Is it time to buy dip?

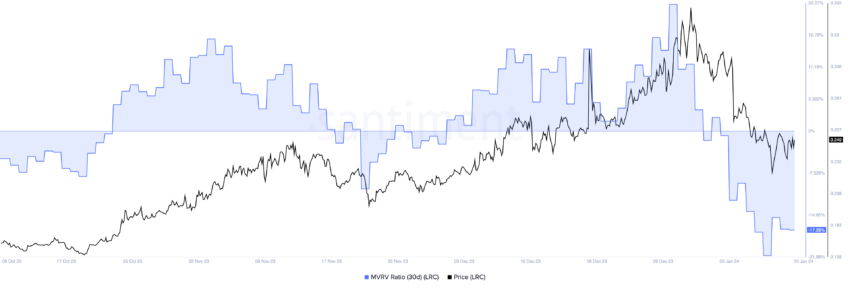

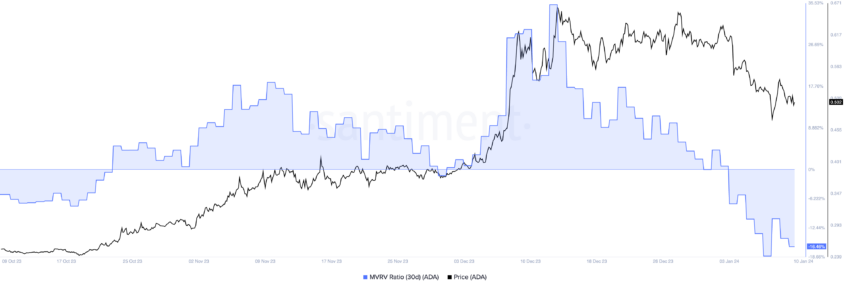

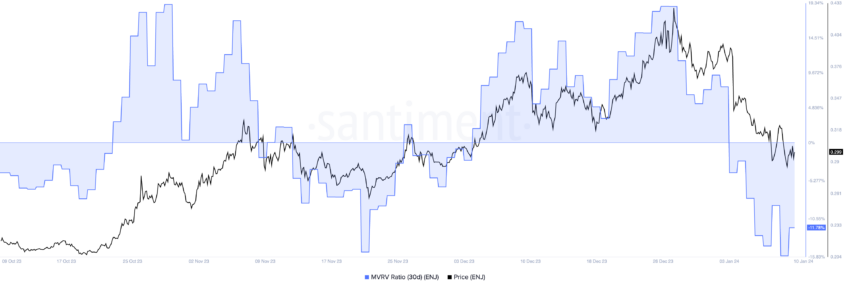

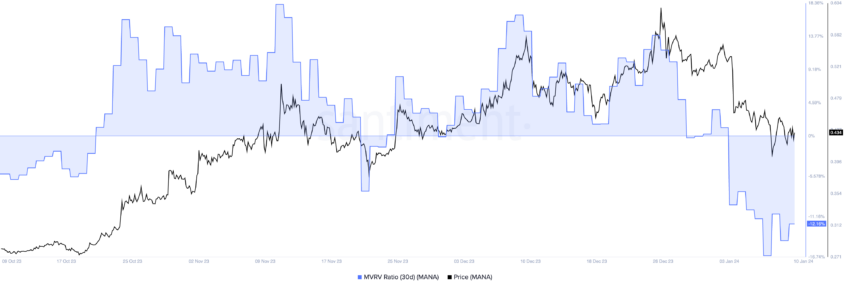

In the cryptocurrency market, astute investors keep an eye out for opportunities, especially during market dips. Recently, the MVRV (market-value-to-realized-value) ratio highlighted that several cryptos are significantly undervalued.

This raises an interesting question for seasoned and novice investors as to whether now is the time to buy a dip.

Very low value cryptos

The MVRV ratio, comparing asset market capitalization to realized capitalization, provides insights into whether a crypto's value is above or below its “fair value.” It serves as a barometer for market profitability and potential highs and lows.

Basically, when the market price is greater than the realized cap, it indicates that unrealized profit is high, which suggests that selling is possible. Conversely, a low market value compared to the realized cap may indicate low value or weak demand.

Read More: 10 Cheapest Cryptocurrencies to Invest in January 2024

Currently, several cryptocurrencies show low MVRV values, indicating low valuation.

Here's a list of cryptocurrencies that seem to be undervalued right now:

These negative values indicate that a significant portion of the asset is in bankruptcy or bankruptcy, a typical market capitalization indicator and a sign that can attract investors looking for a bargain.

Is it time to buy dip?

Investors often consider such depressions as favorable times to buy. The main reason is that buying an asset when its market value is below its realized value can yield high profits after the market corrects itself. However, it's important to note that the crypto market is notoriously volatile, and what appears to be an undervalued asset may drop even further.

While the MVRV ratio is a powerful tool, it is not the only thing to consider. General market trends, global economic conditions and specific news related to each cryptocurrency play a significant role in determining future prices. For example, technological improvements, regulatory news, or changes in investor sentiment can all dramatically affect the value of these assets.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

Investors should also consider the unique aspects of each cryptocurrency. For example, Fantom is known for its advanced blockchain technology that focuses on scalability and efficiency, which may attract a different investor class than its decentralized, metaverse platform. Moreover, crypto narratives can play an important role.

“If you want to be a good crypto investor, the key is to understand that narratives are being driven properly… it's all about narratives. It's just about picking coins in the narrative. This is the difference between making money in crypto and making life-changing money. That's the only difference,” explained Ran Nunner, founder of Crypto Banter.

For this reason, the decision to buy a dip should be based on a balanced view of market indicators, personal investment strategy and risk tolerance.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.