Is it the right time to enter the crypto market?

The crypto market is experiencing a significant trend change, with Bitcoin leading the charge. This increase in altcoins is also due to a series of factors that indicate a major change in the financial system.

These elements attract mainstream attention, from Bitcoin's role in the global economy to emerging investment products. At the same time, there is a palpable enthusiasm for the altseason. Understanding these dynamics provides insight into the future of crypto and the potential for new investment opportunities.

3 reasons behind the increase in the price of Bitcoin

Bitcoin has shown remarkable resilience in 2023, gaining nearly 130% this year. By the end of November, the price of Bitcoin had risen to around $38,440.

According to Matty Greenspan, CEO of Quantum Economics, this rise in Bitcoin's price can be attributed to its role as a global safe haven amid geopolitical instability, sovereign debt crises and global economic turmoil. He told BeInCrypto about the importance of Bitcoin in this chaos.

“In a world of tremendous geopolitical uncertainty…Bitcoin is playing the role of a global safe haven,” Greenspan said.

Economic indicators such as the Consumer Price Index (CPI) fuel Bitcoin's popularity as a hedge. Although the CPI was flat from the previous month in October, it was up 3.2 percent from a year ago.

While the CPI has a strong impact on traditional assets, Bitcoin will grow as the purchasing power of the US dollar gradually declines.

“Bitcoin, being a good manifestation of digital scarcity, will benefit from the erosion of fiat money over time. So, while these data points may affect short-term prices, the overall economic landscape and the gradual decline of fiat currencies is what gives Bitcoin its strength,” Greenspan added.

Another factor behind the declining Bitcoin price is the introduction of new financial products such as spot Bitcoin ETFs (exchange-traded funds) from traditional companies such as BlackRock and Fidelity. Greenspan cited this as proof of the growing institutional interest in cryptocurrencies.

The approval of the Bitcoin ETF position in the United States has proven to bring short-term market reaction and more stable and long-term growth. Especially as institutions look for regulatory-friendly and compliant ways to add Bitcoin to their portfolios.

“Of course, there has been a lot of speculation as far as allowing a bitcoin ETF space in the US. If one is accepted, my guess is that the immediate reaction will probably be a short pop and a quick sell-off as traders take their profits. But, in the medium term, institutions will want to add bitcoin to their books in a regulatory-friendly and diverse fund structure.” It should provide a frictionless path to institutions in a consistent manner.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

Meanwhile, Anthony Scaramucci, founder of SkyBridge Capital, emphasized a key Wall Street maxim, “Products are sold, not bought.” He envisions a situation where dedicated groups actively promote Bitcoin ETFs to financial advisors and brokerage offices.

According to Scaramucci, these groups, with their persuasive tone and engaging approach, support the inclusion of Bitcoin ETFs into investment portfolios, bringing fresh capital into the cryptocurrency market.

“I think these products, the Bitcoin ETFs space, are going to release tens of thousands of people from the sales force,” Scaramucci said.

Crypto market tips on the new Altseason

Altcoins are also charting a remarkable course. Solana's native token SOL, for example, has been leading gains among altcoins, showing interest in the crypto market beyond Bitcoin.

When asked about the recent performance of lesser-known altcoins such as TIA, SEI and TAO, which surged 182%, 132% and 250% in November alone, Greenspan admitted he was unfamiliar with them, underscoring their broad nature. crypto market.

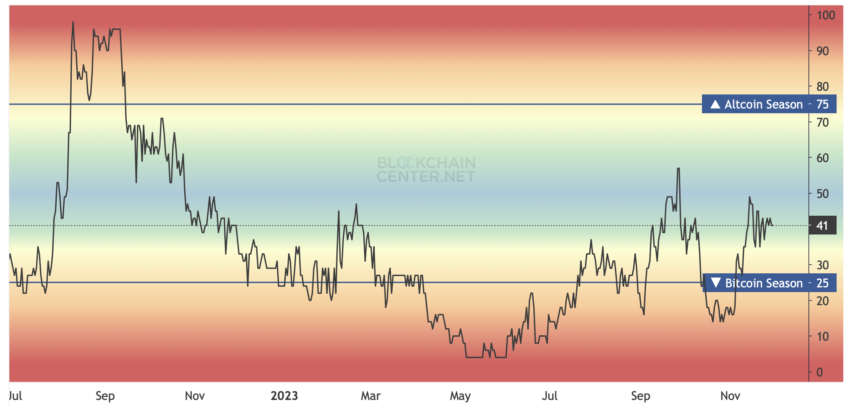

Still, technical analyst Jacob Canfield confirmed that despite such performance by some altcoins, “this is not yet an altseason…”.

“Most altcoins are bleeding against Bitcoin but gaining in USD. Bitcoin dominance is down 4.5%. The real altseason starts when the Bitcoin dominance market structure turns bearish. Yes, there are outliers.” [But] Until further notice, this is still a Bitcoin show. Canfield said.

As anticipation builds for the upcoming altseason, Greenspan has some critical advice for investors. He emphasized the importance of fully understanding each altcoin's unique value and its inflationary or deflationary characteristics.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

Greenspan explained the benefits of speaking directly with project founders, citing ten years of experience in token evaluation. Still, he often relies on his intuition to guide these assessments.

As the crypto market emerges from an extended bear phase, Greenspan suggests that any projects that have been actively developing in recent months should be of interest to investors. This construction period, often overlooked, can be a key indicator of potential success in the coming Alsace.

“Definitely wash your feet as soon as possible, but be vigilant. There are a lot of scams out there. Learn how to take care of yourself and keep your private keys safe,” Greenspan concluded.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content.