Table of Contents

ToggleWe do the research, you get the alpha!

Get exclusive reports and key insights on airports, NFTs and more! Sign up for Alpha Reports now and step up your game!

Go to Alpha Reports

NFT-backed investment DAO Vanta is making a serious journey on the road to decentralization.

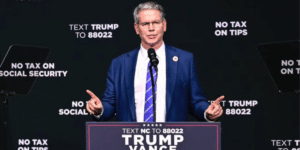

Originally launched as an investment syndicate in 2021 by Josh Field and Mike Granis — the founders are giving ownership of the entire business to the VantaClub NFT-owning community.

“We're in this process of decentralization,” Field said on the Hash Rate podcast. This means “giving what is essentially a million dollar business to the community where we get more capital and more value for the founders we invest in.”

What is Vanta?

Grantis and Field originally launched Vanta as a community of friends, builders, and tastemakers on the Web3 space. “We've established a lot of capital among the tastemakers at Web3, the people who really have their ears on it. Builders, thought leaders, angel investors and entrepreneurs,” said Field.

The model was simple: the couple would generate the agreements themselves, present it to the Vanta community and take a share of the investments made by the community—10% initially, after the NFT launch in February 2024, it will be reduced to 5%, with the investment divided into NFT holdings. Vanta quickly grew to over 250 notable members, including the likes of Mark Jeffrey, Mario Nauful, RyandCrypto, Farroq, and Seedphrase. As of today, they have deployed more than $12 million in capital, with notable investments including Portal Gaming, which earns Vanta members more than 20x.

While there is no shortage of investment syndicates, Vanta distinguishes itself through the quality of its deal flow, low fees and the quality of its own investors. When Vanta was flooded with thousands of requests for new members to join, Grantis and Field decided it was time to take it to the next level in its evolution—turning it into a decentralized, independent organization.Dao).

Investment DAOs were one of the first DAO use cases to draw fire after the invention of the Moloch DAO framework, which limits DAO management to approved members. Giving groups of people the ability to pool capital and deploy onchain in a decentralized manner was a huge breakthrough for the crypto industry and onchain coordination in general.

Now, five years after the launch of the Moloch DAO, there are investment DAOs and syndicates of all shapes and sizes. They allow investors from all walks of life to access deal flow normally reserved for venture funds, and create a sense of transparency not found in traditional investment syndicates.

It takes two to contango

As they prepared to convert Vanta Syndicate into a DAO, Grantis and Field started their own venture capital fund, Contango Digital. Their goal was to eventually start a fund, but after seeing the vibrant community they had built in Vantaa, letting it go was not an option.

“Why would you separate it?” Field asked. he said. “Why not keep it going and do something even bigger? Take this business that's made millions in revenue and turn the vehicle over to the community and let it run itself.”

They wanted to create a symbiotic relationship between Vanta and Contango that could benefit both – while creating the infrastructure, Vanta should operate autonomously, completely managed by its members.

While Vanta already has a community of well-known builders and thought leaders from the crypto space, Field and Grantis believe more is needed if it's going to reach the same heights as its centralized competitors. “If we want Vanta to be on the same capital table as funds like A16z… we need to deliver incredible value and impact,” Field said. “The best way to do that is to bring in the highest value members of the crypto space.”

To bring in more high-quality members, the founders believe Vanta needs to be decentralized – and many in the crypto space are not attracted to investment syndicates that are essentially owned and managed by funds. Be owned by the membership.

Contango shares all of its deal flow with Vanta—an area that non-VC investors typically don't have access to. Vanta, in turn, offers a “decentralized due diligence” process on the projects that Contango brings to the table. With Vanta's community filled with developers, KOLs and notable investors – they provide the “wisdom of the crowd”, a balance and quality of due diligence that cannot be achieved by a closed traditional team.

The road to decentralization

As Vanta continues its path to decentralization, there is still much to be done. Currently, Grantis and Field generate 90% of consensus flow – and for Vanta to function as a DAO, that needs to change. The pair felt they were hindering Vantas' growth by bringing in most deals.

“There are so many different deals that we don't have access to or visibility into,” Grantis said. “And there are other people in different parts of the industry who have a lot of connections with different sectors. We want those people to offer deals and be compensated for that.

They are focusing on breaking down the DAO into different roles, including researchers and consensus scouts. Deal Scout brings potential deals to DAO; If the DAO community is interested, the scouts will receive a commission and the deal will be forwarded with the researchers. The researchers then compile in-depth reports, and are also compensated through the DAO.

Vanta is currently working with Decent DAO to transition to a DAO structure and create a governance system and process. They expect the process to take about six months, which means Vanta could be fully in the hands of the community by this November.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.