Is it a public offering in the transfer market? Technical analysis

Bitcoin has fallen below $100,000, losing 12% in one week to one month. The Fear and Greed Index “Fears the Total Crypto Market Over 700 Billion Dollars Over 700 Billion Dollars.”

So, do all these market indicators come in a bear market? Let's roll the technical and historical data.

Comments are at the property level

10 Fear and Greed Index from 2022 and 2020 Compared to June 2022, it reflects a high level of fear, both car market levels confirmed.

Yesterday 16 Last week: 20 Last day 28 28 Sponsored Sponsored

The trend is to accelerate the fear, it shows the feeling of not being able to feel emotional. Depression often begins with this kind of constant fear.

However, it does not guarantee the right to access the market of thought – it is only the signatories of payment or fatigue.

Bitcoin broke the most important bull market support

The 365-day moving average is a long-term structural pivot.

Current situation

The 365 MA MA is $102,000. Bitcoin is the business below. The break mirror December 2021 price is a kind of mana and when the bear market starts.

Historically

Failure to perform this step is often a quick confirmation of the cycle system. This is one of the strongest technical issues in the market.

Sponsored Sponsored

On the basis of the value of the chain, the capital may not be distributed

The 6-12 month UTXO (Unknown Trading Output) guaranteed price is currently sitting at around $94,600. Bitcoin price currently stands slightly above this level.

Because of this importance

These owners bought it when they bought it. They “represent bull-cycle judgment buyers.” When their position is lost, the market structure is weakened.

In the year In 2021, the cost base fell below the hill. This is the first time since 2022 that the cost-base tension has been alarmed again.

This supports the idea of a mid-cycle break, not yet a full-blown macro trend.

Sponsored Sponsored

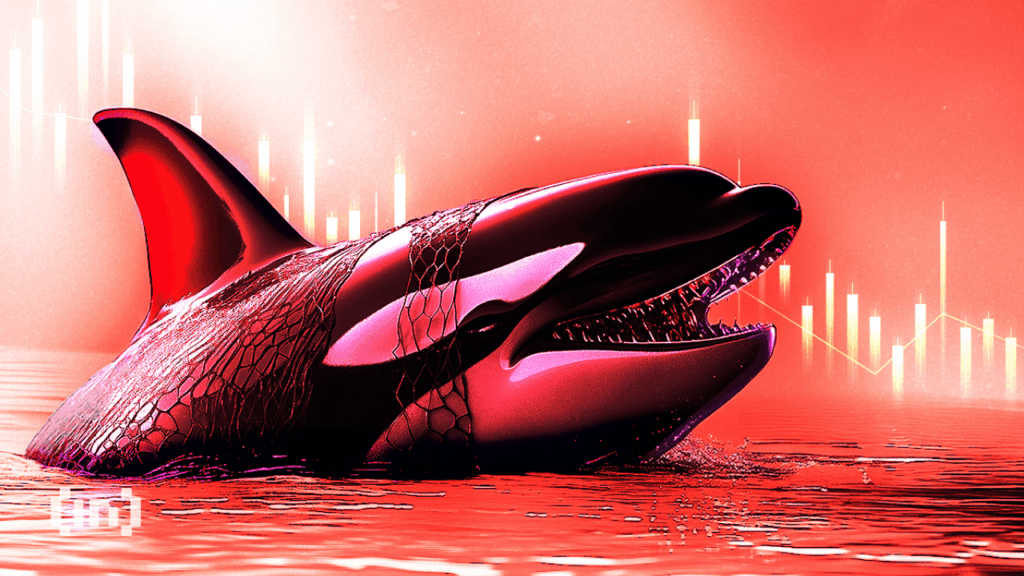

The RSI shows the typical experience of mid-cycle breakdowns

Market-wide RSI readings

AVERAGE CREPPTO RSI: 43.09 BTC RSI 2.5% of asset is too high

This may look like – July 2021, August 2023, August 202, and August 2024. Each of them is a child of the completion-cycle. While PSI has deep peanut prices for weeks, it confirms the speed of study.

