Is Bitcoin (BTC) Bad Following Monday’s Price Drop?

“Black Monday” Broad Market Bitcoin (BTC) Price Correction That's what he called $58,000 to $49,000 on August 5th. This phenomenon was not surprising as experienced players saw bulls and bears with different cycles.

While the event caused a lot of large-scale liquidity, participants may have thought that was the worst one-day correction. This analysis on chains gives more context to this idea.

Bitcoin is not overpowered yet, future gains are possible.

To answer this question, BeInCrypto looks at the key parameters that have been repeatedly proven to be critical for BTC. One of them is the Market Value to Real Value (MVRV) ratio. The MVRV ratio provides insights into the profitability of the market.

The increase in the price suggests that Bitcoin owners have a good level of unsecured profit, which makes it more likely to sell. However, as the ratio decreases, profits decrease, and holders are less likely to sell.

Historically, this metric tells us when Bitcoin is undervalued, undervalued and nearing the top of the cycle. At the time of publication, data from IntoTheBlock shows that the MVRV ratio is 1.76.

In previous cycles, the ratio reached such a high reading that the bull market could be called “over.” However, despite BTC's impressive price performance at some point, the benchmark shows that the price has yet to peak.

Putting it in context, Juan Pellicer, senior researcher at IntoTheBlock, explained that BTC, like other cryptocurrencies, has yet to reach an overvalued point.

“Most properties have yet to return to their historic valuation range. For example, Bitcoin's highest MVRV this year has reached around 2.64, while in the previous cycle it was as high as 3.68. For many altcoins the difference is even greater. Pellicer told BEncrypto.

Based on this opinion and the historical analysis above, BTC's recent decline may be bearish. At press time, the coin is trading at $57,255. This means that the price is still 22.37% lower than the high (ATH) reached in March.

Retail investors hesitate, but there is a way out.

It should be noted that institutional investors have been the main driver of the rally to a new ATH through Bitcoin ETFs. It's important to note that BTC prices experienced a significant decline after ETF net flows began to dry up.

ETF flows were negative amid the flash crash on August 5. However, recent evidence suggests that this may no longer be the case. This is due to a total daily net inflow of $45 million on August 7.

This is a low figure compared to previous net positive flows. At the same time, it could serve as the beginning of Bitcoin's price stability, as long as it is not sustainable.

Read more: What is a Bitcoin ETF?

If this happens, the worst may pass for BTC, and the price will not drop below $50,000 again for some time.

Furthermore, Bitcoin's potential is not limited to the capital these institutions have. Remember that in previous bull markets the coin did not have this kind of institutional adoption.

However, the coin did not experience anything close to the retail participation that the 2017 and 2021 market saw. During our conversation, Pellicer also weighed in on the matter and said:

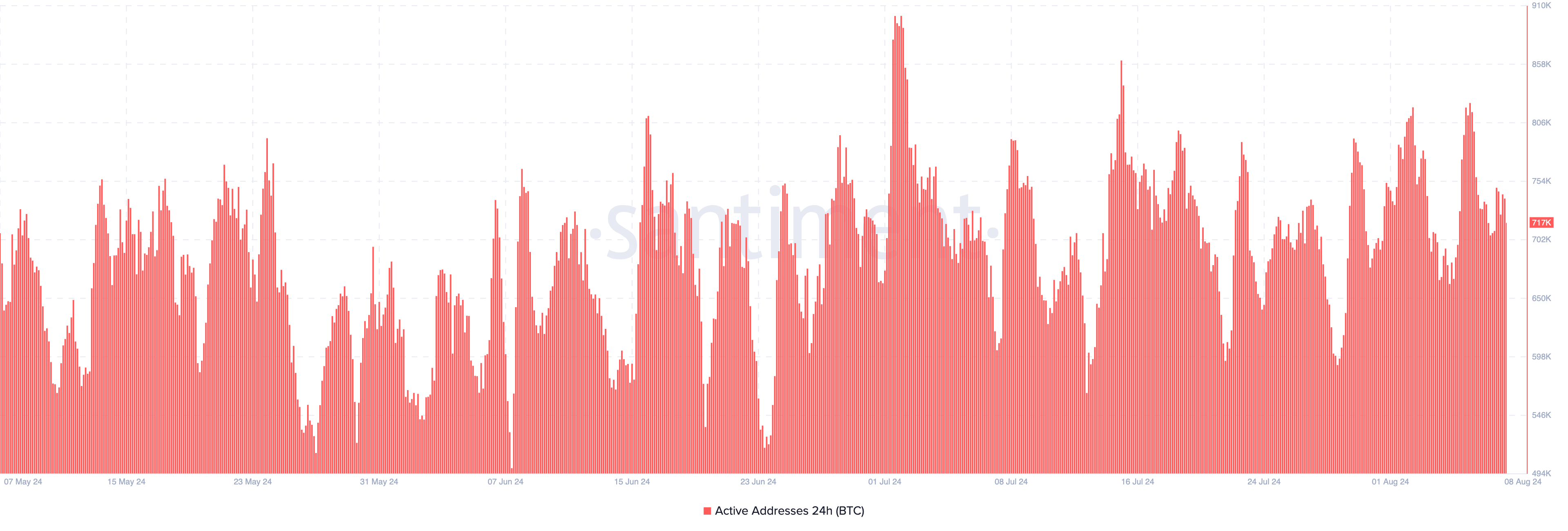

“Active addresses on Bitcoin have been trending since November 2023. This is typically a bearish sign for the entire market, as new participants in the Bitcoin market can act as proxies for newcomers to the industry.”

In several cases, BeInCrypto has noticed that the number of active addresses is more than one million, where a good retail interaction with BTC begins. But, Sentiment said, the measure has struggled to reach this range since March.

However, it shows a steep increase in active addresses, with 717,000 registered on the chain at press time. If this metric continues to jump, the price of BTC could gradually climb higher, erasing recent losses.

BTC Price Prediction: Bulls will first seek $60,000

From a technical perspective, Bitcoin may not experience such a steep price drop in the short term. This is because of the Balance of Power (BoP) signals, a technical tool used to measure the strength of buying and selling in a market.

If it is negative, it means that the selling pressure is strong. However, at press time, it is positive, which indicates that market participants are buying the coin. If this continues, BTC could see a significant increase towards $60,000.

Additionally, Bollinger Bands (BB) provide insight into the volatility surrounding the coin. Simply put, BB shows how fast price swings can occur and indicates whether a coin is overbought or oversold.

When the upper band of the indicator hits the price, it is overbought. But when it touches the lower band, it is oversold. As the image below shows, BTC was oversold on August 7th when the price reached $54,594.

Read more: Half a story of Bitcoin: Everything you need to know

The widening bands, coupled with recent buying pressure, suggest that the coin may continue to rally. If this is the case, BTC could reach $60,534 in a short period of time. From a medium to long-term perspective, the price may reach $71,996.

However, in a worst-case scenario, with strong selling pressure, BTC could drop to $54,482.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.