Is a $100K raise just around the corner?

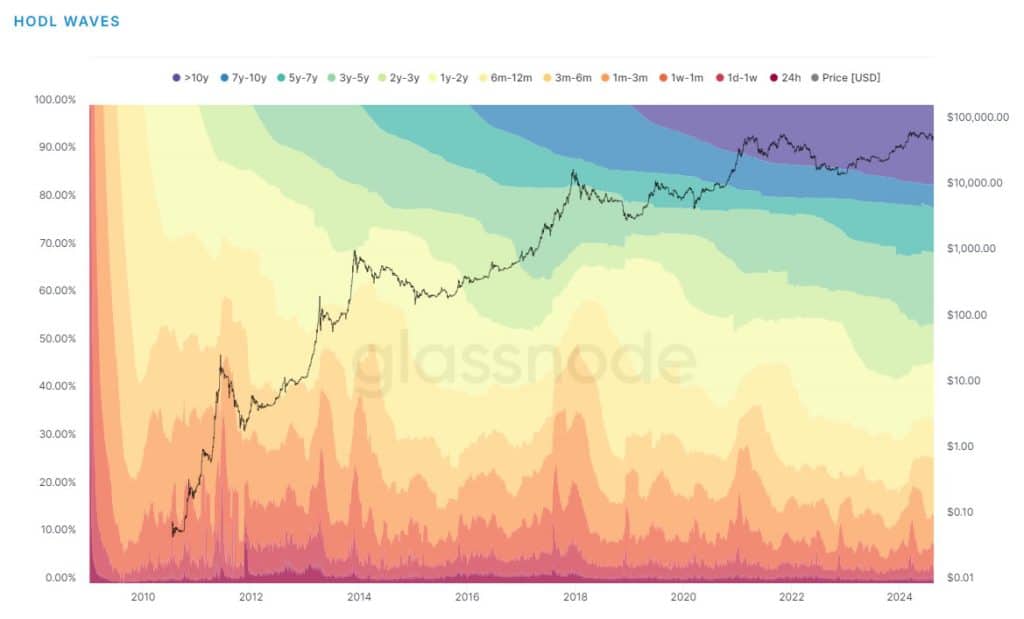

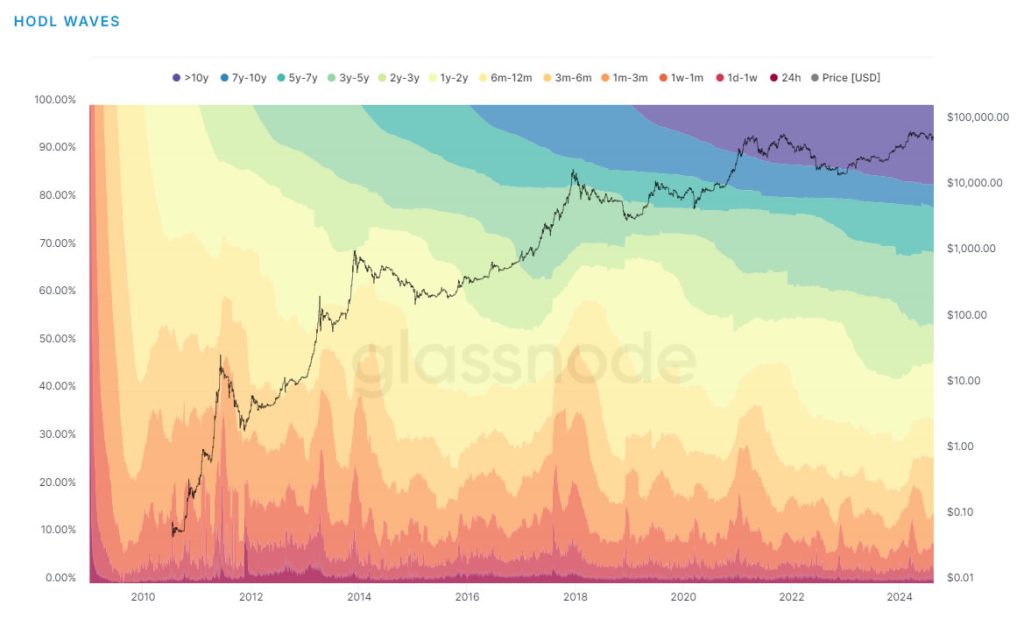

Bitcoin and its believers are staying strong no matter what market conditions they face. The data shows that 75% of Bitcoin circulation has not moved in the last 6 months. This clearly indicates that despite the bearish pressure on the market, bitcoin HODLERS are not afraid. So, what does this mean for the future of BTC, let's find out.

