Iran’s attack on Israel reached 495 million dollars

The post Iran Attacks Israel, Crypto Liquidations Reach $495 Million

Following Iran's attack on Israel, the crypto market saw an outflow of nearly half a billion and reversed the overall market sentiment. In the year On October 1, 2024, local news outlets reported that Iran fired hundreds of ballistic missiles at Israeli cities, causing bloodshed in the crypto market.

The crypto market has poured 495 million dollars

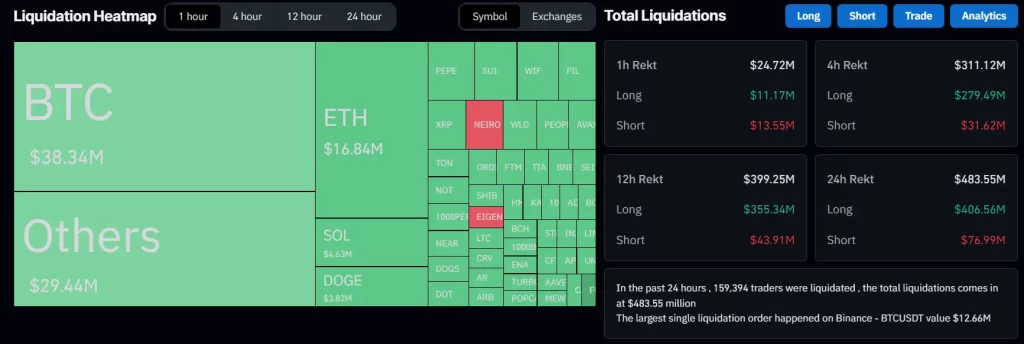

During the strike, more than 160,000 crypto traders spent $495 million on long and short positions. However, the single largest liquidation of around $12.66 million occurred on Binance's BTCSDT pair.

Of the $495 million in liquidations, bulls liquidated nearly $416 million in long positions, while short sellers faced $78 million in short liquidations. This massive liquidation suggests fear and further price declines as bears begin to dominate the market.

The main cryptocurrencies hit

According to CoinMarketCap data, major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and Binance Coin (BNB) have seen declines of over 1.85%, 3.2%, 4.5% and 3.4% respectively. , in the last 24 hours. However, following the Iranian strike, prices have fallen significantly.

In the middle of the decrease in the profits of the Ethereum well

Amid bear market sentiment, on-chain analytics firm Lookonchain recently reported that an Ethereum whale on X (formerly Twitter) sold 29,480 ETH worth $76.8 million for an average sale of $2,605, making a profit of $2.34 million. This suggests that the whale may have been aware of an impending decline before the market plunged.

Current price momentum

At the time of press release, ETH is trading near the $2,480 level and has lost more than 3.5% in the last 24 hours. At the same time, the transaction volume increased by 45 percent, showing high participation from traders and investors.

In addition, ETH futures open interest fell by 4.5% in the last 24 hours, indicating that traders have lost positions, and there has been a reluctance to build new positions due to fear in the market.