the U.S. District Court in Illinois that defendants in crypto-related lawsuits failed to file under the Fraud and Commodity Markets Act.

Specifically, Oregon defendant Sam Icurtti lured investors into their funds by promising 15% annual returns in “digital asset products,” including both BTC and ETH.

“The order found that not only Bitcoin and Ethereum commodities are within the CFTC's jurisdiction, but also that “OHM and Klima, two non-Bitcoin virtual currencies … qualify as commodities,” read a CFTC press release last Wednesday.

While Bitcoin's regulatory classification has long been clear, further uncertainty surrounds Ether, for which the Securities and Exchange Commission (SEC) has refused to make a clear statement on whether it considers the asset under its jurisdiction.

Developments in recent months have left the crypto industry wondering if Ether has been accepted as a commodity. In May, the SEC approved exchanges to list Ether spot ETFs, qualifying the products as “commodity-based trust shares.” They also dropped their investigation into Consensys last month about ETH being an unregistered security.

Acceptance of ETH as a commodity is clearly similar to SOL ETH, so it has invited crypto firms like VanEck to offer Solana ETFs.

Call of the CFTC Crypto Authority

During his testimony, Benham questioned the CFTC's legislative authority.

“Given the important role that the Securities and Exchange Commission (SEC) plays in regulating security-based digital tokens, the committee should consider an orderly, balanced framework for defining tokens as commodities or securities under existing law,” he said.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive a $600 exclusive welcome bonus at Binance (full details).

LIMITED OFFER 2024 on BYDFi Exchange: Up to $2,888 Welcome Reward, use this link to register and open a 100 USDT-M position.