Is the next target $3,000?

Despite recent corrections in the Ethereum (ETH) price, Ethereum daily active addresses continue to increase, suggesting sustained interest and participation in the network. This contrast between price movement and network activity raises questions about the future of ETH price.

ETH's move into the ‘belief-denial' zone as indicated by NUPL data, combined with the EMA lines suggesting a consolidation phase or further correction, raises a crucial question: will the ETH price stabilize at the consolidation phase or are we? More corrections?

Despite recent corrections, daily active addresses are still increasing.

From February 22 to March 11, the price of ETH showed a significant increase of 36.52%, with daily active addresses increasing from 449,000 to 545,000 at the same time, which shows strong growth and participation in the Ethereum network. However, the trend has recently taken off as the price of ETH corrected and dropped from $4,000 on March 13 to $3,400 on March 21.

Typically, there is a significant correlation between active addresses on the Ethereum network and the price of ETH, suggesting that active network participation often reflects price movements. However, last week saw a departure from this pattern.

Despite the price correction, Ethereum daily active addresses continued to rise, rising from 540,000 to 626,000 between March 14 and March 21.

This difference may indicate that the Ethereum network's increasing user activity and continued participation can prevent higher price corrections. Rather than witnessing a strong decline, strengthening daily active addresses and continued network activity may provide enough support to stabilize the ETH price, indicating a more bullish market scenario ahead of corrections.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

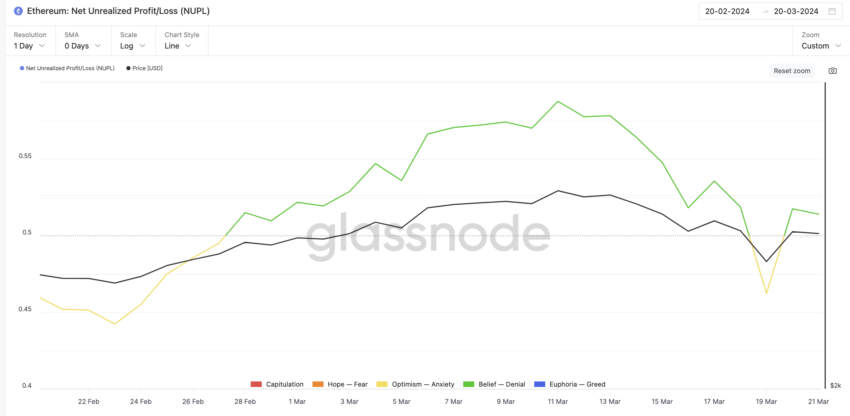

Ethereum NUPL metric exchange

The ETH Net Unrealized Profit/Loss (NUPL) gauge has been oscillating between the ‘Optimism – Anxiety' and ‘Belief – Deal' states, suggesting that a significant number of ETH investors perceive their holdings positively.

This realization shows growing confidence and optimism for Ethereum's value and potential future. The NUPL scale, by measuring the total unrealized gains and losses on Ethereum wallet addresses, provides an overview of the network's overall financial health and investor sentiment.

This vacillation between optimism and faith reflects the society's expectation of stabilizing prices through cautious trading behavior, closely monitoring price movements to plan their next moves. If NUPL moves to the ‘Optimistic – Distressed' range, it may signal the conclusion of recent market corrections, indicating a period of recovery and stability for the ETH price as investor sentiment awaits Ethereum's upward trajectory.

ETH Price Prediction: $3,000 Next?

The ETH price chart has shown significant movement: the short-term exponential moving averages (EMAs) have recently fallen below the long-term EMAs, all connected to the current price level. This pattern typically indicates a one-time decision on the future price direction of the asset.

When short-term EMAs cross below their longer-term counterparts, it usually signals a bearish trend, indicating that recent prices are lower than their average, which may predict a downtrend.

EMAs are designed to be more responsive to asset trends by emphasizing recent price information over older prices. This sensitivity to new market information makes EMAs particularly useful for traders looking to gauge short-term market momentum and identify trend changes.

Unlike simple moving averages, EMAs adjust more quickly to price changes, providing a different perspective on market dynamics and helping investors make informed decisions based on current trends.

Read more: What is Encrypted Ethereum (WETH)?

If this bearish trend occurs, as suggested by the EMA lines, the price of ETH could soon test the critical support zone at the $3,000 mark.

However, ETH is highly responsive to news and ecosystem changes. For example, positive news such as the approval of an Ethereum ETF can quickly change investor sentiment and push prices to $4,000 or more.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.