Litecoin is seen as a commodity, a Litecoin ETF may launch under Trump, experts say.

Key receivers

Canary Capital's Litecoin ETF could be the first space crypto ETF to be approved by the SEC in 2025. The CFTC classifies Litecoin as a commodity, which sets it apart from other digital assets that face regulatory challenges.

Share this article

Canary Capital's Litecoin ETF is on track to become the first position approved by the SEC under the incoming Trump administration, given Litecoin's commodity status, according to Bloomberg ETF analyst Eric Balchunas.

Following Canary Capital's amended S-1 filing yesterday, Nasdaq filed a Form 19b-4 with the SEC on Thursday, officially starting the review process for the Canary Litecoin ETF. The SEC now has 45 days from publication in the Federal Register to approve or disapprove the listing, which can be extended by another 45 days.

According to Balchunas, the Litecoin ETF application has met all the necessary requirements and conditions for approval.

“The Litecoin ETF now ticks all the boxes. The first alt coin ETF of 2025 is about to hit the clock. “I don't see any reason why this should be raised if the SEC issues comments on the S-1, Litecoin is seen as a commodity and there's a new SEC sheriff in town,” Balchunas wrote on X on Thursday.

Balchunas said Wednesday that the SEC has issued an opinion to Canary Capital's S-1 for its proposed Litecoin ETF. This prompted the organization to propose the amendment.

“A 19b-4 really starts the approval/deny clock,” said Bloomberg ETF analyst James Seifert, a Balchunas partner.

Canary Capital filed its Litecoin ETF S-1 statement with the SEC in October 2023. The revised filing names US Bancorp Fund Services as the ETF manager, along with Coinbase Custody Trust and BitGo as custodians for the ETF's Litecoin holdings.

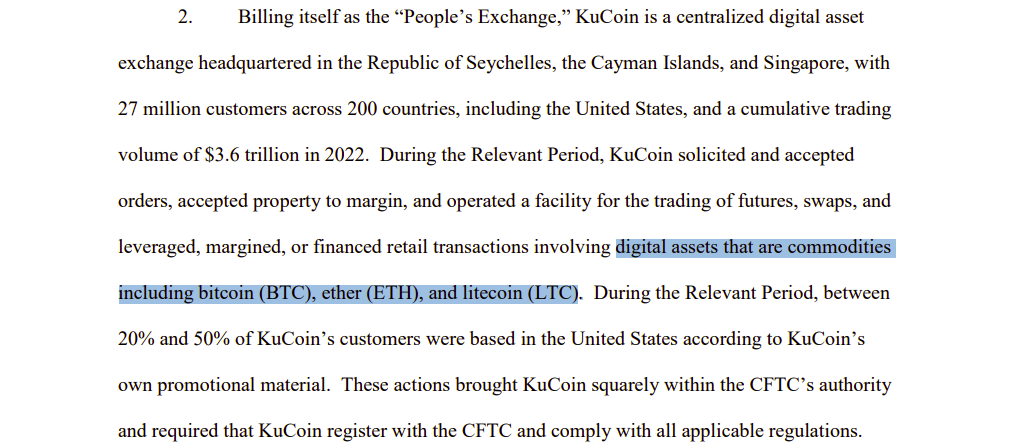

The CFTC classifies Litecoin as a commodity

The CFTC has designated Litecoin as a commodity in its lawsuit against crypto exchange KuCoin, thereby exempting it from SEC securities regulations.

The SEC has not taken any official action or made any public statement classifying Litecoin as a security or as a security.

Unlike Litecoin, Ripple and Solana face an open SEC investigation. Ripple continues to be involved in ongoing litigation with the SEC, which asserts that its native token, XRP, retains security.

The SEC also classified Solana's SOL token as a security in separate cases on Binance and Coinbase. These legal disputes have not been resolved.

Share this article