June Crypto Recap Including Bitcoin Range, Ethereum ETF Base, and Solana Rebound

June provided a diverse platform for the market with several major changes in assets such as Bitcoin, Ethereum, Solana and Toncoin. Here's how this month changed the shape of the market.

Bitcoin range-bound trading

Bitcoin price stuck in the range of $60,800 to $71,700 in June. The cryptocurrency has encountered resistance in its attempts to cross the upper bounds and will eventually return to the lower end of the range. The technical analysis shows Bitcoin finding significant support levels and showing persistence, aided by steady ETF inflows of around $666 million per month.

Ethereum ETF forecast and layer-2 tests

In anticipation of the approval of the ETF, which is expected to begin trading in early July, Ethereum managed to maintain mid-range stability. However, gas prices fell significantly during the month and activity on the chain slowed. While raising questions in the community about valuation differences and post-TGE (Token Generation Event) market dynamics, well-known layer-2 solutions like ZKSync and Blast, the token launch showed Ethereum's continued efforts to scale.

Solana's renaissance and innovations

After briefly falling below $138, Solana emerged as a player and quickly recovered. The recovery occurred after VanEyck filed for the first Solana US ETF, indicating an increase in institutional attention. Analysts are optimistic about the near-term prospects for ETFs, but remain cautious due to the divergence in liquidity between Solana and Ethereum. Market sentiment has further increased with innovations such as Solana Blinks. Products created in collaboration with Dialect, a bridge between Web2 and Web3 technologies, enabling on-chain transactions. These solutions include more than 70 ecosystem builders, increasing the resilience of the Solanas ecosystem.

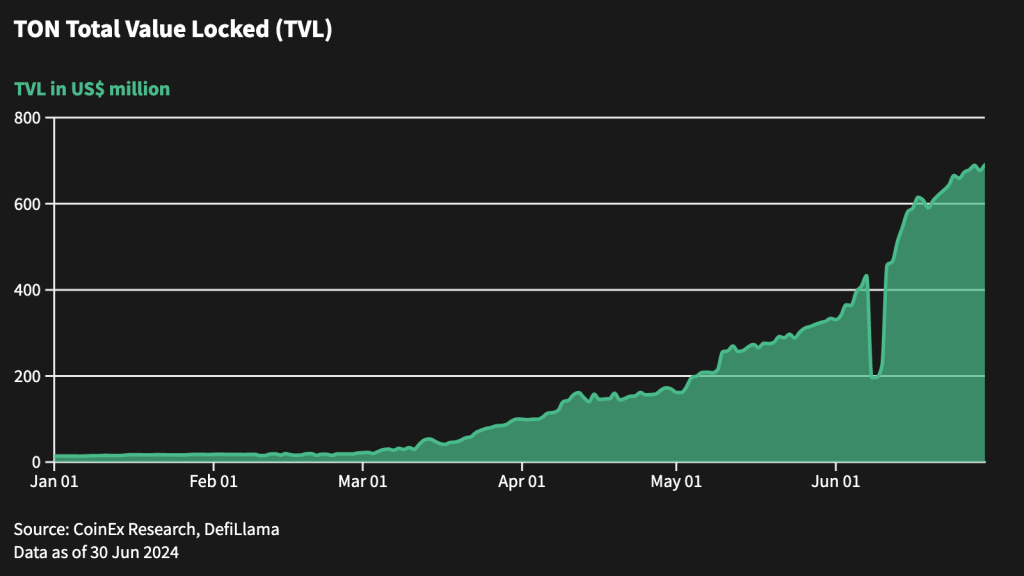

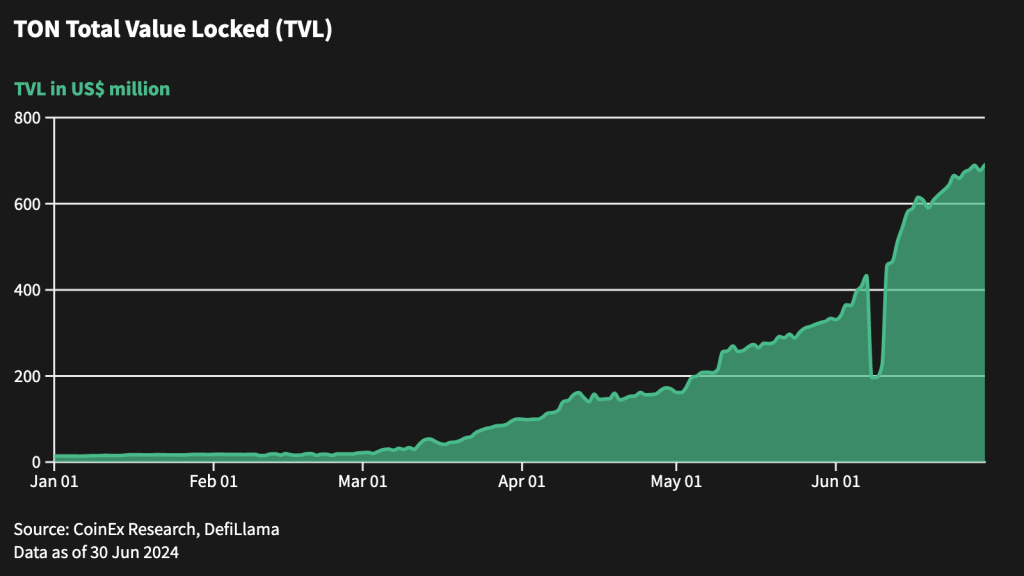

Toncoin growth trend

Toncoin's Total Value Locked (TVL) has seen significant growth, as evidenced by its growth from $99 million at the end of Q1 to $700 million at the end of June. In addition, USDT's net distribution per ton has exceeded $500 million, indicating the rapid adoption of the ecosystem. Although Toncoin is still in its infancy, its growing infrastructure makes it a promising player in the evolving blockchain.

