Litecoin (LTC) Price Analysis: Could It Reach $115 Next Week?

Litecoin (LTC) price is up 11% in three days, but is there more room for growth? As technical indicators suggest. The coin's RSI remains healthy, indicating there is still room for bulls to push prices higher.

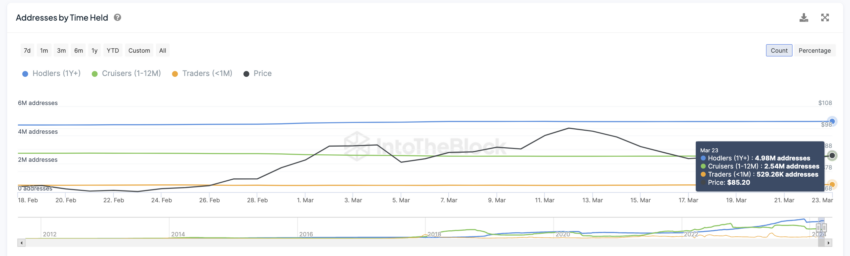

The number of short-term traders holding LTC has been increasing over time, which may lead to more price volatility in the future. These short-term traders are known to jump in and out of positions quickly, creating price volatility.

Litecoin RSI is still healthy despite the recent price surge.

The Litecoin RSI has shown significant improvement over the past two weeks, moving from 60 to a current level of 67. The Relative Strength Index (RSI) is used as a useful tool to measure the relative strength of an asset and to indicate turning points.

RSI reflects the overall movement behind price movements by comparing the magnitude of recent gains to recent losses. This indicator ranges from 0 to 100, with readings above 70 generally considered to indicate overbought conditions, which may indicate a price correction. Conversely, values below 30 suggest an oversold asset that could be set for a reset.

This recent rise in the LTC RSI indicates increased buying pressure, indicating higher investor interest and a more active market. While the current reading of 67 falls within a healthy zone, it is important to note that it is approaching overbought territory.

Read more: Litecoin (LTC) Price Prediction 2024/2025/2030

This suggests that it may be time for a consolidation or even a pullback as some investors choose to take profits. However, it is still too early to predict a reversal, and the RSI itself does not provide a guaranteed road map for future price movements.

Traders are still growing

A deeper dive into LTC holder trends reveals a steady increase in short-term holders. These traders held LTC for less than a month, growing from 429k to 529k between February 18th and March 25th.

However, this short-term increase in ownership comes with a loss of leverage. Intermediate-term holders, or “cruisers” as they are known (those held for more than a month and less than a year), are showing signs of retreat. This demographic has decreased from 2.74M to 2.54M over the same period.

This move towards short-term traders and away from long-term believers could have a two-way effect on the price of LTC. Increased flexibility is a possible outcome. Short-term traders are known for buying and selling too quickly, causing prices to rise.

LTC price forecast: EMA lines have just formed a golden cross

LTC's recent price hike may just be the beginning. The short-term EMA lines recently crossed above the long-term EMA lines. This is known as the golden cross. This is a bullish setup, suggesting that a new bull run may begin soon.

Exponential Moving Averages (EMAs) are technical analysis indicators used to understand price trends and potential turning points in an asset's value. Unlike the simple moving average (SMA), which gives equal weight to all prices within a certain time frame, EMAs focus more on recent price points. This weighting system allows EMAs to react quickly to market changes and identify trends with greater accuracy.

A bullish crossover occurs when the short-term EMA rises above the long-term EMA, while a bearish crossover is the opposite.

Read more: How to buy Litecoin (LTC) and everything you need to know

Given the influx of short traders and the favorable EMA position, a return to $105 for LTC would not be surprising. If that happens, LTC may continue to grow and reach $115 next week. This marks the highest price of LTC since April 2022. However, a breakdown of established support levels at $83 could create a further dive to $72.

Post Litecoin (LTC) Price Analysis: Could It Reach $115 Next Week? It appeared first on BeInCrypto.