LONG TERM BITCOIN HODLING: A SIGN OF CONFIDENCE

According to the HODL Waves chart by Glassnode, nearly three-quarters of the bitcoin circulation is not moving wallets. This is a sign that a large number of BTC investors believe in its long-term value. It's interesting to see big institutions transition from saying “Bitcoin is bad” to “Bitcoin Dead” to “Bitcoin is the Digital Gold”.

Even though the price of Bitcoin has dropped by 21% this year, people are holding on to their Bitcoin wallets. When a large amount of Bitcoin is held in a wallet and not sold, it reduces the amount of BTC in the market. As demand increases, the price increases. And we're all seeing how big institutions are hoarding Bitcoin and adding it to their portfolios.

Challenges of short-term investors

While long-term investors are unaffected by the current situation, short-term investors are spooked. As of the end of February 2024, 80% of people who have invested in Bitcoin are at a loss, according to a tweet by Chain Analyst.

Not only these, but there are many people who bought in peak time in 2021. These people bought btc above the current price. Recent market corrections have put these short-term investors in a difficult position. This is not the first time. We've seen similar things in previous bull runs. People buy at high prices and when the market corrects, these people panic sell, creating domino effects. This will further expand the market.

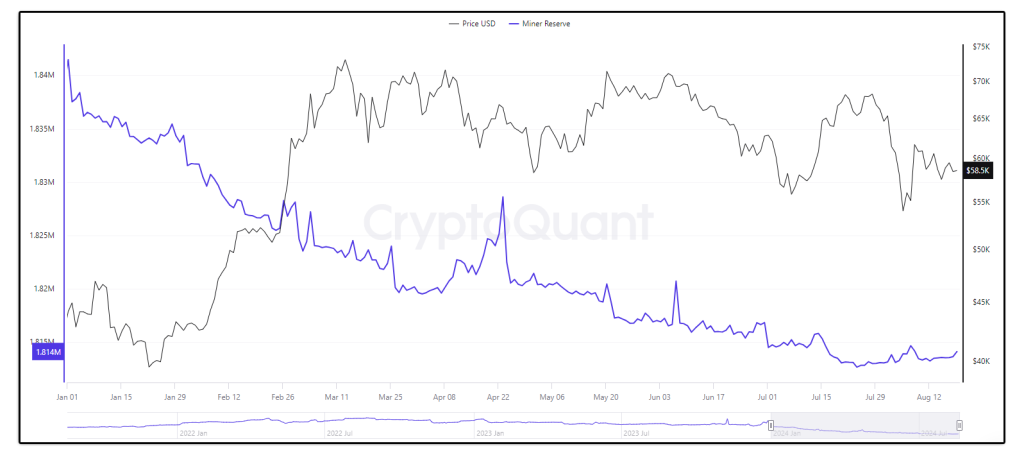

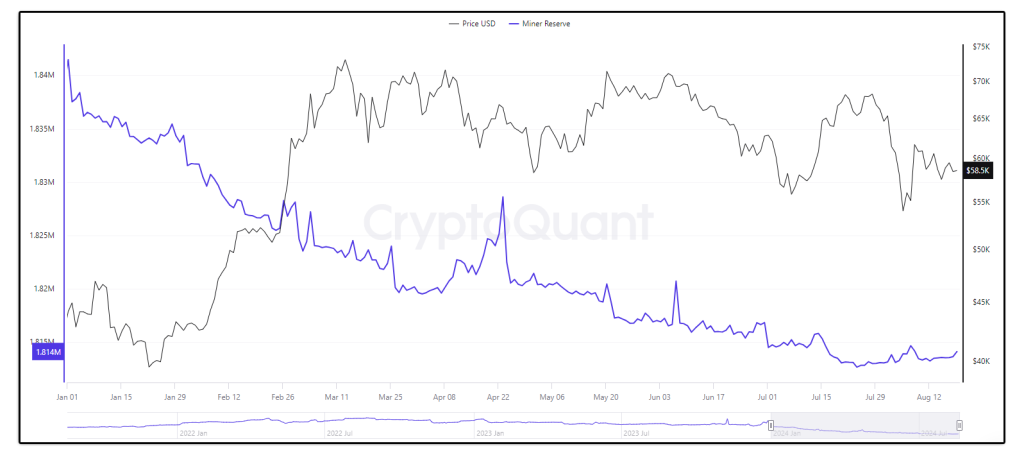

Bitcoin mining in trouble