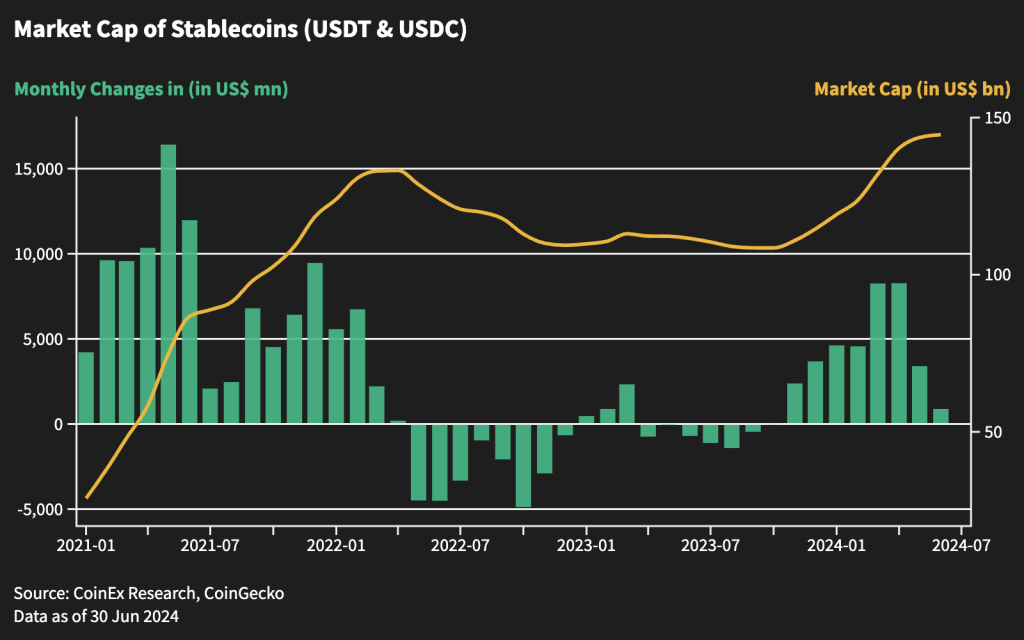

Market Liquidity and Outlook

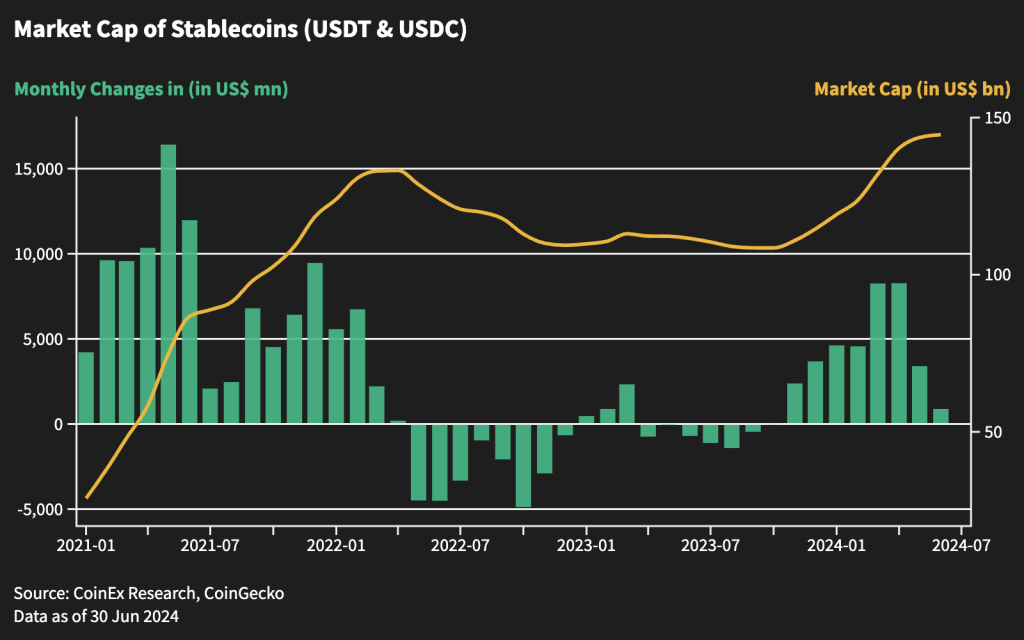

The crypto market has been hovering around declining levels of liquidity in June, as the flow of stablecoins has slowed. While liquidity concerns remain, the absence of significant outflows suggests a resilient market base. Analysts suggest watching for continued consolidation levels for renewed liquidity, which could bolster liquidity and signal future market movements.

Summary

June presented a volatile landscape characterized by Bitcoin's level of consolidation amid institutional flows, Ethereum's wait for ETF approval alongside Layer 2 challenges, Solana's resurgence of ETF ambitions, and Toncoin's rapid ecosystem expansion. As the market continues to evolve, these developments demonstrate the market's resilience and potential for innovation in changing market conditions.

The market landscape is volatile, amid a wave of institutional outflows, Solana's resurgence, Ethereum's ETAP forecast and Toncoin's explosive growth amid several Bitcoin consolidation phases.

About CoinEx

Founded in 2017, CoinEx is a global exchange with the goal of making trading easier for everyone. The platform offers a wide range of services including spot and margin trading, futures, swaps, automated market makers and financial management services. It has more than 5 million users in 200 countries and regions.

More reports @ CoinEX Research