Link price rises 8% in 24 hours despite whale speed reduction.

Chainlink (LINK) price increased more than 8% in the last 24 hours, trading volume increased by 106% to reach $1.04 billion.

Despite this strong price action, whale activity has stabilized as the number of addresses between 100,000 and 1,000,000 LINK remains at 527 after the previous high of 534.

LINK Wales maintains a neutral position.

The number of addresses between 100,000 and 1,000,000 LINK increased significantly from 510 on December 27th to 534 on a monthly basis.

Monitoring the behavior of such whales is crucial as their buying or selling patterns can greatly influence price trends. A rally in whales often indicates confidence in the asset and can lead to further price growth, as higher trading volume moves higher.

However, after reaching the peak of 534 addresses, the number began to decline slightly and then stabilized at 527. This recent stability indicates that large investors are not currently accumulating or unloading their LINK holdings significantly, indicating a neutral sentiment.

Despite an 8 percent rise in prices over the past 24 hours, the lack of continuity in whale stocks may indicate caution regarding the sustainability of the recent rally. For LINK's price to continue its upward trajectory, renewed interest in additional support and increased activity by these large holders may be necessary.

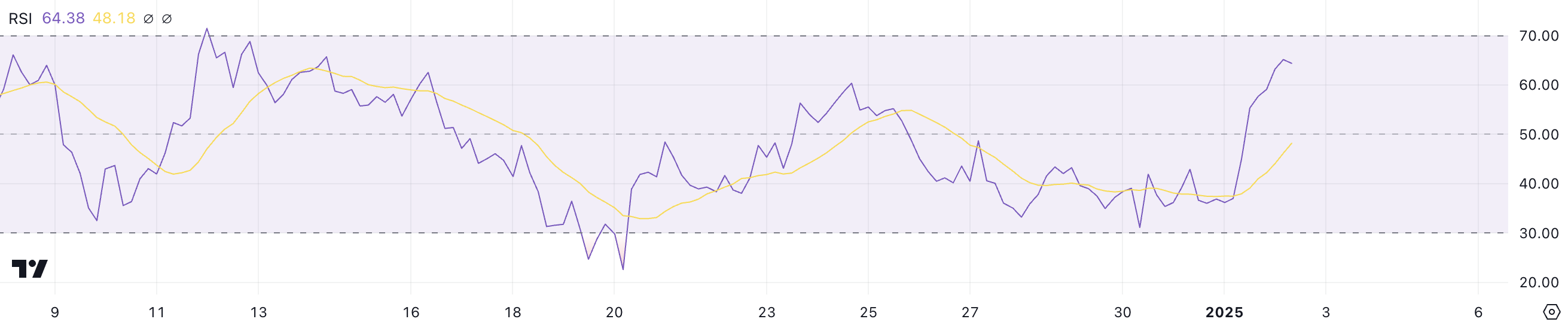

Chainlink RSI signals can be recovered

Chainlink's Relative Strength Index (RSI) jumped sharply from 36.9 to 64.3 in one day. This rapid increase reflects a significant momentum shift, driven by strong buying pressure following the recent price rally.

The widely used momentum indicator RSI measures the speed and magnitude of price movement from 0 to 100, providing insights into whether an asset is overbought or oversold. Readings above 70 indicate overbought conditions, usually indicating the possibility of a pullback, while readings below 30 indicate oversold conditions and the possibility of a pullback.

At 64.3, the Chainlink RSI is approaching the overbought zone, indicating that buying momentum remains strong, approaching a critical level where the asset may face resistance to an upward move. In the short term, this RSI level suggests LINK still has room for modest gains, but traders should watch for signs of fatigue near 70.

If buying pressure continues, the RSI may move into overbought territory, indicating a possible temporary consolidation or correction before further price action. Conversely, a stabilizing or declining RSI may indicate that the momentum is weakening.

LINK Price Prediction: Can It Reclaim $30 in January?

The Chainlink EMA lines are signaling that a golden cross is likely to form soon. A golden cross is a bullish indicator formed when the short-term EMA crosses above the long-term EMA.

If this golden cross materializes and the current uptrend continues, the price of LINK may see higher momentum. The price could test the resistance at $25.99, and a break above this level could open the way for further gains. Potential targets of $27.46 and $30.94 indicate bullish upside for the asset.

On the other hand, recent whale activity and a higher RSI suggest that the current rally may not be fully sustainable, leaving room for a reversal.

If the increased momentum is interrupted and the selling pressure increases, the price of LINK may face a correction, testing the immediate support at $21.32. If this level fails to hold, the price could drop to $20.02, indicating a deep retracement.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.