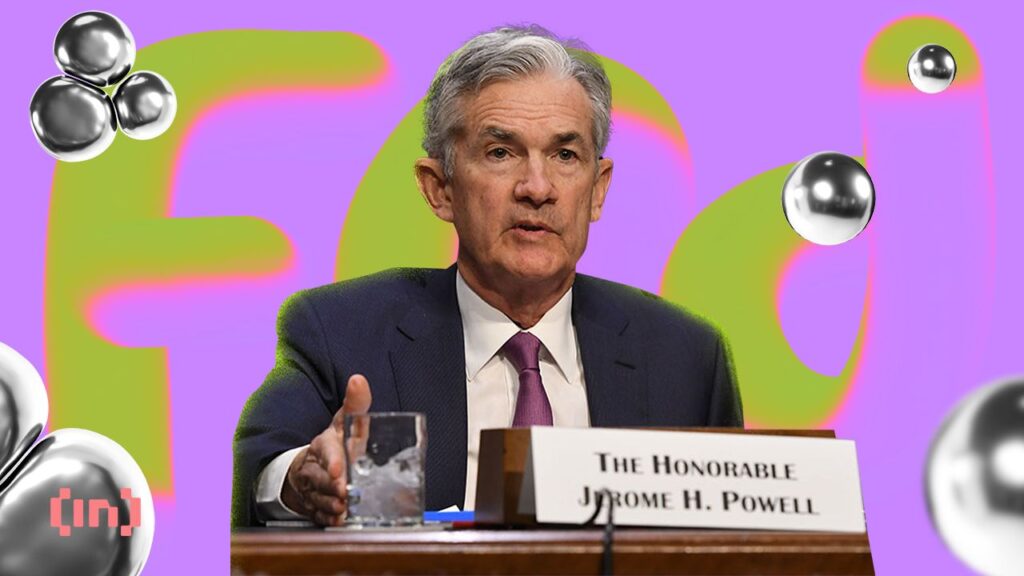

Jerome Powell says a recession is unlikely when he adds bitcoin as a hedge.

Federal Reserve Chairman Jerome Powell has reassured the public, taking a firm stance on fears of a looming recession, while finding bitcoin as a hedge.

Powell's confidence in analyzing current economic data and trends, avoiding the political influences that often cloud economic forecasts. This statement comes amid doubts about the role of monetary policy in ensuring long-term economic stability.

A recession is unthinkable this year.

Jerome Powell's statement is consistent with his previous comments, indicating the Federal Reserve's commitment to supporting data.

Core PCE, which strips out variable food and energy costs, rose 2.8 percent over the past 12 months. Meanwhile, overall inflation has reached 2.5 percent compared to last year. Powell said this is in line with his predictions, and it is encouraging to see results that meet expectations.

Powell's optimism, acknowledging the low risk of recession, reflects a pragmatic view of the economy. Moreover, “the Federal Open Market Committee has downplayed the possibility of cutting interest rates until it confirms that inflation is sustainably below 2%.”

“Growth is strong. As I mentioned, the economy is in a good place. And there's no reason to think the economy is in a recession or on the edge of one,” Powell said.

This perspective shifts attention away from the short-term effects of monetary adjustments to the structural components of economic growth.

Read more: How to protect yourself from inflation using cryptocurrency

While Powell stated that a recession is unlikely this year, Bitcoin is benefiting from an uncertain fiscal and monetary environment.

Jason Trenert, CEO of Strategas Research Partners, attributes this to recent regulatory developments and growing demand for alternatives to traditional fiat currencies. The approval of the Bitcoin ETF and the simultaneous rise in gold prices reflect mutual hedging against the decline in the US dollar.

“In the US, there is no coordination between fiscal and monetary policy when it comes to inflation. And I think people are looking for a hedge against fiat currencies, especially the dollar. So I think that's another reason why people are looking for alternatives to what they've traditionally been, again like fiat currencies,” Trainor explained.

Read more: Jerome Powell has lost America's trust: Is Bitcoin the solution?

With Powell guiding the money leader with a steady hand, the conversation surrounding Bitcoin's viability as a safe haven will intensify. As the US grapples with the national debt and a looming debt default review, Bitcoin's role as a hedge against fiscal instability.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.