Japanese banking giants challenge the dominance of the USDA

Of Japan's three largest banks, Mitsui UFJ Bank, Dollar Usudokon, and USDC.

In the year According to a report from the Japanese kitchen Nikiki Rikiki on October 17, the fixed line will be used by the corporation for the first time.

The three megabucks, which serve a total of more than 300,000 core business partners, are united to drive the adoption of Stardinin, especially in Japan.

“Banks will build a structure so that uniform coins can be transferred between them, first by declaring the currency coin and the coin defaced to the dollar.

The project is to build a Japanese incentive to test the dominance of USDT and USDC

Cysupondows stole this initiative Mittisia Ufija trust and banking the country's first FIAR-backed cut.

According to this development, it is a project, the Botanin infrastructure company was established by MUFG.

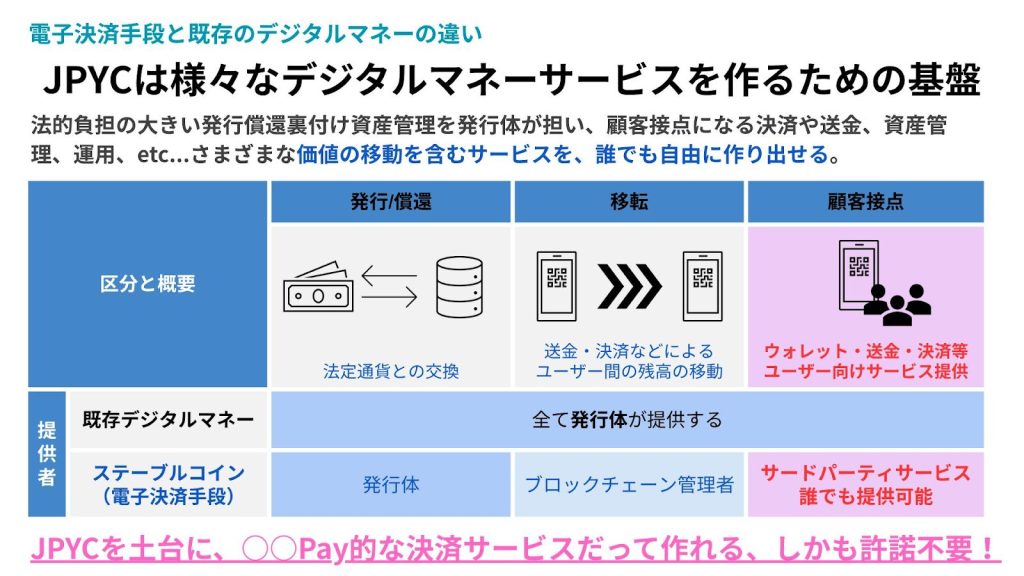

Projective in building digital financial products that meet regulatory requirements

The platform system maintains access and management of the new Starcinin approved and operational supplement.

Banks have partnered with a number of crypto sectors, including Beyond Project, a local blockchain, Czech companies and crypto infrastructure provider Fire Protection.

This previous report of Nikkei is already preparing to approve the first Norkicoin of this entry.

Crypondows confirmed that Tokyo-based fintech company JPYC can lead.

JpyC, also known as jpyC, is held to the Weipen through highly liquid values, including gins and government bonds.

The possible applications of Stardcoin adapted for Thais include the facilitation of decentralized corporate organizations for students abroad and sending money to students so that they can ease participation in conventional financial finance.

In the next three years, banks will have a total of 150.4 billion dollars, equivalent to approximately 6.64 billion dollars, which is approximately 10.42 yen.

The schedule of the recent market capitalization of 307 billion dollars, which is cut off by Globan, is held by international demand and holds the lion's share.

At present, it is only a circle that has been found to be an incentive for the international dollar to be used in Japan.

SBI VC has entered the Japanese market in connection with financial construction to list its mark on the stock exchange.

Jeremy Allor, Japan executive at x post, with Japanese regulators, Japanese markets of the U. Strategic partners, strategic partners, banking partners, banking partners and others are the Japanese markets and other compensating helpers.

Japan has doubled

Japan's revised legal framework, which will be effective from 2023, shows the country's desire to dominate the dollar.

Under the new rules, stop congs are classified as “currency-based assets” and can only be offered by banks and trust companies.

These policy changes made the country twice as much as last year.

Among the five markets in the Asia Pacific region, Japan has the strongest growth and the price is growing more than 1220% year on year in June 2025.

In the year From June 20 months to June 2025, the incentives held by JP showed that purchies mainly to XPN with an income of 8.7 billion dollars, BTC ($ 9.6 billion dollars).

The dominance of XRP trading is particularly popular and investors can bet on real-world consumption following the strategic partnership with SBI Shells.

Closing news news analysed, cryptographic predictions