Is this just the beginning?

Ethena (ENA) shares are up 11%, with signs that there may be more room for growth as labor momentum continues to build. The latest addition comes on the heels of a proposal to integrate Ethereum's decentralized exchange into Etna's reserve management system.

Key technical indicators show that ENA's uptrend is intensifying, but has not reached levels that typically indicate overbought conditions. With buying pressure continuing to outpace selling, the trend suggests more bullish potential.

Ethereal DEX may appear on Athena soon.

Ethena (ENA) rose 11% after Ethereum, a decentralized exchange (DEX) proposed to integrate into the Ethena network's reserve management system became an on-chain platform for USDe, Ethena's synthetic stablecoin, which supports spot and derivative trading.

The proposal, written by user “Fells0x”, suggests distributing 15% of Ethereum's management tokens to Ethena (ENA) holders. Ethereal aims to provide centralized exchange-level performance while maintaining autonomy, features such as cross-margin and liquidity automation, and is expected to launch on the testnet later this year.

Even with the recent pump over the past 24 hours, the ENA RSI still seems to show more room for growth.

Read more: Etena protocol and the US dollar What is a synthetic dollar?

ESA's 7-day RSI is currently at 54.40, a significant increase from the 20-day high of 26. RSI (Relative Strength Index) is a popular momentum indicator used to measure whether an asset is overbought or oversold. Values below 30 indicate oversold conditions, and values above 70 indicate overbought territory.

Despite rising sharply, the ESA's RSI is well below the overbought threshold, indicating that the asset is not yet overheated. This suggests that the recent 11% pump could be just the beginning of a big upside move as there is still room for more gains before ESA reaches overbought levels.

ENE Apprenticeship may be just the beginning.

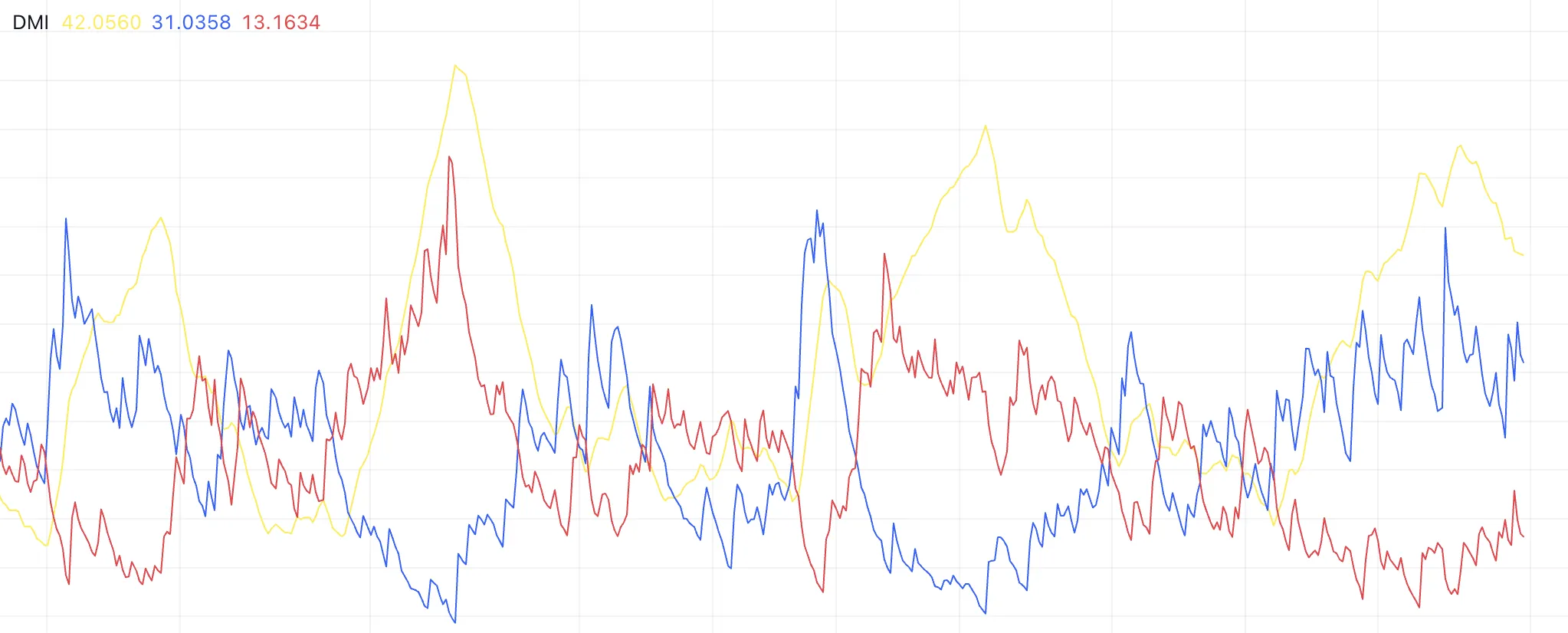

ANA's DMI is showing strong price action, ADX at 42.0560, showing strong price action. +DI at 31.0358 is significantly higher than -DI at 13.1634. That indicates that bullish sentiment is prevailing over bearish pressure.

