Japan’s stimulus, the yen’s fraud and the release of Symposium will shake the international markets

Japan's 40-year bond rose to 3.774% on Thursday. In the year On November 20 to 20.73333 working CDs were distributed. GDP in Q3 2025 and inflation reached 3% in October.

Japan's new stimulus package in January 2025 and long-term bonds have pushed them to record levels, with global markets sizzling with pre-emptive costs.

The cabin from the cabbie-from the 19th century, the cabin from the well-20 times and the advertisement immediately after 2.3 trillion dollars spread in boat, bond money and advertising markets.

Support and pressure on Japan's financial decisions are currently moving forward with how investors rate international risk, especially as liquidity conditions change in detail.

Economic reset

The package focuses on supporting the price pressures, supporting defense and diplomatic capabilities.

The local government's yogurt and energy subsidies are a key part of the plan, and families are expected to receive about 7,000 benefits over three months.

In addition, the government aims to raise the defense position to 2% of GDP by 2027.

Although the supplementary budget is said to be passed by the end of the year, there are only 231 of the 465 lower house seats.

The support comes at a time of weakness.

Japan's GDP fell by 0.4% in the third quarter of 2025, equal to a 1.8% annual growth rate.

Inflation has been above the Bank of Japan's 2% target for 2 months and will reach 3% in October 2025.

Policymakers have set real goals to increase real GDP by 24 trillion and generate a total economic impact of close to 265 billion dollars.

Increasing market pressure

The stimulus is concerned about long-term debt sustainability and market stress.

The yield on five-year Japanese government bonds reached 28.73 basis points, the highest level in six months.

The country's 40-year bond rose to 3.697% immediately after the release, after reaching 3.774% on Thursday.

Over time, the public finances will attract attention to the problems of financial financing, which will raise the costs of 2.8 trillion.

Nikkei continues to be cautious about financial stimulus beyond emergencies.

This argument becomes even more relevant when the yield curve shifts and Japan's mortgage costs rise.

These activities are also important for the 20 trillion dollar Nin business. Investors typically invest in foreign markets at low rates or even high-yield markets.

A mixture of high products and sudden criminal activities can make it unrelenting.

Historical data shows a 0.55 sub-controller between bearer trades, which adds another source of volatility.

Enen's response

After the announcement of stimulus for the future, the stability of the future currency and the ability to enter the market has increased in the race.

From trading 3.6% year-on-year in October, the increase was not enough to ease concerns about the pressure on the broader economy.

Seasonal support and the strength of inflation are fundamental issues in how global markets will shape Japan's next steps.

Crypto Shift

These conditions directly feed into the secret markets.

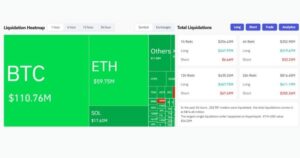

One shared Wenke. Drive to alternative investors for various doctors, especially during small liquidation.

Japan's decision previously included Japan's federal primary recipients of access, grazing financial activities, and liquid support from China in the next international environment.

Together, these factors are creating the conditions that you are most likely to develop.

At the same time, higher long-term yields lead to risk.

Nin-bearers may be forced to sell assets, including pipelines, to meet the institution's liquidity needs.