Is the Bitcoin (BTC) price trend still bullish?

Last week, the price of Bitcoin (BTC) completed eight consecutive bullish candles.

The decline took BTC price below the key horizontal and Fib resistance area. Can BTC recover?

Bitcoin could not close beyond resistance

The weekly time frame technical analysis shows that the price of Bitcoin has increased rapidly since October. Bitcoin hit a yearly high of $44,730 during last week's uptrend.

During that time, Bitcoin price formed eight consecutive bullish weekly candles, which led to a rise above the critical horizontal and Fib resistance area.

However, the price of BTC fell last week, creating the first bullish weekly candle since the beginning of the upward movement. This has taken Bitcoin below its main resistance, which indicates that the breakdown is a distortion.

With RSI as a momentum indicator, traders can determine whether the market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have the advantage if the RSI reading is above 50 and the trend is up, but if the reading is below 50, the opposite is true. RSI is still above 50 and in overbought territory. While it fell slightly, it did not go below 70, which is considered a bearish sign.

Read more: Where to trade Bitcoin futures – a comprehensive guide

What do analysts say?

Cryptocurrency traders and analysts at X are bullish on the short-term BTC trend.

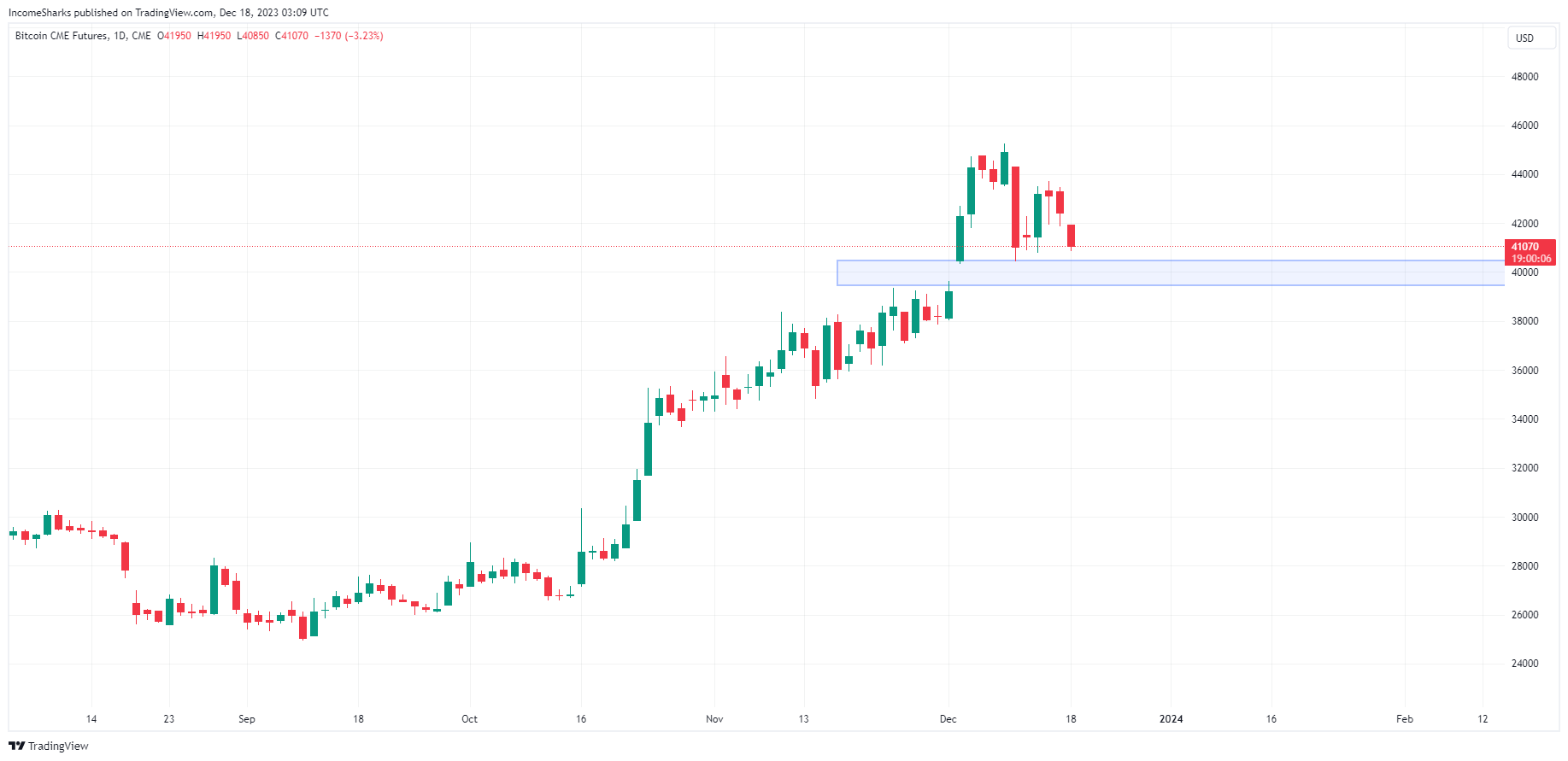

IncomeSharks has suggested a CME gap of $40,000, which it believes will be filled.

Rager believes that BTC price will return to test the moving average as the current rally is overextended. They tweeted.

Every rise in $BTC throughout the year has always resulted in a correction which has retested several major moving averages.Bitcoin has been in a clear bullish trend since October and of course due to a mean reversion the price has fallen in the $30ks here. The range should not be alarming and will be very healthy for further growth in Q1 2024.

Finally, CredibleCrypto is volatile in the short term due to the number of waves. However, he believes that there may be another high before a major correction.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

BTC Price Prediction: Has the Correction Started?

Technical analysts use Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of the trend.

The most predictable wave count suggests that BTC has begun wave four of the five-wave uptrend (white) that began in September. The sub-wave count is in black, the extended wave shows three.

As the daily RSI has formed a significant bearish divergence, wave three is likely to be broken. A bearish divergence occurs when a decrease in velocity is accompanied by an increase in price. It usually leads to downward movements.

The first target of the wave four bottom is the 0.382 Fib retracement support level at $37,650, 8% below the current BTC price.

Despite this BTC price forecast, a rise above the annual high means that the correction is complete. This could create a 23% increase to the next long-term resistance at $50,500.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.