Internet Computing (ICP) is up 14%, eyeing a $11 target

On September 11, 2024, Internet Computing (ICP) made waves in the cryptocurrency market with its impressive price performance. However, based on the chart and price action, it looks like ICP is only one step away from the 25% rally.

Internet Computer (ICP) price performance

At the time of publication, ICP is trading at the $8.8 level and has seen a price increase of over 15% in the last 24 hours. Meanwhile, the transaction volume increased by 60 percent.

ICP technical analysis and upcoming standards

According to expert technical analysis, Internet Computer (ICP) is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, but looks bullish. Currently, ICP is facing strong resistance near the $8.9 level.

This is the second time since early August 2024 that the ICP price has hit resistance. The last time ICP reached that level, it faced heavy selling pressure, resulting in a steep decline of nearly 20 percent.

However, this time, trader and investor participation is different, and the sentiment has changed, increasing the possibility that ICP may breach this resistance level. If ICP clears this resistance level and the daily candle closes above $9, there is a strong possibility of a 25% upside, reaching the $11 level in the coming days.

This bullish thesis only works if the ICP price closes the daily candle above $9, otherwise it may fail.

Bullish On-Chain Indicators

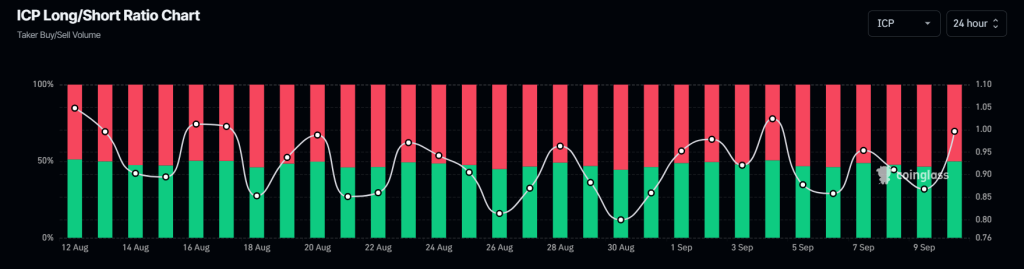

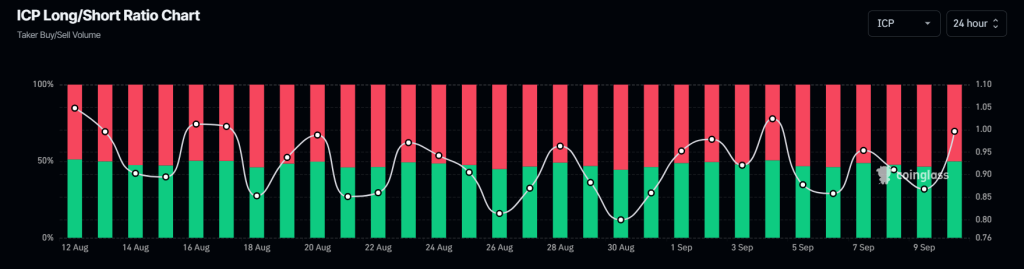

Additionally, Internet Computing (ICP) optimism is also supported by chain metrics. Coinglass ICP's long/short ratio currently stands at +1.019, indicating bearish market sentiment. Additionally, ICP futures open interest increased by 21%, indicating that many futures long positions have been built over the past 24 hours. In particular, this OIA is constantly increasing.

According to the data, a positive long/short ratio and an increase in futures open interest indicate buying opportunities. Traders and investors often take this when building long/short positions.