Is Ethereum a bull run soon? $3.5 billion will leave ETH exchanges

Ethereum (ETH), the world's second-largest cryptocurrency by market cap, looks bullish and is poised for a popular upside rally due to higher price action and favorable on-chain metrics. In addition, whales and investors have moved a large amount of ETH from the exchange in the past week.

Fall of the Ethereum exchange stock

According to the on-chain analysis company CryptoQuant, the Ethereum currency reserve dropped from $42 billion to about $38.5 billion, a decrease of about 3.5 billion dollars. A significant decline in this currency stock is a sign of hoarding or buying by whales or investors.

Additionally, the decline in the currency's stock occurred near a strong support area where ETH is currently trading.

Ethereum technical analysis and upcoming levels

According to expert technical analysis, ETH appears to be moving in a bearish bullish channel pattern with higher highs and higher lows. Currently, ETH is at the lower limit of the pattern, forming a higher low.

Based on historical data and price correction, there is a strong possibility that the asset could jump by 12% and reach the $2,800 resistance level in the coming days. In fact, this level not only acts as resistance, but also aligns with the 200-day EMA and the upper bound of the bullish pattern.

This breakout thesis will only hold if ETH continues above the $2,400 level, otherwise it may fail.

Bullish On-Chain Indicators

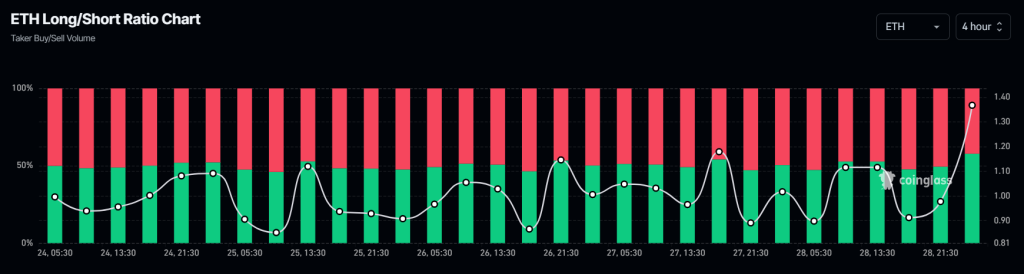

ETH's positive outlook is further supported by chain metrics. According to on-chain analytics firm Coinglass, ETH's long/short ratio stands at 1.36 over the past four hours, indicating strong bullish sentiment among traders. At the same time, 57.76% of top traders opened long positions and 42.24% opened short positions.

ETH open interest has increased by 4.9% in the last 24 hours and by 3.1% in the last four hours. This increase in open demand indicates growing commercial interest in the property, which leads to new positions.

Looking at the technical analysis of the benchmarks on the chain, it seems that the bulls are currently in control of the asset and may continue to support the upcoming rally.

Current price momentum

At press time, ETH is trading near the $2,520 level and has experienced a 1.20% rally over the past 24 hours. During the same period, the transaction volume increased by 90 percent, indicating a higher participation of traders and investors.