Bitcoin miners are not immune to these market conditions either. They are also feeling overwhelmed. According to CryptoQuant data, miners are now operating with profit margins that have dropped to their lowest level since January. Miners have been selling their Bitcoin stock to continue their business. This may seem shocking, but the market has historically recovered from such situations.

Terrible market sentiments

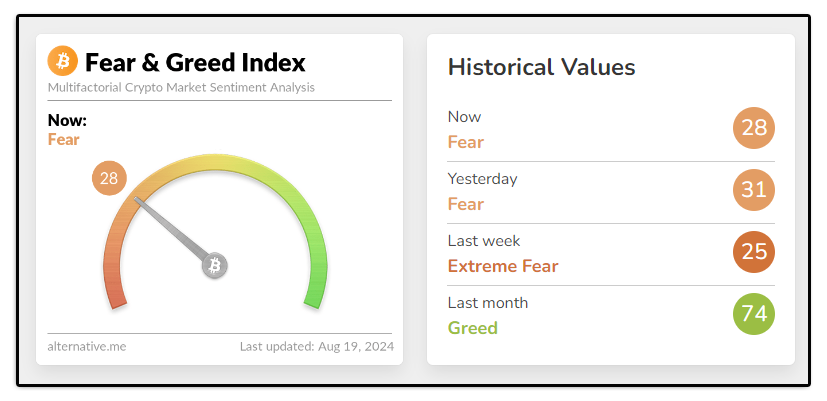

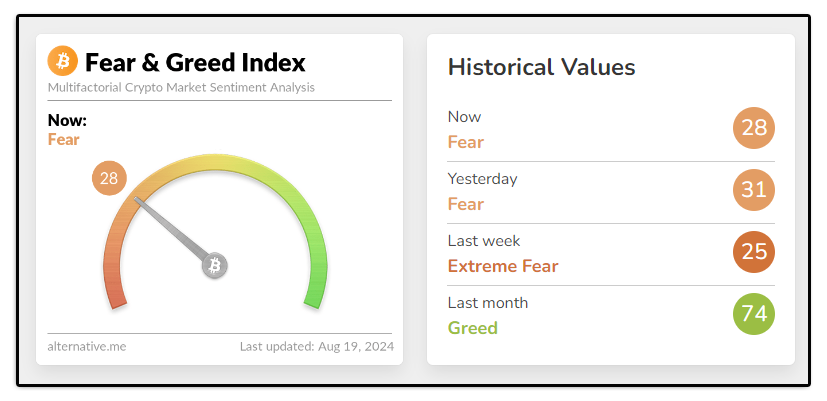

The market situation is very cautious. The Crypto Fear and Greed Index fell to Fear at 74 at 28 from last month's Greed. Since early August, this index has only indicated market fear.

In my previous article, I shared information about why Bitcoin is testing the $48,000 zone due to market fears. These factors are still valid as we have not seen any positive change in the price of Bitcoin. Several factors, such as the US government moving 10,000 BTC to Coinbase, suggest another dip.

The big picture

Bitcoin's historical data shows that before a real bull run, the market always enters the same conditions. Currently, BTC is in a consolidation zone. The months of August and September have been favorable months for the market for the past 12 years and October gives a big jump. Following these patterns and data appearing on the charts, we can say that the market may take another dip before the October rally. This washes away panic sellers and opens up new accumulation opportunities for those who understand the true value of Bitcoin. Different experts are giving different numbers for the bull run, but one thing is common, everyone believes that Bitcoin price will cross 100 thousand dollars in the next six months.