Now, RSI shows depression but not reversal.

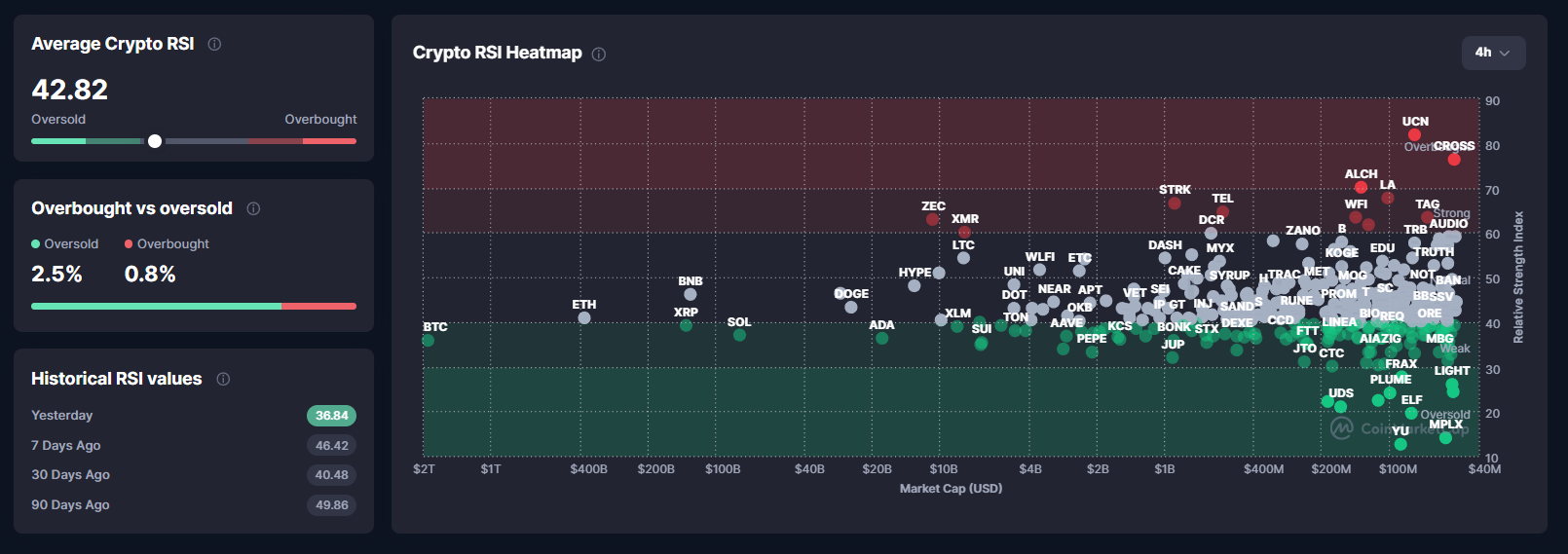

Macdo demonstrates a strong ability to distinguish itself across the market

Average Normal MACD is currently 0.02. This makes the tiny tiny particles that indicate the tired well. Also, 58% of market properties have a positive sentiment.

Sponsored Sponsored

However, Bitcoin remains in the negative zone towards the end of the day.

When BTC has a negative MACD, the market still has 50%+ positive momentum, the market is in a transition phase rather than a full bearish trend.

90%+ of properties in property markets show negative returns at the same time. Right now, this is not the case.

Cresspto market is not in the guaranteed car market – if two conditions are met, the opportunity to become a market is using the opportunity to catch.

These are the three conditions that confirm a bear strike

Bitcoin will remain below 365 weeks from 365 weeks. This was in 2014. In 2014, In 2022, each chest will launch the market. Long-term owner continue to divide hard. If the Lth (long-term holder) sells above 60 m, the cycle is completely negative in the upper part of the overall market. We are not there yet.

In general, the crypto is not yet in the market, but if the current decline can bring down the long-term support of Bitcoin, it will put the market in the market at a high risk.