Is there a price adjustment for Chainlink?

Chainlink's price has been trending upward for the past few weeks, but that momentum appears to have slowed in the past 48 hours.

However, what's more surprising is that whales have long signaled an imminent correction.

Chainlink Wales can cause depression.

Chainlink's price recently hit a resistance level of $21.69, a 25-month high. Oracle token has been corrected after falling by 5.66% since today. At the time of writing, LINK is seen trading at $20.47.

Apparently, the decline may come, and the behavior may be the same for investors. Whale investors in particular have been showing signs of slowing down for some time. Addresses ranging from 10,000 to 100,000 LINKs have been on sale steadily since early February. Within a month and a half, their supply was reduced to nearly 2 million LINKs worth over $40 million.

Historically, these whale addresses are a strong indicator of trend reversals, as they follow bullish accumulations and sell-off corrections. This makes their recent sell-off an indication of what is to come.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

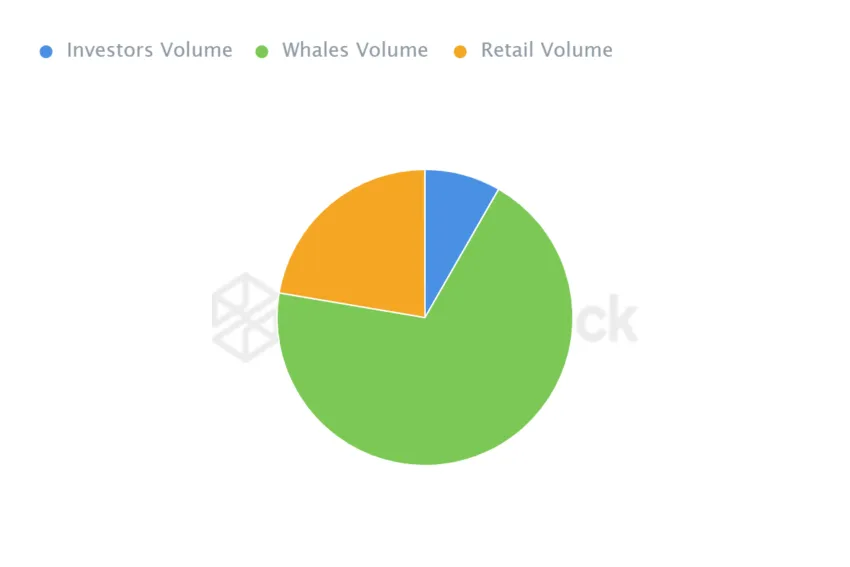

Additionally, whales influence LINK price action especially since 69% of this group's distributed LINK supply is held in wallets. The remaining 31 percent of the supply is divided into fish and small bags.

Now the price reduction is expected and has not yet arrived because the sale is not as significant and sudden as before. This caused a difference of opinion, which will be fixed after LINK remembers the decline.

LINK Price Prediction: All in Whale's Favor

While the price of Chainlink is slowly rising, the altcoin is seen losing its momentum in the short time frames. This is confirmed by the negative signals shown by the Moving Average Convergence Divergence (MACD) indicator.

MACD tracks the relationship between two moving average security prices. By measuring the difference between short-term (indicator line) and long-term moving averages (signal line), it helps identify trend direction, momentum and potential buy or sell signals.

When writing, the indicator will notice a hidden crossing with the red candles recorded on the histogram. The 50-day exponential moving average (red) is also currently above the candlestick. This is considered a short-term bearish signal, with LINK likely to see a drop to $20.12.

If bearish sentiment weighs heavily on Chainlink's price, it may fall further to test the support level at $19.22.

Read more: What is Chainlink (LINK)?

However, the 100-day EMA (green) is acting as a support line for LINK. Oracle Token can stay above $20.12 if it avoids a major decline. Further support from retail investors may reverse the downward trend. This will push the altcoin above $21, undermining the bearish trend.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.