Is Toncoin (TON) Price Rally at Risk? 95% of holders are now profitable.

Ton's daily trading volume has surpassed $314 million, pushing it to a new high. Despite this recent uptick, the tone EMA lines indicate high price gains and potential.

However, a cause for concern is the high profitability of shareholders, currently at 95% – the highest level since 2021. Historically, this suggests a selloff may be on the horizon. Is this a buying opportunity or a sign to wait?

Tons of daily trading volume is reaching new records.

Ton's daily trading volume recently hit an all-time high of $314 million. This impressive milestone surpasses the previous record of $295 million, which was set two weeks ago on February 28. In particular, a significant and consistent trend has been observed between the price movements of TON and the volume of trade, which shows that there is a strong relationship between the two.

Such a pattern will cause the price of a ton to be the same as the transaction volume increases, thus showing the increasing speed of the ton. Since this trend can indicate a positive outlook for the ton, it indicates that the signal is getting a lot of pressure in the market.

As a result, investors and market watchers are growing optimistic that the upward trend in both transaction volume and token value will continue in the future, thus reinforcing the positive momentum around TON.

Read more: 8 Best Crypto Platforms for Futures Copy Trading

Most holders are now profitable.

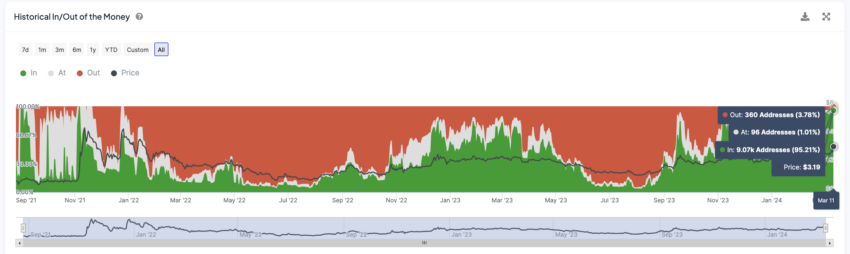

Analyzing the distribution of tonnage holders based on their profit and loss position reveals a fascinating picture. More than 95% of tonnage holders are currently sitting on a profit, marking the highest level of profitability since 2021. This statistic, derived from the “in/out of the money” measure, provides valuable insight into investor sentiment.

This metric calculates the average price at which different addresses have earned Ton Tokens. If the current market price for a particular address is greater than the cost basis (average purchase price), that address is classified as “in the money,” indicating profitability. Conversely, addresses whose current value is below cost are considered “out of the money,” indicating unrealized losses.

While the high percentage of profitable holdings may raise concerns about the possibility of a sell-off, historical trends suggest a more pessimistic view. There have been instances where many profitable holders have not picked up on a continuing downward trend. In addition, the ton has considerable room for growth before reaching its previous all-time high. To revisit those peaks, the price needs to climb another 22.10%. This indicates that the market may still be in the accumulation phase. At this point, investors may hold their positions in anticipation of further inflation.

However, it is wise to embrace the potential of pressure selling. The recent 37% price increase has undoubtedly put many owners in a profitable position. Some may be tempted to lock in their profits by liquidating a portion of their holdings. This potential selling pressure should be closely monitored, especially if it coincides with the weakening of current high signals identified by technical analysis.

Price forecast ton: Can it reach $4?

Ton's 4-hour chart is giving high signals on several fronts. A recent crossing of short-term EMAs above long-term lines is a classic technical indicator that indicates an uptrend.

Exponential moving averages (EMAs) are indicators used in technical analysis to gauge price volatility and identify trends. Adding to the worrisome sentiment, the price of TON is currently above all EMA lines on the chart. This further reinforces the bullish signal as it suggests that the price trend is currently to the upside.

However, if the price encounters resistance or a reversal, it is important to consider support levels. A ton has historically found support around $2.6 and $2.38. If the price breaks below these zones, it could indicate temporary weakness and a move down to $2.10.

On the other hand, the good news is that tonnage prices may continue to rise. A recent telegram shared on X with channel owners mentions Toncoin as an example:

“The company (@telegram) will pay rewards using Toncoin on the TON Blockchain. Channel owners will start receiving 50% of the company's revenue from displaying ads on their channels,” the announcement said.

If the current launch continues, Tons could see a steep price hike. A rise past the $4 mark would represent an improvement to levels not seen since 2021, opening the door for even higher prices.

Read more: 10 Best Crypto Exchanges and Apps for Beginners in 2024

Overall, the technical analysis of the 4-hour chart suggests an optimistic outlook for TON, while the EMAs and current price position provide positive signals. However, traders should be aware of potential support levels and be prepared to adjust their strategies accordingly.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.