Lido Stacking’s Dominance in ‘Attack’ by Rival Protocol Diva

A new liquidation platform called Diva is trying to ‘vampire' the industry-dominated lido by offering better incentives to stakeholders. Meanwhile, the Lido administration voted to sunset the protocol on Solana.

On October 16, the crypto community shared information showing that the Diva Liquid Staking Protocol was trying to ‘vampire attack' Lydon. This is achieved by offering DIVA token rewards to stakeholders to lock in ETH and stETH for DiveETH.

Diva Vampire Attack

The ‘attack' seems to be showing the first signs of success as the total price has increased by almost 600% in the last two weeks.

Divascan reports that TVL currently has 14,123 Lido staked ETH (stETH) worth around $22.4 million at the current price.

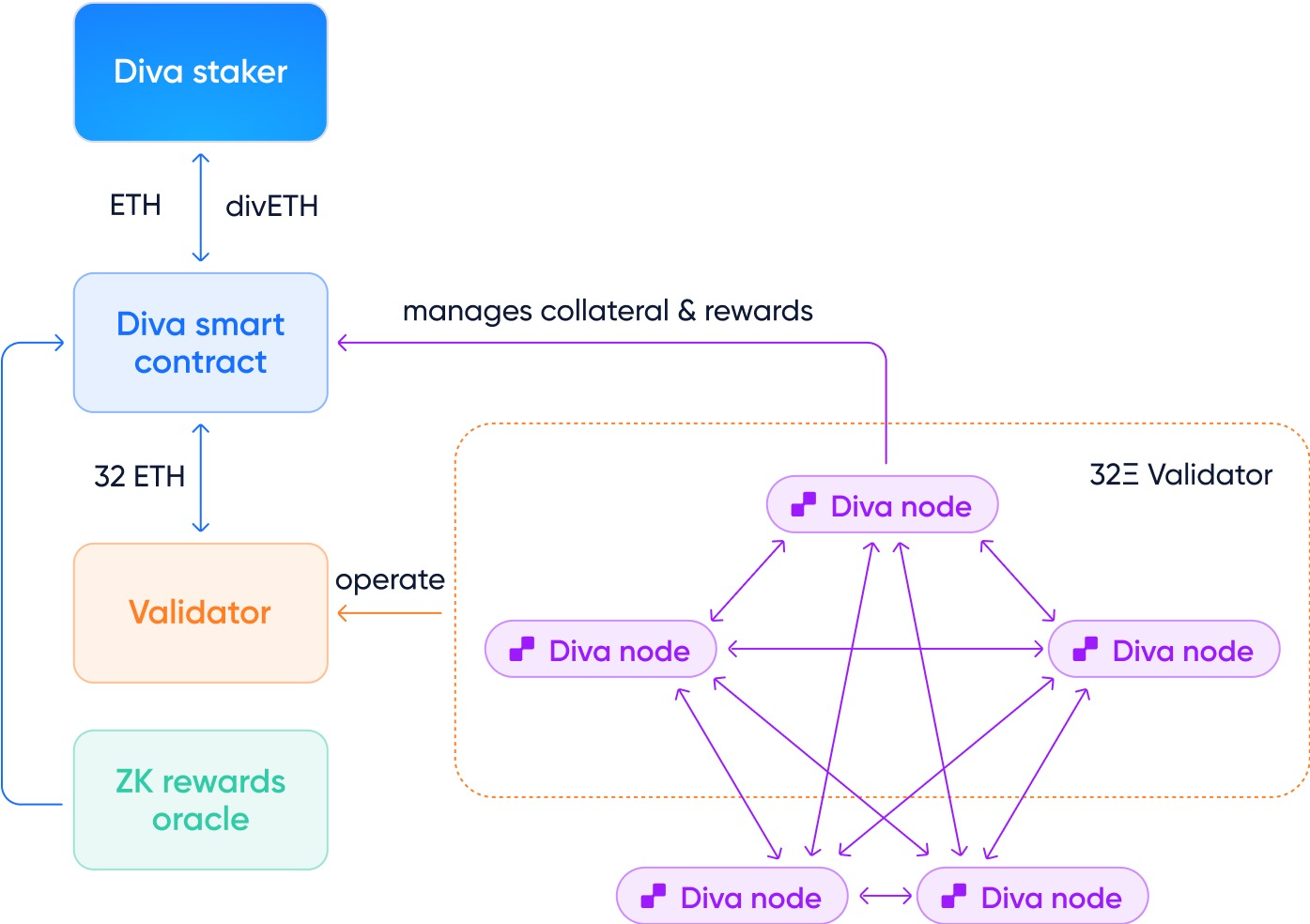

Diva is Ethereum's first liquidity solution powered by Distributed Verification Technology (DVT).

The platform offers a liquid staking token, divETH, and thousands of viable, unlicensed operators back it faithfully.

In addition, Diva provides node operator access for only 1 ETH instead of the 32 ETH needed to directly compensate and become a full node validator.

“The Diva Smart Contract accepts ETH deposits from Liquid Stakers. Every time 32 ETH are earned, it deposits them into the Ethereum Consensus Layer to form a new validator, which is managed by 16 unique key shares to generate staking rewards.”

The move was welcomed by the Ethereum community, which is increasingly concerned about Lido's dominance.

David Hoffman from Bankless (Diva's partner) explains the tactics of the “vampire attack”

“It's a bootleg scheme that uses token incentives to steal TVL and users from a bigger player.”

This is good because Lido is “threatening to break the 33% share of ETH.” It would be “crossing the critical line and violating the values of decentralization and trust neutrality held by Ethereum.”

Ethereum developers like Danny Ryan have warned of the dangers of investing in “cartelization” like Lido.

Additionally, Lido's stake is currently 31.6% according to Dune Analytics.

Lido Solana at sunset

In related news, Lido management token holders have voted to terminate Lido on Solana.

An announcement on October 16 stated that stSOL would end the awards. Users are urged to uninstall SOL by February 4, 2024.

He added.

“This decision does not reflect the confidence Lido contributors have in the potential and longevity of the Solana ecosystem as a whole.”

Moreover, Lido DAO (LDO) token prices fell by 2.7% during the day to $1.59 at the time of writing.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content.