LINK prices are offered for a 13% discount, here’s what’s happening.

Amid the uncertain cryptocurrency market sentiment, Chainlink (LINK) is set for a bearish price action pattern on its daily time frame. In addition to LINK's bearish outlook, its price has started to decline along with other major cryptocurrencies.

LINK price momentum

At press time, LINK is trading near the $10.52 level and is down more than 2.7% in the last 24 hours. Trading volume fell by 19 percent during this period, indicating low participation from traders and investors.

LINK technical analysis and upcoming level

Based on expert technical analysis, LINK has formed a bear-and-shoulder price action pattern on the daily timeframe. Additionally, it broke the critical downtrend support that has been in place since August 2024 with the recent price decline.

Based on recent price movements, if LINK breaks the neckline of this bearish pattern and closes a daily candle below $10.30, there is a strong possibility that the asset will experience a 13% drop in price, potentially reaching the $9 level in the near future. Days.

As of now, LINK is trading below the 200 exponential moving average (EMA), indicating a bearish trend. Often, traders and investors look at the 200 EMA when building positions, both long and short.

Bearish On-Chain Indicators

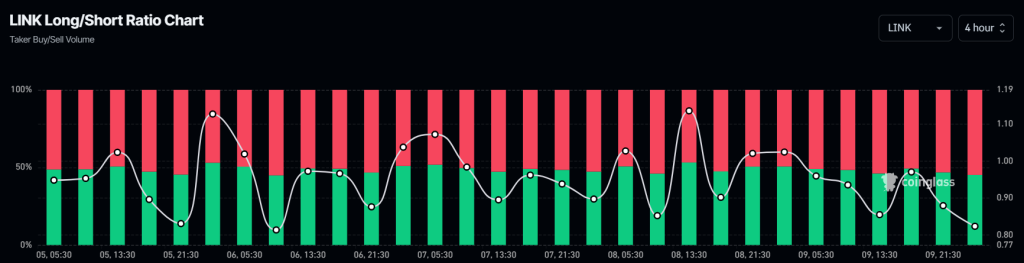

LINK's bearish outlook is further supported by chain metrics. According to on-chain analytics firm Coinglass, LINK's long/short ratio currently stands at 0.82, indicating strong bearish market sentiment among traders. Additionally, its futures open interest has increased by 5.2% in the last 24 hours, which is currently a sign for LINK holders.

A long/short ratio below 1 indicates that traders are starting to go short as open interest increases.

Currently, 54.84% of top traders hold short positions and 45.16% hold long positions. Traders seem to be betting on the short side as they believe the price will drop.