This suggests that buying interest in ESA is strong at the moment and will push the price up, allowing the trend to continue.

The Directional Movement Index (DMI) measures the strength and direction of a trend. The ADX measures the overall strength of the trend, while the +DI and -DI lines represent the magnitude of bullish and bearish movements. In this case, the high +DI reflects strong upward movement, with the bulls firmly in control.

Given an ADX value above 40, the trend is considered very strong. This means that ESA's recent gains are likely to continue. This combination of increasing bullish momentum and a strong ADX suggests that ENA may experience continued price movement in the near term.

ESA price forecast: 66% increase possible?

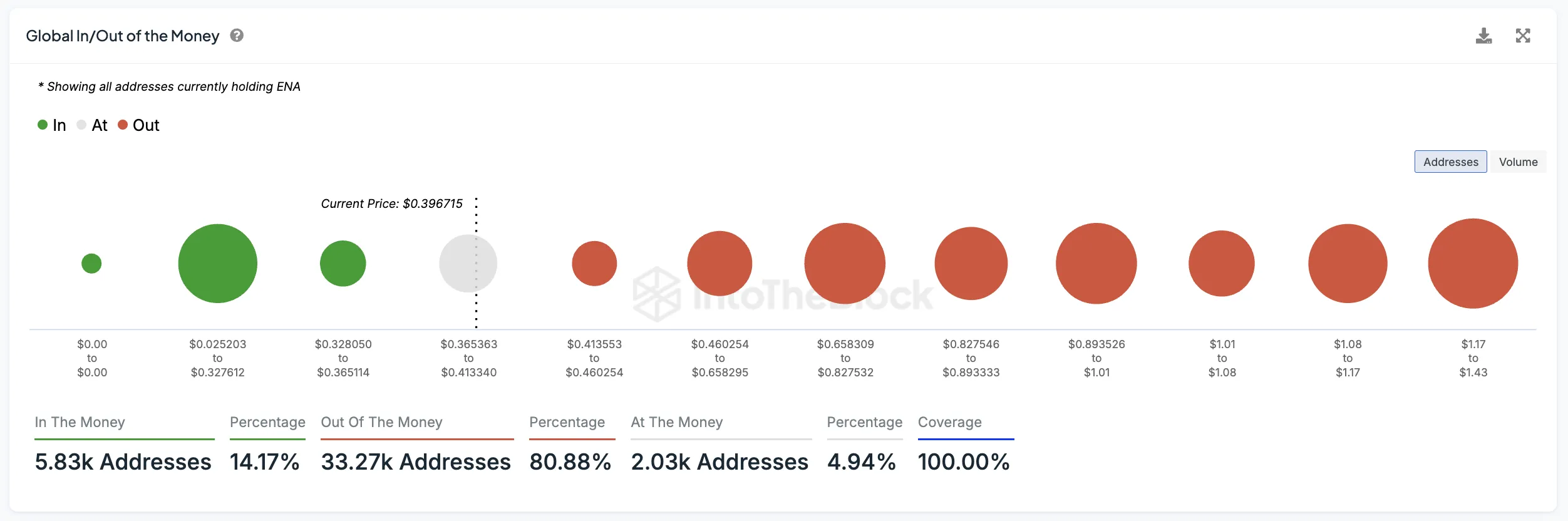

ENA price is currently facing relatively weak resistance between $0.41 and $0.46. This indicates that he has room to continue his growth. Beyond that, there is another resistance zone between $0.46 and $0.65, which suggests that ESA could rise as much as 66%. This creates a strong case for further upward movement against the current price action.

The Global In/Out of Money (GOM) metric is a tool used to determine the profitability of an asset holding address. It analyzes the average purchase price of tokens on different wallets to identify areas of support and resistance.

Read more: How to use Etena financing to offset USDe

When a large number of holders are “in the money” (ie, profitable), these holders can sell and the price tends to resist. On the other hand, “out of the money” positions can act as support because buyers are less likely to sell at a loss.

On the downside, if the current trend reverses, ESA has a weak support zone between $0.32 and $0.36. If it fails to hold above $0.32, the price may drop further, possibly as low as $0.25. This indicates that while the upside potential is high, failure to maintain support levels could result in significant downside risk.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.